Please use a PC Browser to access Register-Tadawul

EPAM Systems (NYSE:EPAM): Valuation Insights After Azerbaijan Innovation Hub Launch and Growth Pivot

EPAM Systems, Inc. EPAM | 209.63 | -0.70% |

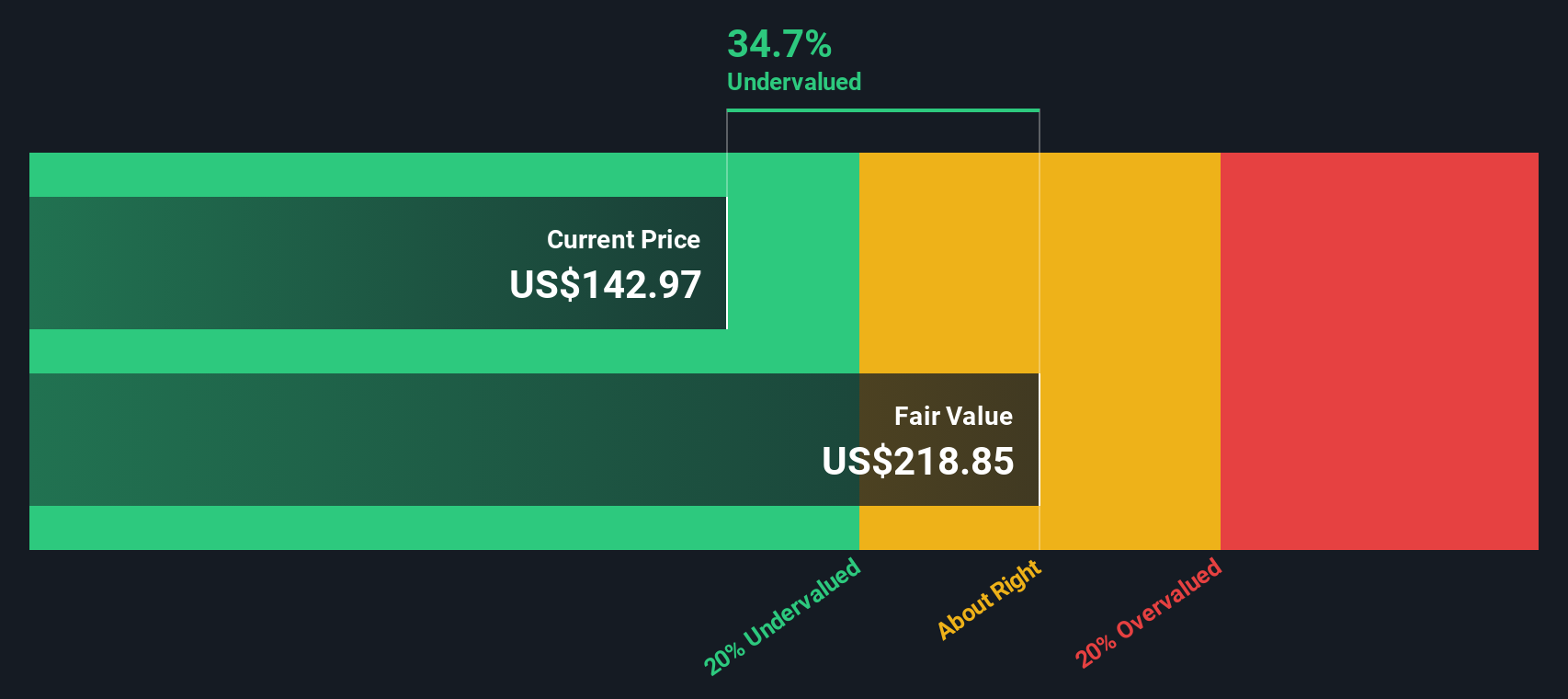

Most Popular Narrative: 27.5% Undervalued

According to the most widely followed narrative, EPAM Systems is seen as significantly undervalued, with analysts suggesting the stock trades well below its estimated fair value based on future growth prospects.

Expanding AI expertise and proprietary platforms are enabling EPAM to secure larger, high-value client engagements and move further up the value chain. Diversification across industries and geographies, coupled with operational efficiencies, is boosting resilience, supporting sustainable growth, and improving margins.

Want to know the story behind this discounted valuation? The secret lies in the ambitious expansion plans and the bold, underlying assumptions fueling future growth. This is essential reading for those interested in what could influence this stock’s next significant move.

Result: Fair Value of $211.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising automation and fierce competition could threaten EPAM’s growth if clients shift toward off-the-shelf solutions or if industry giants expand their market share.

Find out about the key risks to this EPAM Systems narrative.Another View: What Does Our DCF Model Suggest?

Looking through the lens of our discounted cash flow (DCF) model, EPAM also appears attractively valued. This approach weighs future cash flow and investor expectations, so does it confirm the optimism or reveal hidden risks?

Build Your Own EPAM Systems Narrative

If you think this story misses something or you prefer to take a hands-on approach, you can craft your own narrative in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding EPAM Systems.

Looking for More Smart Investment Ideas?

Your next winning stock could be just a click away. Don't let opportunity slip by. Use these handpicked screens to uncover market potential few others are watching.

- Spot tomorrow’s blue chips before the crowd by accessing penny stocks with strong financials that show exceptional financial strength and hidden momentum.

- Boost your yield with confidence by targeting dividend stocks with yields > 3% offering attractive income streams and solid fundamentals for steady growth.

- Capitalize on transformative trends as you pursue AI penny stocks at the forefront of artificial intelligence and disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.