Please use a PC Browser to access Register-Tadawul

Evaluating Cleveland-Cliffs (CLF) Valuation After KeyBanc Downgrade And Morgan Stanley Upgrade

Cleveland-Cliffs Inc CLF | 14.34 14.34 | -1.98% 0.00% Pre |

Cleveland-Cliffs (CLF) is back in focus after a sharp selloff driven by a KeyBanc downgrade was followed by a Morgan Stanley upgrade tied to its POSCO partnership, with technicals highlighting oversold conditions and meaningful short interest.

The sharp selloff around the KeyBanc downgrade, followed by a rebound after the Morgan Stanley upgrade and POSCO news, comes against a backdrop where the 1-year total shareholder return of 28.89% contrasts with a 3-year total shareholder return of 39.01% and a 5-year total shareholder return of 22.57%. Shorter term share price returns suggest momentum has recently faded, then tentatively stabilised.

If Cleveland-Cliffs has you thinking about where capital might work next, this could be a good moment to compare it with other steel names and broader industrials using fast growing stocks with high insider ownership.

With Cleveland-Cliffs trading at a discount to both its analyst price target and an internal intrinsic value estimate despite recent rebound talk, investors must consider whether this represents a reset that offers potential upside or whether the market is already incorporating expectations for future growth.

Most Popular Narrative: 3% Overvalued

The most followed narrative puts Cleveland-Cliffs’ fair value at US$12.45, slightly below the last close of US$12.76, framing the current price as a small premium.

The analysts have a consensus price target of $10.859 for Cleveland-Cliffs based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $5.0.

Curious how a company reporting a loss today ends up with projected profits, expanding margins and a higher future earnings multiple in this narrative? The full breakdown shows exactly how revenue, profitability and valuation are being stitched together to justify that fair value number.

Result: Fair Value of $12.45 (OVERVALUED)

However, this fair value story could change quickly if U.S. steel tariffs are relaxed, or if Cleveland-Cliffs' dependence on higher cost blast furnace assets pressures margins further.

Another Angle On Value

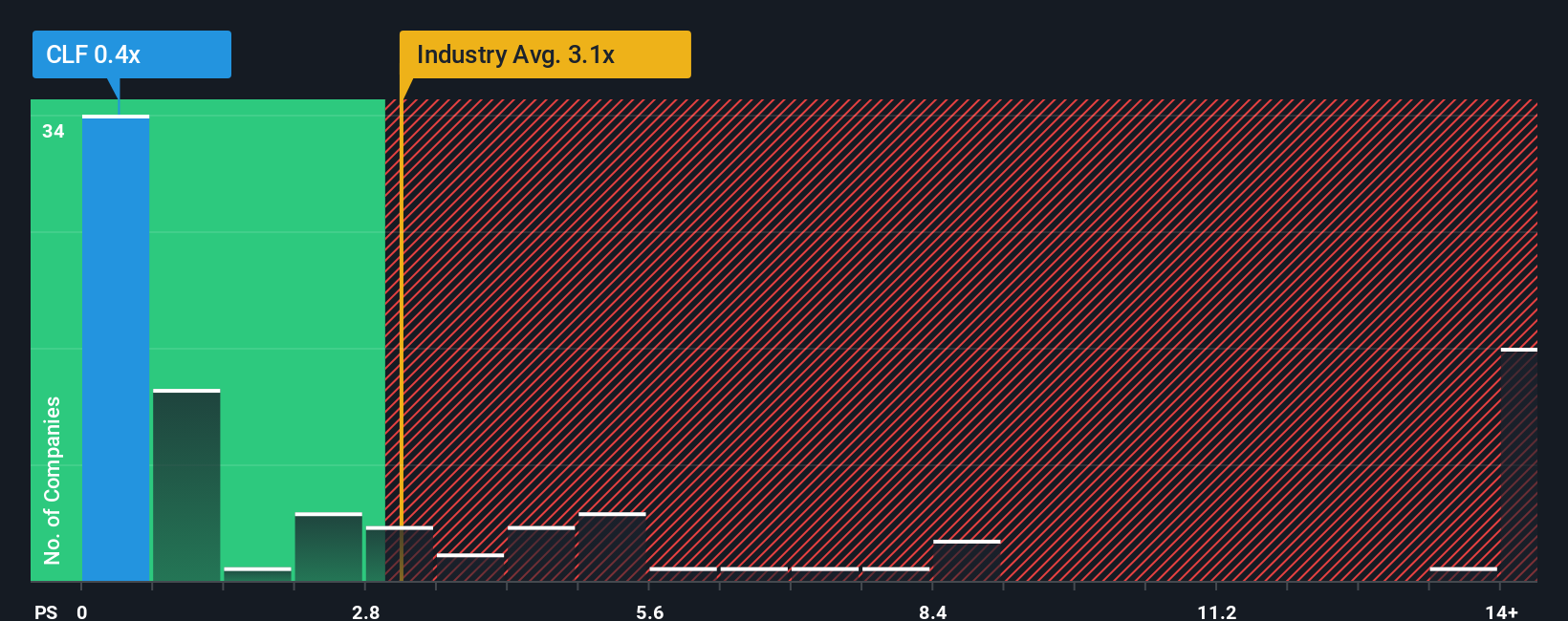

So far you have seen a fair value of US$12.45 that paints Cleveland-Cliffs as slightly overvalued. Yet on simple pricing, the stock looks quite different, with a P/S ratio of 0.4x versus 1.7x for peers and 2.6x for the wider US Metals and Mining industry, and a fair ratio of 0.6x. This raises the question of whether sentiment has swung too far.

Build Your Own Cleveland-Cliffs Narrative

If you see the numbers differently, or prefer to test the assumptions yourself, you can create a custom view in minutes with Do it your way.

A great starting point for your Cleveland-Cliffs research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking For Your Next Investment Idea?

If Cleveland-Cliffs has sparked fresh questions about where to put money to work next, do not stop here. The right list could surface your next opportunity.

- Spot potential value setups early by zeroing in on these 882 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Consider technology-related opportunities by scanning these 28 AI penny stocks that are tied to artificial intelligence themes across different industries.

- Strengthen your income watchlist with these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.