Please use a PC Browser to access Register-Tadawul

Esquire Financial Holdings (ESQ) Net Margin Strength Reinforces Bullish Narratives In FY 2025 Results

Esquire Financial Holdings, Inc. ESQ | 107.52 | +0.72% |

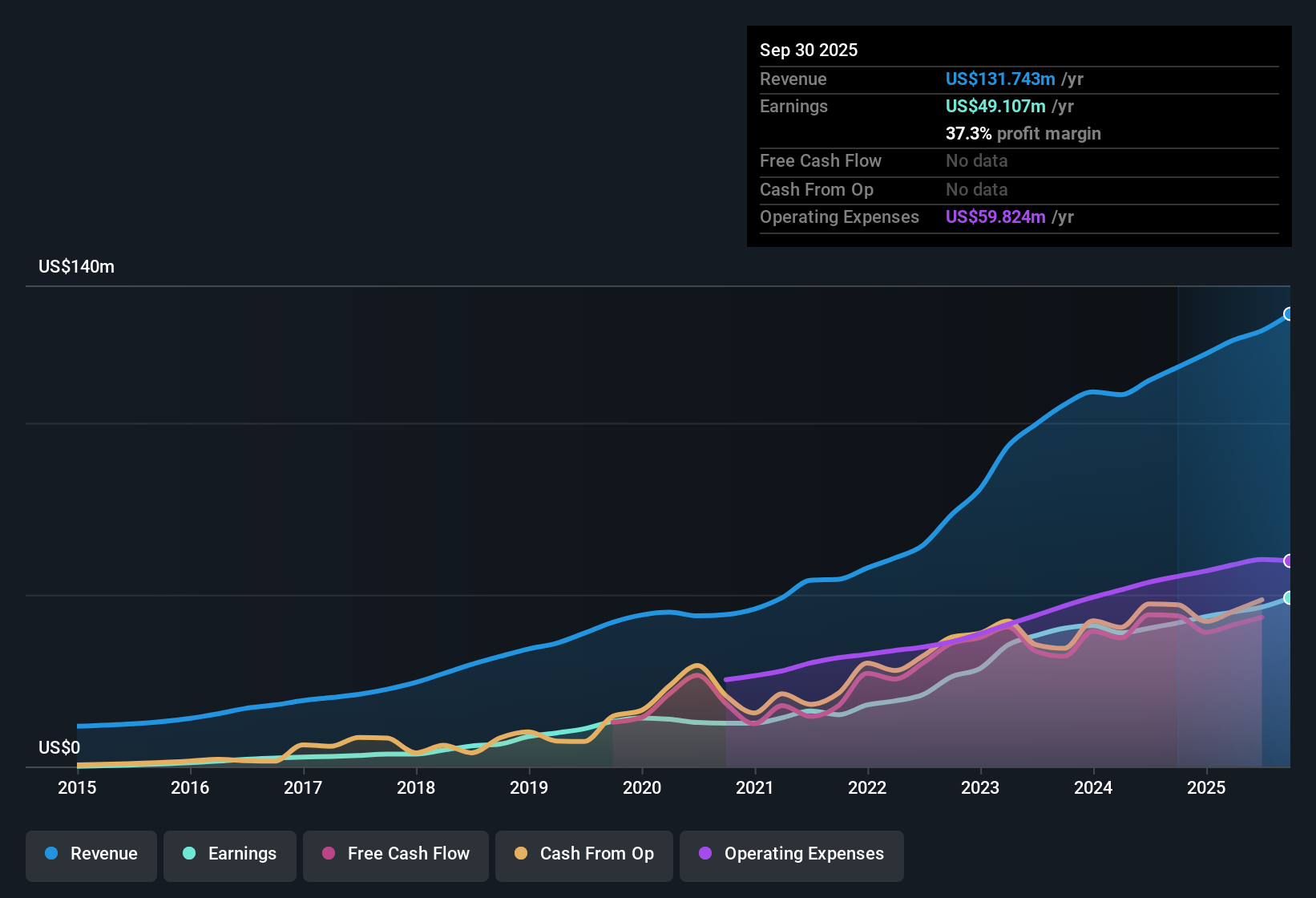

Esquire Financial Holdings (ESQ) has wrapped up FY 2025 with fourth quarter revenue of US$36.5 million and basic EPS of US$1.66, while trailing twelve month revenue came in at US$136.9 million with EPS of US$6.30. The company has seen revenue move from US$120.1 million on a trailing basis in late 2024 to US$136.9 million in the latest period, alongside EPS stepping up from US$5.58 to US$6.30, which may prompt investors to focus on how margins and profit quality support the current story.

See our full analysis for Esquire Financial Holdings.With the headline numbers on the table, the next step is to see how this earnings profile lines up against the widely followed narratives around growth, profitability and risk for Esquire Financial Holdings.

37.1% net margin sets the tone

- On a trailing twelve month basis, Esquire converted US$136.9 million of revenue into US$50.8 million of net income, which lines up with the 37.1% net profit margin highlighted in the analysis and sits slightly above last year’s 36.3% margin.

- Bulls often point to high profit quality, and this margin profile heavily supports that view. At the same time, the slower 16.5% earnings growth over the last year versus the 25% five year average and the more modest ~9.5% earnings growth forecast create a tension between strong current profitability and a less aggressive growth path.

- Supporters can lean on the combination of US$6.30 of trailing EPS and a 37.1% margin as evidence that recent profits are not just a one off.

- The step down from the 25% five year earnings growth rate to 16.5% more recently shows why some bullish expectations might need to adjust to a slower trajectory.

Loan book and credit quality steady around US$1.5b

- Total loans on a trailing basis were US$1.40b to US$1.55b through FY 2025, while non performing loans sat in a tight range around US$8.0 million to US$10.9 million, which means credit issues are small relative to the overall book in dollar terms.

- Bears sometimes worry that more specialized loan books can hide problem credits, but the combination of roughly US$1.55b of loans at 2025 Q3 and non performing loans of US$8.6 million and US$8.7 million around mid 2025 challenges that concern by showing only a small portion of the portfolio tagged as non performing in the period we can see.

- Critics can still point out that non performing loans were US$10.9 million in late 2024, so the risk is not zero even if the dollar amounts remain contained versus total loans.

- Supporters may counter that loan growth from US$1.30b in 2024 Q3 to around US$1.55b in 2025 Q3 without a sharp rise in non performing loans supports the idea of disciplined credit so far.

P/E premium and DCF gap pull in different directions

- At a share price of US$110.43 and a trailing P/E of 17.6x, Esquire trades above both the US Banks industry average P/E of 12.1x and peer average of 12.9x, while the provided DCF fair value of US$174.33 sits well above the current price.

- What stands out is how this richer P/E and the slower revenue growth of about 4.6% per year versus a 10.6% market benchmark coexist with a DCF view that sees a large gap between price and DCF fair value. Investors are weighing a premium multiple and below market growth against a model that points to valuation upside.

- Supportive investors can argue that five year earnings growth of about 25% and high margins justify paying more than industry and peer P/E levels, especially if earnings keep tracking near the ~9.5% forecast.

- More cautious investors may focus on the slower forecast growth in both revenue and earnings compared with broader market figures and question how long the 17.6x P/E can hold if growth stays below those benchmarks.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Esquire Financial Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Esquire Financial Holdings pairs high margins with slower recent earnings growth, below market revenue growth, and a richer 17.6x P/E versus its banking peers.

If that mix feels a bit tight for your comfort, use our stable growth stocks screener (2173 results) to home in on companies built around steadier revenue and earnings momentum across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.