Please use a PC Browser to access Register-Tadawul

Essential Properties Realty Trust (EPRT) FFO Growth Reinforces Predictable Income Narrative

ESSENTIAL PROPERTIES REALTY TRUST, INC. EPRT | 32.74 | +0.55% |

Essential Properties Realty Trust (EPRT) just posted its FY 2025 numbers with fourth quarter revenue of US$149.9 million, basic EPS of US$0.34 and funds from operations of US$108.9 million, giving investors a fresh read on its income producing portfolio. The company has seen quarterly revenue move from US$119.7 million in Q4 2024 to US$149.9 million in Q4 2025, while basic EPS went from US$0.31 to US$0.34 over the same period, with FFO per share stepping from US$0.49 in Q3 2024 to US$0.54 in Q4 2025. With trailing net margins sitting in the mid 40s, this latest set of results keeps the focus firmly on how consistently the trust is turning rent into bottom line profit.

See our full analysis for Essential Properties Realty Trust.With the headline figures on the table, the next step is to see how these results line up against the prevailing growth and risk narratives that investors have been using to frame Essential Properties Realty Trust.

FFO and Net Income Step Up Through FY 2025

- Across FY 2025, quarterly FFO moved from US$92.1 million in Q1 to US$108.9 million in Q4, with net income excluding extra items rising from US$55.9 million to US$67.9 million over the same stretch.

- Analysts' consensus view talks about stable, predictable growth and points to factors like near peak occupancy of 99.6% and long leases averaging 14 years. This lines up with the steady pattern in 2025 where revenue went from US$129.4 million in Q1 to US$149.9 million in Q4 and FFO per share ranged between US$0.49 and US$0.54.

