Please use a PC Browser to access Register-Tadawul

Etsy (ETSY) Valuation in Focus After ChatGPT Instant Checkout Partnership Launch

Etsy, Inc. ETSY | 56.63 | +1.76% |

Etsy (ETSY) just made a splash by teaming up with OpenAI’s ChatGPT to offer Instant Checkout, allowing users to purchase Etsy items directly within the ChatGPT platform. This move could widen Etsy’s reach and refresh its growth prospects in a crowded e-commerce landscape.

Etsy’s latest partnership comes at a moment when momentum has started to return. After a rocky stretch, the stock’s 30-day share price return sits at 16.6% and the 1-year total shareholder return has climbed to 38.5%. Still, longer-term returns remain negative, reflecting persistent growth headwinds and shifting buyer preferences even as new tech initiatives gain attention.

If you’re on the hunt for more companies with fresh growth stories and evolving digital business models, now’s a great time to discover fast growing stocks with high insider ownership

After a period of decline, renewed momentum and strategic partnerships have investors asking an important question: is Etsy's rebound just getting started at a bargain price, or is all that future growth already baked in?

Most Popular Narrative: 5.6% Overvalued

Etsy's most widely followed narrative suggests the stock is trading slightly above its consensus fair value, with the last close at $68.73 versus a fair value estimate of $65.12. This sets up a debate about whether recent growth initiatives are fully reflected in the current share price or if the market anticipates further acceleration.

"Analysts are assuming Etsy's revenue will grow by 3.5% annually over the next 3 years. Analysts assume that profit margins will increase from 5.8% today to 12.0% in 3 years time."

Ever wondered what drives such an ambitious valuation? There is a bold set of internal targets and profit margin projections under the hood. The real surprise comes from how analysts expect Etsy’s financial profile to shift dramatically. Want the inside story on which levers matter most? Uncover the key financial gears energizing this fair value estimate.

Result: Fair Value of $65.12 (OVERVALUED)

However, if Etsy cannot reverse ongoing declines in buyer engagement and if margins remain under pressure from rising marketing costs, the growth narrative could falter.

Another View: SWS DCF Model Paints a Different Picture

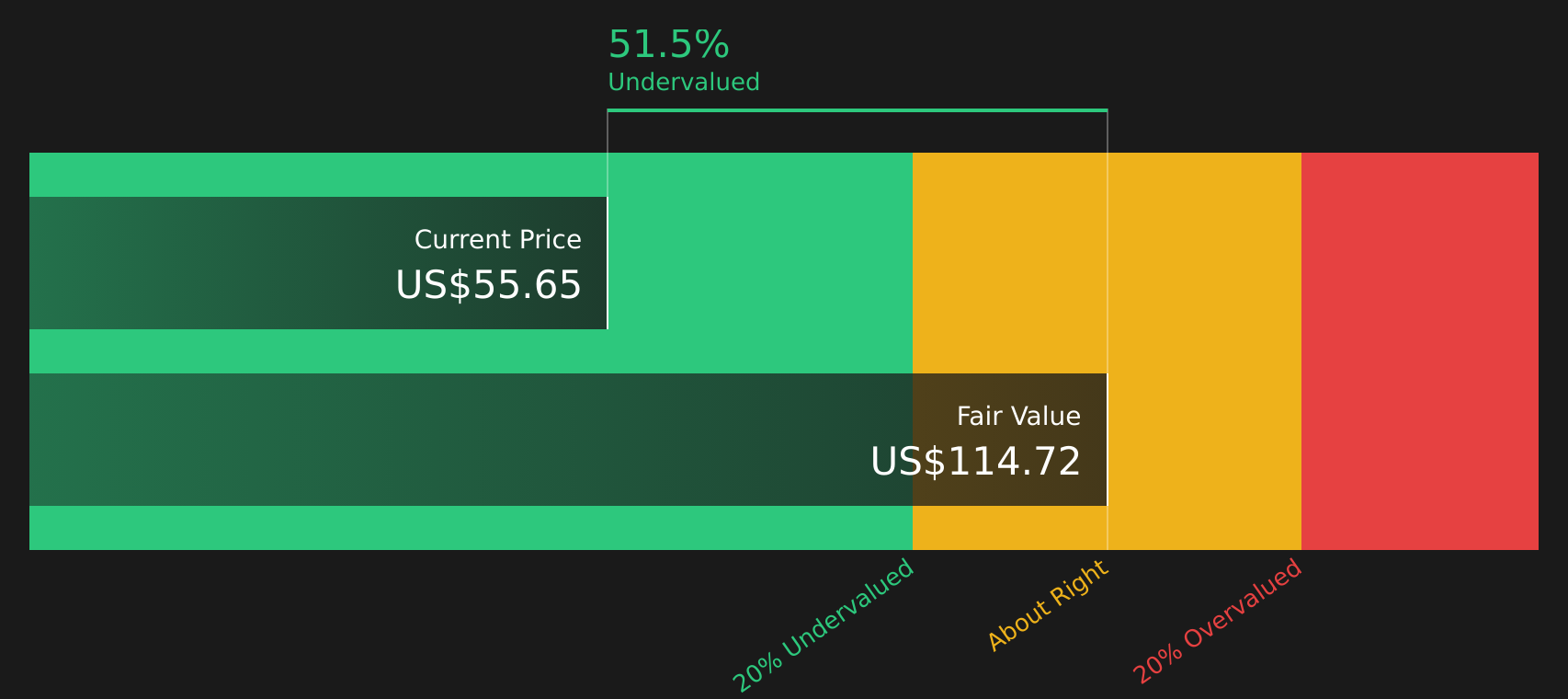

While the analyst consensus sees Etsy as slightly overvalued based on its future profits and market multiples, our SWS DCF model tells a different story. According to this method, Etsy trades at a significant 42.9% discount to its estimated fair value. This suggests the market may be underestimating long-term cash flows. Is Wall Street’s skepticism overdone, or could hidden value be waiting to be unlocked?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Etsy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Etsy Narrative

If you see things differently, or want to dig a little deeper, you can craft your own view in just a few minutes by using Do it your way

A great starting point for your Etsy research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that the biggest wins often come from spotting trends early. Why limit yourself to just one strategy? Take action now and scan these carefully curated stock picks from the Simply Wall Street Screener before the next opportunity slips away.

- Boost your income potential with these 19 dividend stocks with yields > 3%, which offers consistently strong yields backed by stable fundamentals.

- Ride the wave of innovation by tapping into these 25 AI penny stocks, featuring companies shaping the AI landscape with breakthrough technologies.

- Gain an edge by starting your search with these 891 undervalued stocks based on cash flows, where the market may be missing out on undervalued hidden gems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.