Please use a PC Browser to access Register-Tadawul

Enovix (ENVX) Is Up 13.2% After US Invests in Lithium Americas to Bolster Supply Chain – Has the Bull Case Changed?

Enovix Corporation - Common Stock ENVX | 8.64 | -4.00% |

- Following news that the US government has taken a 10 percent stake in Lithium Americas to strengthen domestic supply and lessen import reliance, expectations have grown for policy support across the local lithium industry.

- This initiative raises the prospect that battery manufacturers like Enovix could benefit from reduced raw material costs and enhanced domestic manufacturing capacity.

- We'll now examine how US government backing for lithium production could influence Enovix's growth opportunities and competitive positioning.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Enovix Investment Narrative Recap

To be a shareholder of Enovix, you must believe in the company’s potential to scale high-volume battery production for smartphones and capture demand as next-generation energy storage accelerates. The recent US government backing for domestic lithium may help with raw material costs, but the biggest immediate catalyst remains the successful ramp-up of smartphone battery qualification and manufacturing capacity in Malaysia, while delays in this area continue to be the key risk, this news does not materially change these near-term dynamics.

Among recent announcements, Enovix’s launch of the AI-1 silicon-anode battery platform for mobile devices stands out, signaling efforts to address evolving customer requirements and support its push into high-margin smartphone and next-generation device markets. This ties directly to anticipated growth drivers, especially as mass production readiness for smartphones remains the central focus for realizing revenue potential in the coming year.

Yet, in contrast, investors should be aware of the real risk if smartphone customer qualification or production faces further setbacks…

Enovix's outlook anticipates $460.3 million in revenue and $48.3 million in earnings by 2028. Achieving this would require a 171.2% annual revenue growth rate and an earnings increase of $270.5 million from the current loss of $-222.2 million.

Uncover how Enovix's forecasts yield a $29.50 fair value, a 153% upside to its current price.

Exploring Other Perspectives

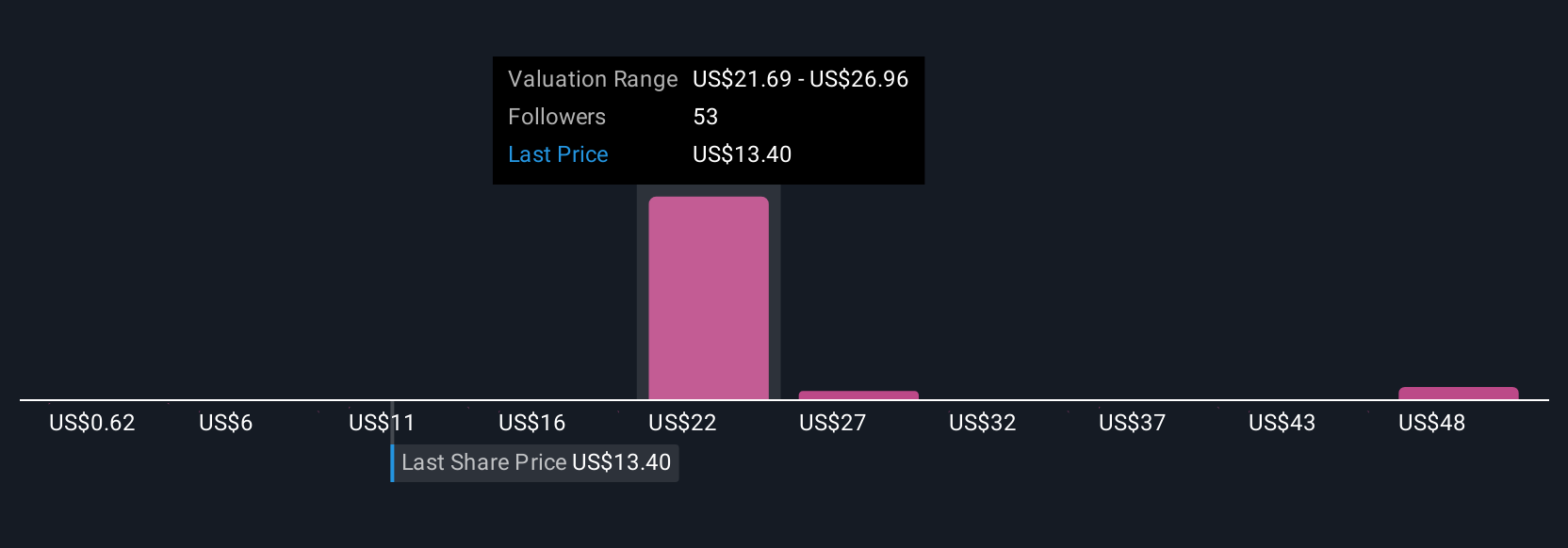

Seven members of the Simply Wall St Community provided fair value estimates on Enovix, ranging from only US$0.81 to US$29.50 per share. While opinions vary widely, remember that Enovix’s major growth still hinges on timely customer qualification and scaled smartphone production.

Explore 7 other fair value estimates on Enovix - why the stock might be worth over 2x more than the current price!

Build Your Own Enovix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enovix research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Enovix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enovix's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.