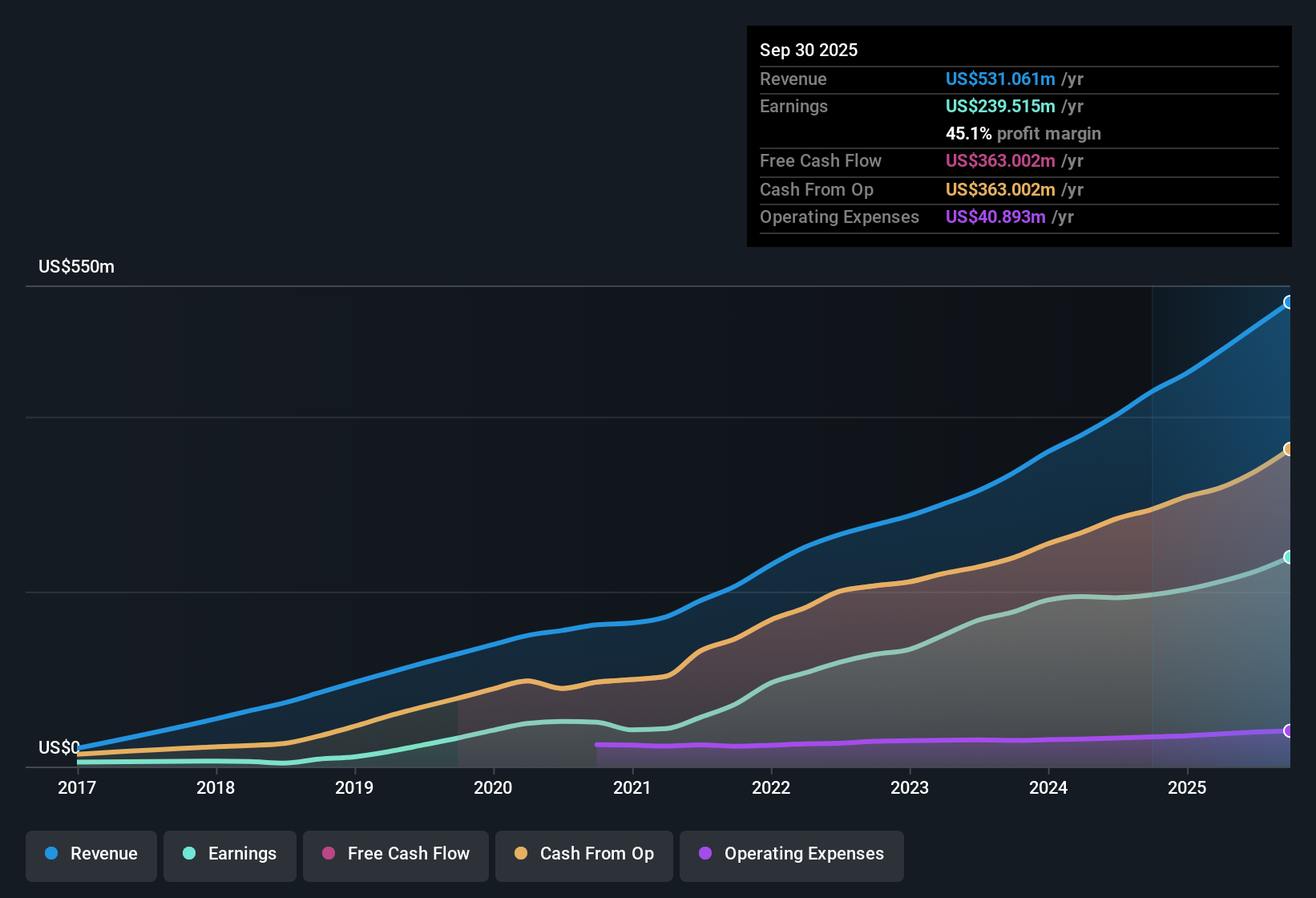

- That same consensus view links growth to a large investment pipeline, and the step up in trailing twelve month revenue from US$402.2 million at 2024 Q2 to US$531.1 million by 2025 Q3 supports the idea that more properties are feeding into rent collection.

- It also highlights diversified tenants and recurring relationships, and the trailing twelve month net income excluding extra items rising from US$193.1 million at 2024 Q2 to US$239.5 million at 2025 Q3 is consistent with that story of a broader, income producing base.

High Margins With Slight Compression

- Trailing net profit margin is 45.1%, compared with 45.8% a year ago, so the company is still keeping close to half of its revenue as profit after expenses on this trailing basis.

- Consensus narrative suggests the business model supports strong and predictable margins through inflation linked rent bumps. Yet the small margin slip from 45.8% to 45.1% fits with the risks section that flags rising competition, higher G&A and sector specific pressures as potential headwinds.

- The risk discussion mentions increasing compensation and G&A costs as the organization grows, and that is one clear explanation the consensus view gives for why margins might tighten even while earnings grew 22% over the past year.

- Analysts also expect profit margins to move from 44.3% to 40.5% over three years, which matches the idea that, although current margins are high, the business might need to work harder to offset extra costs and financing terms to keep them at this level.

Valuation Gap Versus Debt Coverage Risk

- At a current share price of US$32.09, the stock sits below both the analyst price target of US$36.00 and the DCF fair value of US$95.43, while trading on a P/E of 27.7x compared with a Global REITs industry average of 16.2x and a peer average of 32x.

- Bears focus on balance sheet risk, pointing out that debt is not well covered by operating cash flow in the trailing twelve months. This contrasts with the more optimistic view that earnings grew 22% over the past year and revenue is forecast to grow about 12.8% per year, so investors are weighing the DCF fair value gap against the leverage concern.

- Critics highlight that a higher P/E than the broader Global REITs group sits alongside that weaker debt coverage, so the shares are not priced like a distressed situation even though leverage is a key flagged risk.

- Supporters point to the 28.5% five year annual earnings growth and the 11.1% forecast earnings growth rate as reasons some investors pay a higher multiple. Yet both sides are using the same debt coverage data when judging how comfortable that premium really is.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Essential Properties Realty Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a fresh look at the data, shape your own view in a few minutes, and Do it your way

A great starting point for your Essential Properties Realty Trust research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite strong profitability, Essential Properties Realty Trust carries highlighted debt coverage concerns alongside a premium P/E, so some investors may see the risk return trade off as uneven.

If that balance sheet worry is on your mind, compare this profile with companies screened for stronger debt coverage and financial resilience using our solid balance sheet and fundamentals stocks screener (44 results) today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.