Please use a PC Browser to access Register-Tadawul

Equitable Holdings (EQH): Evaluating Valuation Following Senior Notes Tender Offer and Balance Sheet Moves

AXA EQUITABLE HOLDINGS, INC. EQH | 48.33 | +0.05% |

If you’re following Equitable Holdings (NYSE:EQH), this week’s cash tender offer developments are well worth a closer look. The company confirmed the early results and pricing for its purchase of outstanding 4.35% senior notes due 2028, moving decisively to accept a significant portion at the top priority level while leaving tenders at other levels untouched. For equity investors, these proactive moves to optimize the balance sheet can alter the risk landscape and send important signals about management’s capital strategy going forward.

In the context of the past year, Equitable Holdings has already shown strong momentum. The stock has returned 37% over twelve months and nearly doubled over the past three years, outpacing many peers in diversified financials. Recent steps like the debt tender, alongside ongoing dividend payments, reinforce the impression that management is focused on both shareholder returns and financial stability. This approach appears to have supported positive sentiment around growth and resilience, especially as markets reward companies willing to tackle liabilities directly.

After such a run, and with the debt tender now increasing clarity around future obligations, the key question is whether there is more upside left for Equitable Holdings or if future growth is already reflected in the current price.

Most Popular Narrative: 17.7% Undervalued

The current consensus among analysts suggests that Equitable Holdings is trading below their collective estimate of fair value, making the stock appear undervalued by a notable margin.

Product innovation (notably in RILAs, fee-based, and protection-focused annuities) and first-mover advantages through partnerships with major asset managers (BlackRock, AB, JPMorgan) position Equitable to capture premium pricing, differentiate from competitors, and access new markets. This is expected to improve average margins and support long-term earnings growth.

Curious about the big levers behind this optimistic price target? One powerful, but rarely discussed, projection drives almost every analyst’s valuation for Equitable Holdings. Hungry to discover which key numbers underpin this bullish outlook? The full narrative reveals the quantitative secrets behind the fair value call.

Result: Fair Value of $65.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition in retirement solutions and ongoing outflows from key asset management units could put pressure on Equitable Holdings' growth and margin outlook.

Find out about the key risks to this Equitable Holdings narrative.Another View: Market Comparison Paints a Different Picture

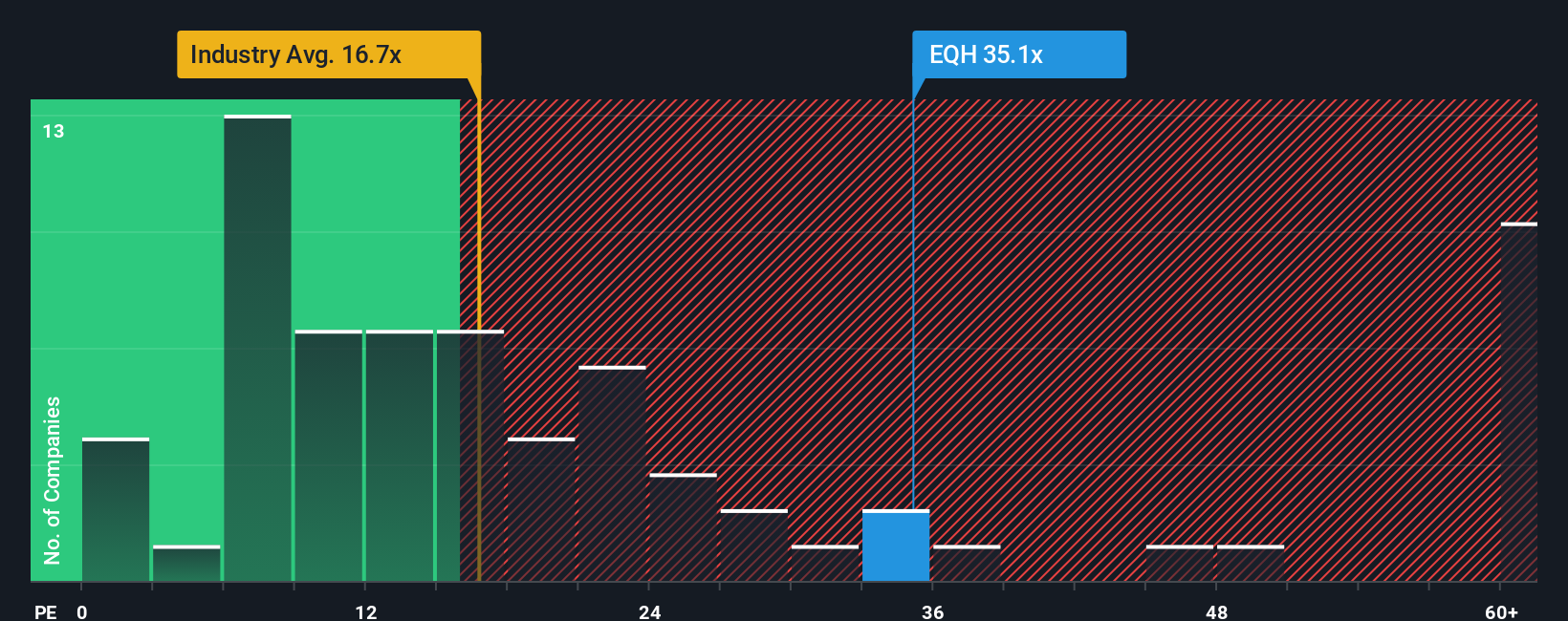

Looking through the lens of market ratios, Equitable Holdings currently looks expensive compared to the industry average. This approach challenges the earlier view and raises the question: Which valuation truly tells the story?

Build Your Own Equitable Holdings Narrative

If you're eager to challenge these findings or want a fresh perspective, you can dive into the numbers and build your own narrative in just minutes. Do it your way

A great starting point for your Equitable Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for one portfolio pick when new opportunities are just a click away. Make your money work harder by finding stocks that match your style.

- Tap into up-and-coming innovators and access penny stocks with strong financials by checking out penny stocks with strong financials before they make headlines.

- Boost your returns by uncovering companies with dividend yields over 3% using dividend stocks with yields > 3% and see how your investments can grow.

- Stay ahead of the curve and find undervalued gems by using our tool for undervalued stocks based on cash flows, where value meets opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.