Please use a PC Browser to access Register-Tadawul

Evaluating Certara (CERT): Fresh Analyst Buy Rating and Global Recognition Spark New Valuation Debate

Certara, Inc. CERT | 8.58 | -2.61% |

Certara (CERT) saw renewed attention after Craig-Hallum’s William Bonello initiated coverage with a buy recommendation. This move comes as Certara celebrates global recognition for both its scientists and industry contributions this month.

Riding the wave of analyst attention and recent global accolades, Certara’s 1-year total shareholder return stands at 23.5%. This reflects solid momentum and growing optimism about its growth prospects. The share price sits at $12.50, with notable strength shown in its 17% year-to-date climb and a 7.8% gain for the past month.

If you’re interested in what other innovative healthcare names are making waves, see the full list for free with our latest screener: See the full list for free.

Despite the analyst upgrade and impressive recent gains, questions remain for potential investors. With Certara trading near its target price, is the current momentum a true buying opportunity, or is future growth already priced in?

Most Popular Narrative: 15.3% Undervalued

Certara’s narrative puts fair value at $14.75 per share, about 15% above the recent close of $12.50. Recent catalysts are center stage for the forecast, with special attention on the company’s sector positioning and product momentum.

The recent qualification of Certara's Simcyp platform by the European Medicines Agency sets it apart as the only PBPK modeling tool with such approval. This distinction is likely to increase customer adoption among global pharma companies seeking regulatory certainty and speed for their drug approvals, supporting future revenue growth.

Can Certara’s industry advantage really justify its premium? One bold assumption stands out: the valuation relies on future margin expansion and a jump in recurring revenues from new launches and cross-selling. Want to see what projections push the price so much higher than today’s market?

Result: Fair Value of $14.75 (UNDERVALUED)

However, slower-than-expected pharma adoption or unexpected R&D budget cuts could quickly challenge Certara’s bullish narrative and reset growth expectations.

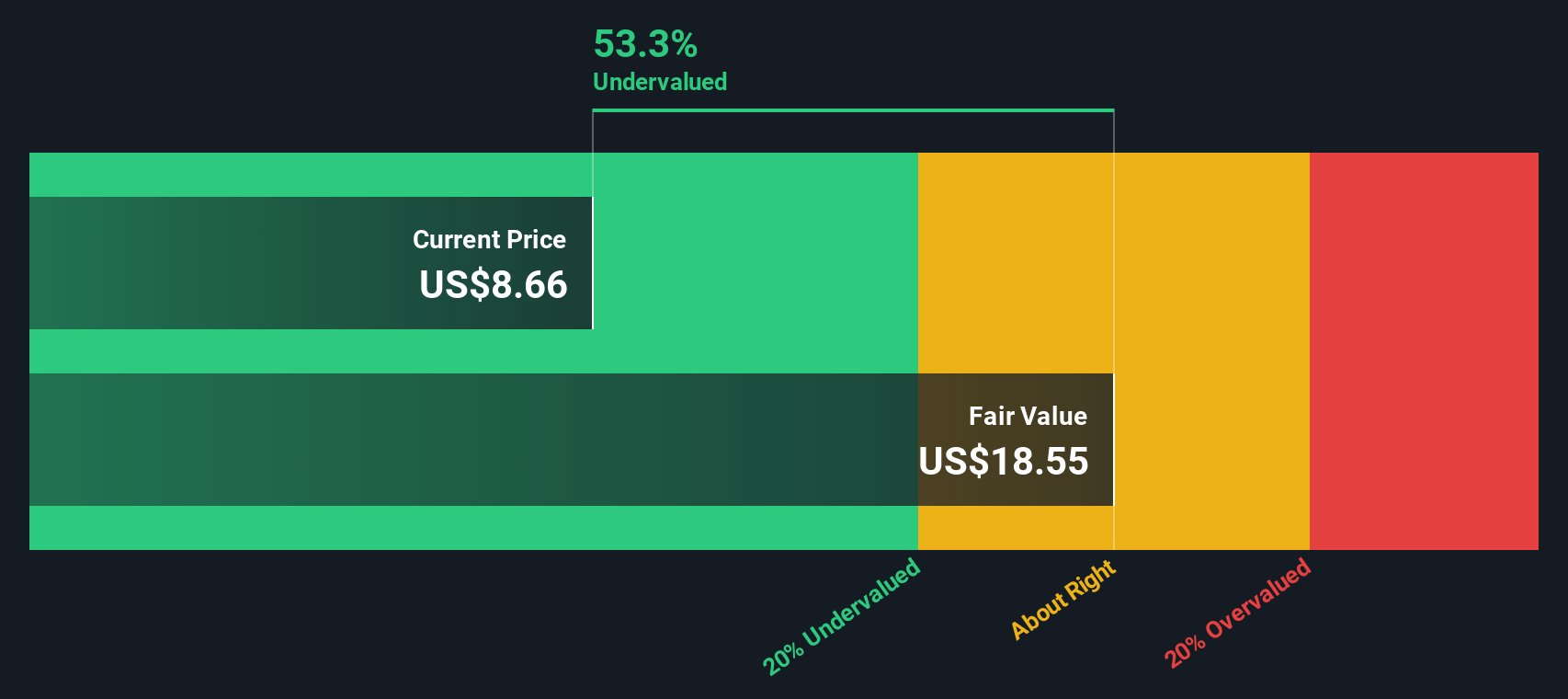

Another View: SWS DCF Model Says Even More Upside

While recent valuation focuses on peer price-to-sales and analyst targets, our SWS DCF model tells a more bullish story. According to the DCF, Certara’s fair value sits at $20.65, which is over 60% above the current share price. Could the market be underestimating Certara’s long-term earnings power?

Build Your Own Certara Narrative

If you want to chart your own path, you can dive into the numbers yourself and shape a Certara story in just a few minutes. Do it your way

A great starting point for your Certara research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize the chance to get ahead by screening standout stocks that meet your goals. Don’t let lucrative opportunities slip by while others take action.

- Capitalize on stocks with high recurring cash flows and strong price upside using these 875 undervalued stocks based on cash flows in your search for value.

- Tap into the booming artificial intelligence sector by starting with these 27 AI penny stocks that are changing what’s possible in tech-driven investing.

- Snap up shares offering robust, above-average yields through these 17 dividend stocks with yields > 3% before these income opportunities shrink.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.