Please use a PC Browser to access Register-Tadawul

Enovix (ENVX) Is Down 5.5% After Removal from Major Russell Indexes - What's Changed

Enovix Corporation - Common Stock ENVX | 8.64 | -4.00% |

- On July 24, 2025, Enovix Corporation was removed from a broad range of major Russell equity indexes, prompting institutional investors to adjust their holdings of the stock.

- This sweeping removal from multiple indexes can influence trading volumes and change Enovix’s visibility to funds and investors that track these benchmarks.

- We’ll examine how the widespread index removals could affect Enovix’s investment narrative and future market positioning.

Enovix Investment Narrative Recap

To be a shareholder in Enovix today, you need confidence in its ability to achieve large-scale customer qualification and high-volume production for smartphone batteries by late 2025. The recent removal from a wide range of Russell indexes could affect near-term trading activity and reduce visibility with index-linked funds, but does not appear to change the primary catalyst, the scaling of its core Malaysia manufacturing line, or alter the biggest risk, which remains execution on production ramp-up and customer adoption timelines.

Of the recent announcements, the appointment of Srikanth Kethu as Head of Enovix India stands out. While unrelated to the index changes, his experience leading engineering teams and scaling overseas operations is likely to support the company’s expansion of R&D and manufacturing capabilities, reinforcing its efforts to achieve the volume and efficiency needed for upcoming smartphone launches, the focus of Enovix’s most important near-term catalyst.

However, despite new leadership, investors should note that if smartphone customer qualification or mass production milestones slip, then...

Enovix's outlook anticipates $460.3 million in revenue and $48.3 million in earnings by 2028. This scenario implies a 171.2% annual revenue growth rate and a $270.5 million improvement in earnings from the current $-222.2 million level.

Exploring Other Perspectives

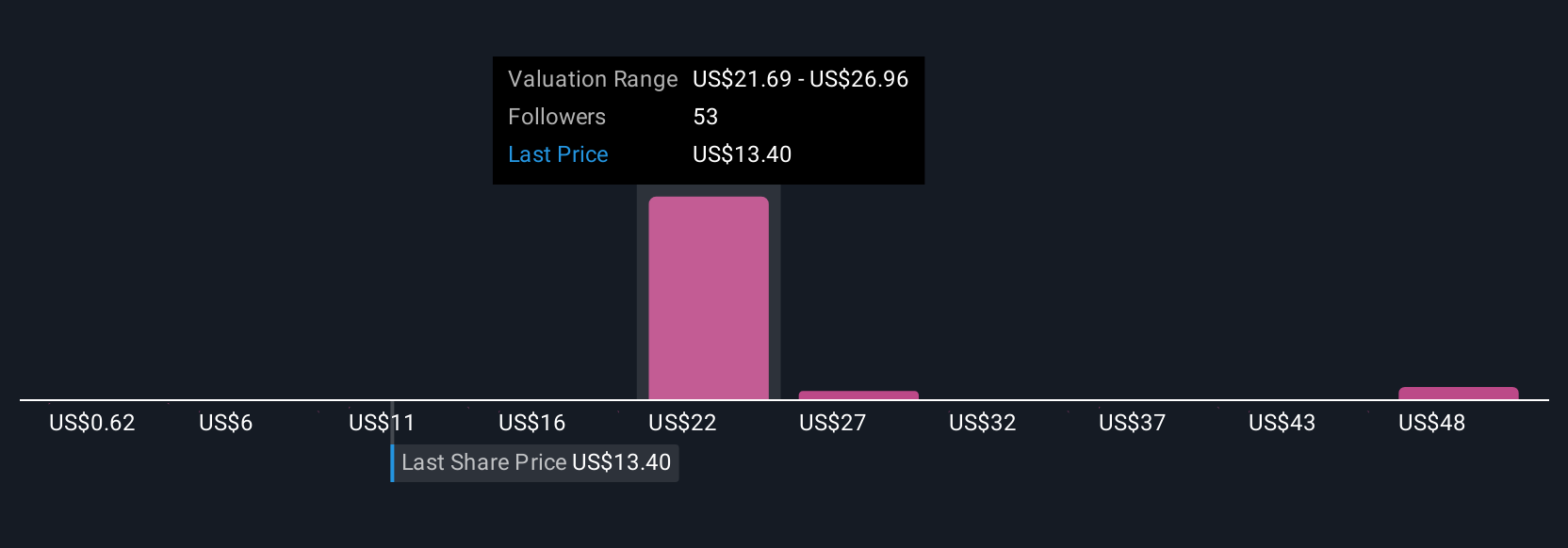

Members of the Simply Wall St Community have estimated Enovix’s fair value from just US$0.62 to US$53.73, with eight distinct perspectives. This diversity matches the company’s high-stakes catalyst around manufacturing scale and customer qualification, showing that expectations for performance and valuation can differ markedly.

Build Your Own Enovix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enovix research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Enovix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enovix's overall financial health at a glance.

No Opportunity In Enovix?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.