Please use a PC Browser to access Register-Tadawul

ESCO Technologies (ESE): Exploring Valuation After Recent Share Price Gains

ESCO Technologies Inc. ESE | 204.17 | -1.15% |

ESCO Technologies (ESE) shares have climbed about 1% over the past day and 4% this month. The steady gains suggest that investors are keeping a close eye on the company's ongoing performance and upcoming milestones.

What stands out most is ESCO Technologies’ growing momentum, with a 68% year-to-date share price return and an outstanding 71% total shareholder return over the past year. This kind of outperformance suggests that investors are seeing real growth potential. Recent steady gains indicate that confidence could be building even higher.

If ESCO’s breakout has you looking for what else is gathering steam, why not use this moment to explore fast growing stocks with high insider ownership

But with ESCO Technologies’ share price so close to analyst targets, is the market underestimating future growth, or has investor optimism already been fully priced in? Could there still be a buying opportunity here?

Most Popular Narrative: Fairly Valued

ESCO Technologies’ current share price of $221.25 is nearly identical to the most-followed narrative’s fair value estimate of $225. This highlights a market consensus around this level.

Heightened focus on power reliability, grid modernization, and compliance, spurred by stricter regulatory requirements and infrastructure aging, directly boosts demand for ESCO's advanced diagnostic, monitoring, and testing products. This enables margin expansion as utilities prioritize reliability investments and premium solutions.

Curious about what’s driving such strong confidence in ESCO's price? The narrative hints at powerful demand catalysts and a head-turning leap in profit margins just ahead. Want to discover which specific projections are fueling this bold valuation? Find out what numbers underpin this forecast before the market fully catches on.

Result: Fair Value of $225 (ABOUT RIGHT)

However, ongoing integration challenges and sudden end-market volatility could quickly derail ESCO’s growth momentum and put pressure on profit margins.

Another View: The Market Ratio Perspective

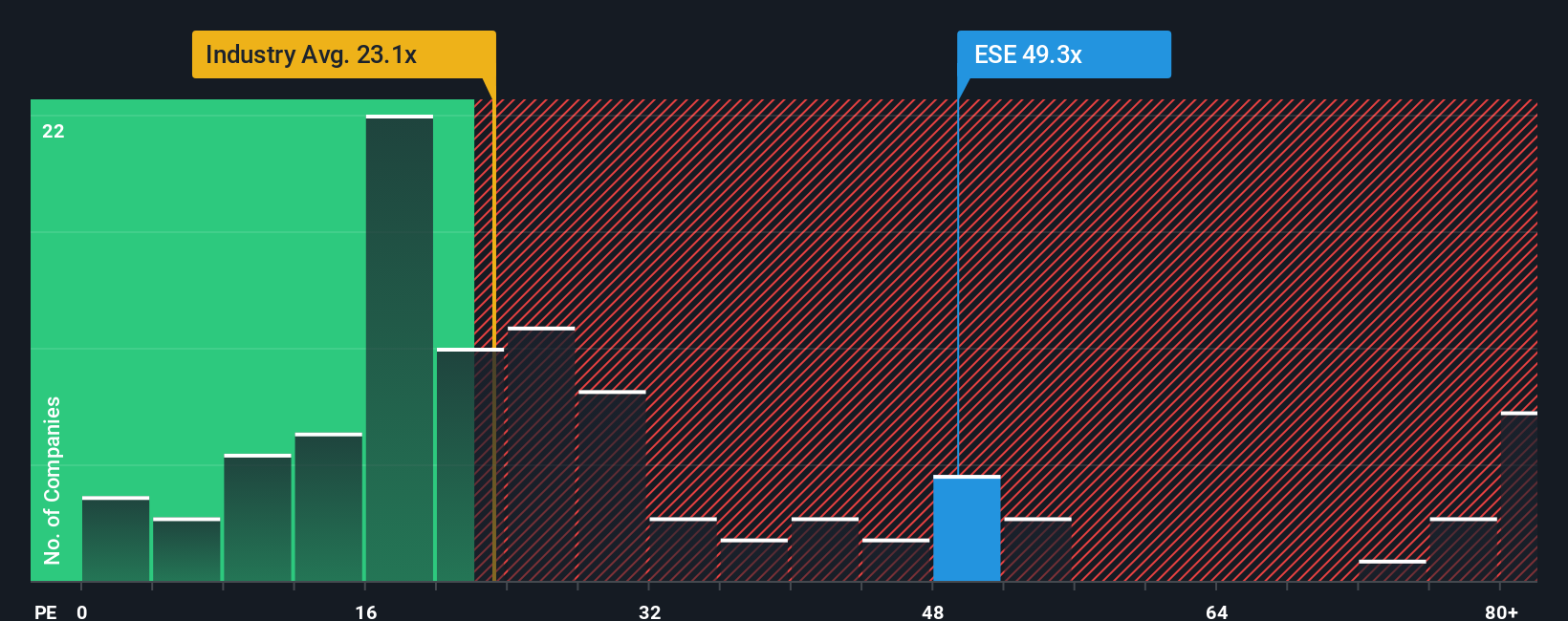

Looking beyond the fair value estimate, ESCO Technologies is trading at a price-to-earnings ratio of 51.9x, which is notably higher than the US Machinery industry average of 24.7x and the peer group average of 41.4x. Even compared to the fair ratio of 27.7x, the premium is substantial. This could suggest that investors are paying up for quality and growth, or that optimism has run ahead of fundamentals. Does the market risk a pullback if expectations reset?

Build Your Own ESCO Technologies Narrative

If you see things differently or want to dig into ESCO Technologies' story for yourself, crafting your own analysis takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ESCO Technologies.

Looking for More Investment Ideas?

Smart investors do not just wait for opportunities to come their way. Take the lead and let these tailored ideas inspire your next winning move to help you get ahead of the market.

- Uncover steady income streams and strong yields by checking out these 17 dividend stocks with yields > 3% that are making waves among income-focused portfolios.

- Capture tomorrow's innovation today by spotting these 27 AI penny stocks at the forefront of artificial intelligence breakthroughs.

- Start your search for hidden value with these 877 undervalued stocks based on cash flows and target great companies the market has not fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.