Please use a PC Browser to access Register-Tadawul

Equifax (EFX): Evaluating Valuation After Muted Share Performance and Long-Term Growth Signals

Equifax Inc. EFX | 220.83 | +0.10% |

Equifax (EFX) shares are coming off a month where the stock slipped slightly, down around 0.3%. Despite this modest dip, long-term investors might look to recent performance and the broader sector for context on what could come next.

Equifax's share price has seen only muted moves lately, holding steady at $236.67 after a flat month. The longer-term picture points to resilience, as five-year total shareholder returns have managed to outpace short-term price slips. This suggests momentum is more in pause than in full retreat while the market reassesses growth potential and risk appetite.

If you’re curious what’s catching investor attention elsewhere, now’s a good time to broaden your search and discover fast growing stocks with high insider ownership

The question for investors now is whether Equifax’s current valuation leaves room for upside if growth accelerates, or if the market has already accounted for any future gains in its share price.

Most Popular Narrative: 15.6% Undervalued

With a calculated fair value of $280.50, Equifax’s shares sit noticeably below what the most popular narrative sees as justified, given current growth trajectories and future earnings potential. This gap between the narrative valuation and the recent close of $236.67 hints at optimism driven by specific, anticipated business catalysts.

"Accelerating customer adoption of new multi-data product solutions (e.g., TWN indicator, Single Data Fabric, EFX.AI) and continued high NPI (New Product Introduction) rates are expanding Equifax's value proposition, positioning the company to capture incremental market share and drive sustained organic revenue growth above historical levels."

Want to know what’s fueling this valuation jump? The forecast is anchored by a powerful combination of product launches, sticky customers, and a fresh margin story. Which financial levers are driving these bullish projections? Click through to uncover the surprising figures that set this narrative apart.

Result: Fair Value of $280.50 (UNDERVALUED)

However, sustained high litigation costs and increased government budget constraints could dampen Equifax’s projected growth momentum and challenge the optimistic outlook.

Another View: The Earnings Multiple Test

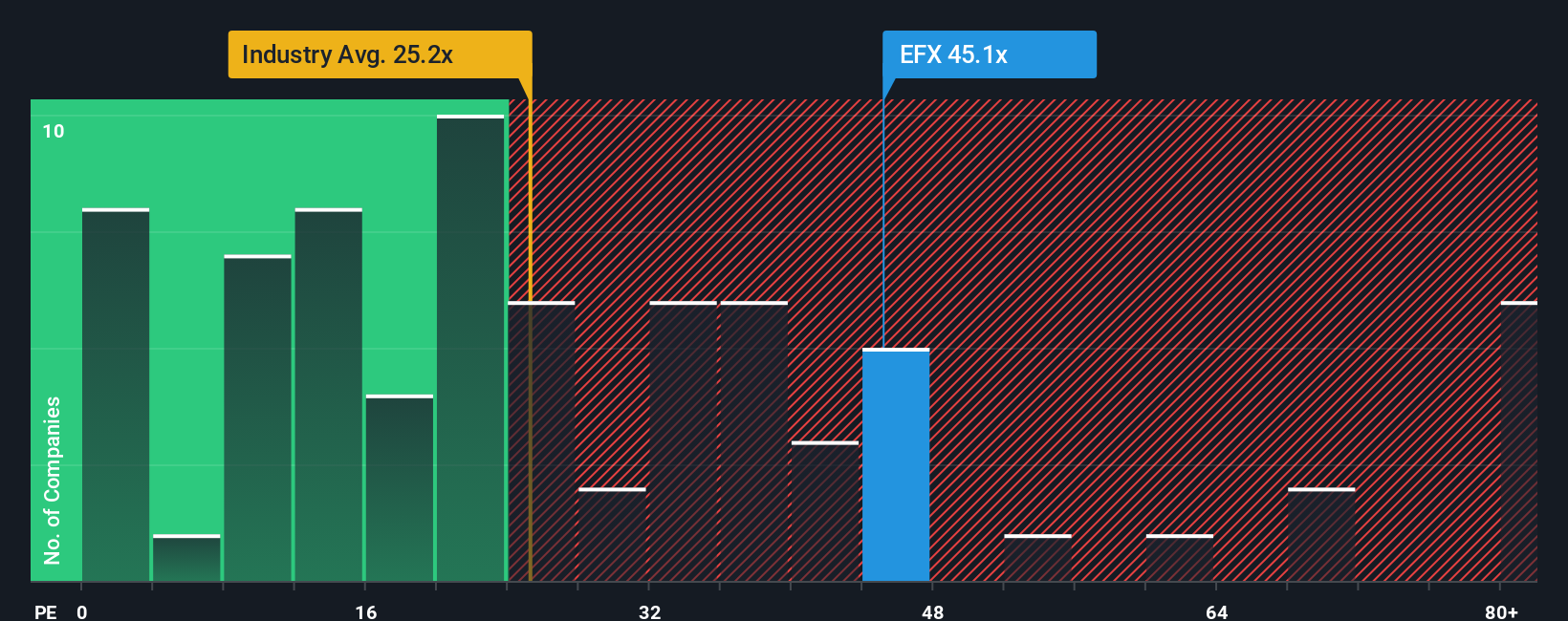

Looking through the lens of earnings multiples, Equifax looks expensive. The company is trading at 45 times earnings, well above the U.S. Professional Services industry average of 26.7 times and a peer average of 34 times. Even compared to its fair ratio of 35.9 times, the current premium implies the market is already pricing in significant growth and little room for disappointment. Does this gap suggest valuation risk lies ahead if future results underwhelm?

Build Your Own Equifax Narrative

If you see things differently or want to dive into the numbers yourself, it’s easy to craft your own take on Equifax’s outlook in just a few minutes, so why not Do it your way?

A great starting point for your Equifax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Don’t settle for just one stock idea when you could be capitalizing on fresh trends. Make your next smart move by seeing what’s climbing, yielding, or revolutionizing portfolios right now.

- Unlock strong, stable growth with asset picks delivering consistent yields over 3 percent by checking out these 19 dividend stocks with yields > 3%.

- Embrace tomorrow’s technology wave by tapping into leaders driving innovation in medical intelligence with these 31 healthcare AI stocks.

- Ride the unstoppable shift toward decentralized finance by scanning the latest contenders within these 78 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.