Please use a PC Browser to access Register-Tadawul

Encompass Health (EHC): Valuation Spotlight After New York Times Report and Investor Scrutiny

Encompass Health Corporation EHC | 107.00 107.00 | +0.14% 0.00% Pre |

There’s been quite a buzz lately around Encompass Health (EHC), and investors may be wondering if now is the time to act. The spotlight landed squarely on the company after a high-profile New York Times article raised concerns about patient safety and performance at some of its rehabilitation hospitals. Within days, legal attention followed, with a prominent law firm announcing an investigation into whether investors were misled by management. All of this has thrust the stock onto watchlists, raising questions not just about risk but also about potential opportunity.

This wave of negative publicity had an immediate effect, with Encompass Health shares dropping 10% following the initial news in July. Despite that sharp move, the bigger picture tells a different story. Encompass Health stock has still returned 35% over the last year and has roughly doubled over the past three years, signaling underlying growth momentum. Recent events such as the opening of a new rehab facility in Florida show the company remains focused on expanding its footprint, even as it manages legal and reputational challenges.

With the stock bouncing back from its recent lows, the real question is whether the market is already pricing in these risks, or if there could be an opening where long-term value might emerge for patient investors.

Most Popular Narrative: 9.7% Undervalued

According to the most widely followed narrative, Encompass Health is trading at a nearly 10% discount to its consensus fair value. The narrative emphasizes the company’s ability to deliver sustainable growth despite sector challenges, driven by key demographic and operational catalysts.

The surge in the 65-plus population and persistent undersupply of inpatient rehabilitation beds are driving high and still-unmet demand for Encompass Health's core services. Ongoing hospital openings and bed expansions position the company to capture significant incremental patient volume, supporting higher revenue growth for years to come.

What propels this bullish view? The full narrative hints at bold financial forecasts, robust growth targets, and a valuation multiple that sets Encompass Health apart from its peers. Want to learn which assumptions underpin this attractive discount and what key growth levers could unlock value? There is more beneath the surface. Dive in to see the numbers and logic moving the stock’s fair value higher.

Result: Fair Value of $137.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent labor shortages and increased regulatory scrutiny could pose real challenges. These issues may potentially limit growth and pressure margins if trends worsen.

Find out about the key risks to this Encompass Health narrative.Another View: The Market Multiple

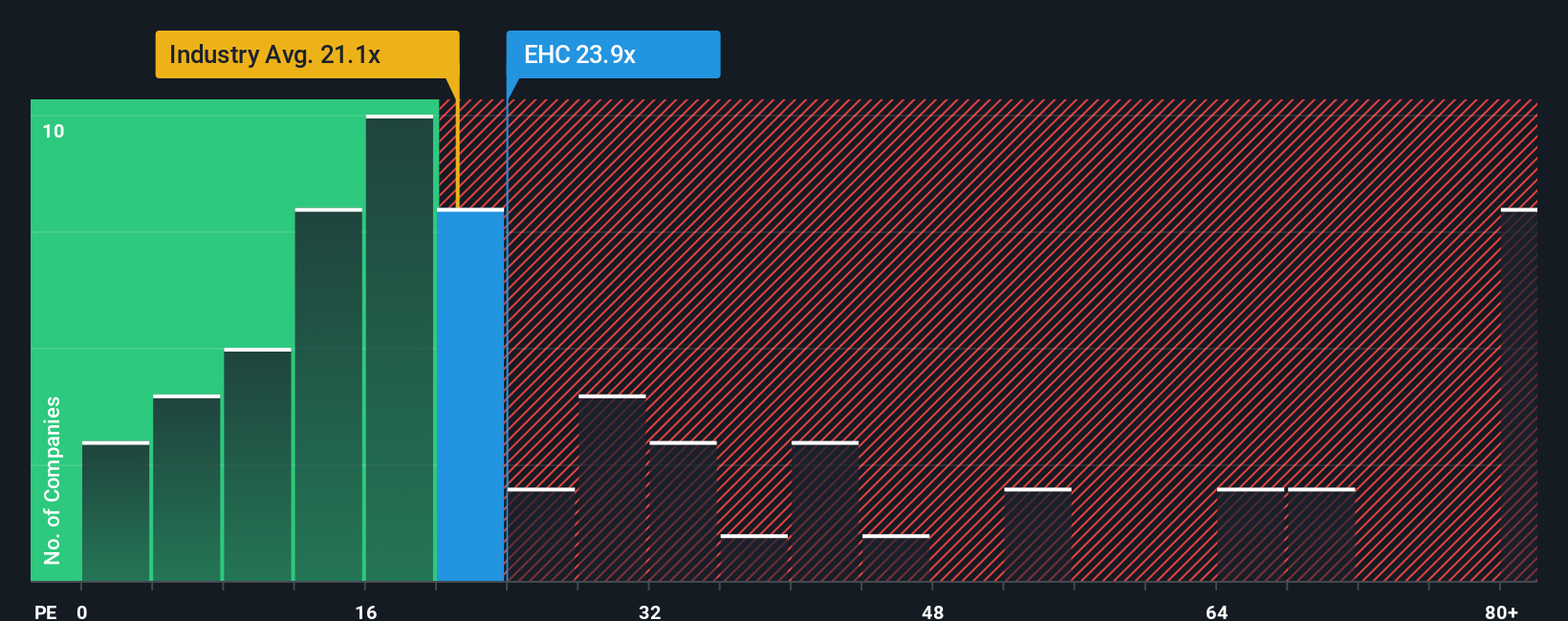

While the previous valuation highlights Encompass Health’s long-term outlook, a simple comparison to industry averages tells a different story. By this measure, the stock is considered pricey. Which angle will prove right for investors?

Build Your Own Encompass Health Narrative

If you'd rather dig into the numbers yourself or have a different perspective, you can craft your own take on Encompass Health’s outlook in just a few minutes. Do it your way.

A great starting point for your Encompass Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at one opportunity. If you want to catch the next big trend or boost your portfolio’s edge, you’ll want to see what else is out there. Here are three hand-picked ways to level up your research using the Simply Wall Street Screener. Don’t let these slip by:

- Tap into surging demand for innovative healthcare by checking out companies pushing boundaries in medical AI through our healthcare AI stocks.

- Uncover stocks with robust cash flows trading far below their true worth in our collection of undervalued stocks based on cash flows.

- Target growing digital payment networks and blockchain disruptors by browsing today’s hottest cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.