Please use a PC Browser to access Register-Tadawul

Ethereum The Next Big Thing In Banking? Tom Lee Thinks So And Wants This Small-Cap Company He Chairs To Front-Run The Likes Of Goldman Sachs, JPMorgan

BitMine Immersion Technologies BMNR | 30.95 31.15 | -11.22% +0.64% Post |

Goldman Sachs Group, Inc. GS | 889.59 890.01 | +0.18% +0.05% Post |

JPMorgan Chase & Co. JPM | 320.02 319.98 | +0.47% -0.01% Post |

Strategy MSTR | 162.08 162.00 | -8.14% -0.05% Post |

Financial analyst and strategist Tom Lee stated Monday that Ethereum (CRYPTO: ETH) will play a crucial role in the banking sector’s future, highlighting the rationale for buying and holding the second-largest cryptocurrency in reserves.

What Happened: During a CNBC interview, Lee was confident that financial behemoths such as Goldman Sachs Group Inc. (NYSE:GS) and JPMorgan Chase & Co. (NYSE:JPM) would use Ethereum to power their stablecoin offerings.

“Ethereum is also the architecture that future banks will have. When Goldman issues a stablecoin and JPMorgan doing it on Ethereum, as a Layer-1 blockchain they’re going to want to secure it by staking Ethereum,” Lee said. “We’re trying to get in front.”

Lee announced his new role as chairman of BitMine Immersion Technologies (AMEX:BMNR), a small-cap Bitcoin mining firm that will transition to an Ethereum-focused treasury company, adopting ETH as its primary reserve asset.

He said that the company wants to “get in front” of the impending ETH accumulation by Wall Street giants.

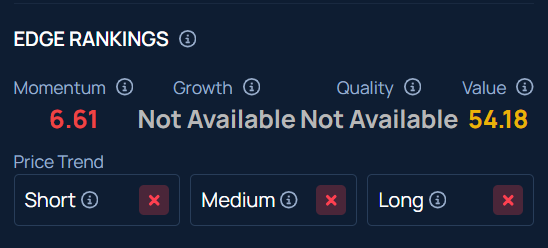

BitMine shares skyrocketed on Monday, closing at $33.90, up 694%. As of this writing, the stock had an average Value rating and a poor Momentum. Visit Benzinga Edge Stock Rankings to see how Strategy Inc. (NASDAQ:MSTR), the pioneer of a cryptocurrency treasury a, stacks up.

Why It Matters: Ethereum works on a proof-of-stake model where users contribute to the network’s security by staking ETH. It also lets users earn rewards in return.

Moreover, due to its smart contract capabilities and its role as a leading platform for decentralized finance applications, it plays a significant role in powering stablecoins. According to DeFiLlama, it has a stablecoin market capitalization exceeding $126 billion, the highest among all networks.

Price Action: At the time of writing, ETH was exchanging hands at $2,482.94, down 0.85% in the last 24 hours, according to data from Benzinga Pro.

Photo Courtesy: alfernec on Shuttertsock.com

Read Next:

- Ethereum Traders Target $4,000 In Summer: What’s Fueling The Optimism?