Please use a PC Browser to access Register-Tadawul

Evaluating Fidelity National Information Services's Valuation After New AI Treasury and Bank Modernization Launches

Fidelity National Information Services, Inc. FIS | 66.53 | -0.86% |

If you have been watching Fidelity National Information Services (FIS) lately, the company just rolled out not one, but two initiatives designed to foster major change. After missing earnings and revenue targets in the most recent quarter, FIS still raised its full-year revenue guidance, signaling management’s optimism even as the market stays cautious. The company’s introduction of the Neural Treasury suite, an AI-powered innovation, and its new Bank Modernization Framework, which lets banks rethink their technology in flexible ways, both point to a strategy focused on adapting and growing amid industry shifts.

While investors may appreciate these developments, the share price tells a different story. FIS has hit its 52-week low, and its stock is down more than 20% over the past year, underperforming the broader market. Despite ongoing operational efforts and fresh products, this follows declining momentum over the short and long term, even after the latest announcements.

With FIS now trading well below prior levels, the question becomes clear: does this dip reflect only near-term challenges, or is the stock offering a genuine value opportunity before these modernization bets pay off?

Most Popular Narrative: 23.9% Undervalued

The prevailing narrative sees Fidelity National Information Services (FIS) as significantly undervalued, with current prices well below modeled fair value given the company’s future prospects and ongoing transformation efforts.

Acceleration in digital payment solutions, highlighted by strong client wins in digital banking, embedded finance, and international payment processing (including new digital asset capabilities via partners like Circle), is positioning FIS to capture a growing share of global transaction volumes and capitalize on the continuing move toward cashless societies. This is likely to drive higher recurring revenue growth.

Curious how FIS keeps landing partnerships in major fintech trends? The real twist is that the narrative’s fair value is driven by earnings and margin forecasts that could change the way investors look at the stock. Want the details behind these bullish assumptions? The numbers inside may surprise you.

Result: Fair Value of $85.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent fintech competition and challenges integrating past acquisitions could undermine FIS’s projected growth and threaten the bullish case outlined above.

Find out about the key risks to this Fidelity National Information Services narrative.Another View: Looking at Valuation From a Different Angle

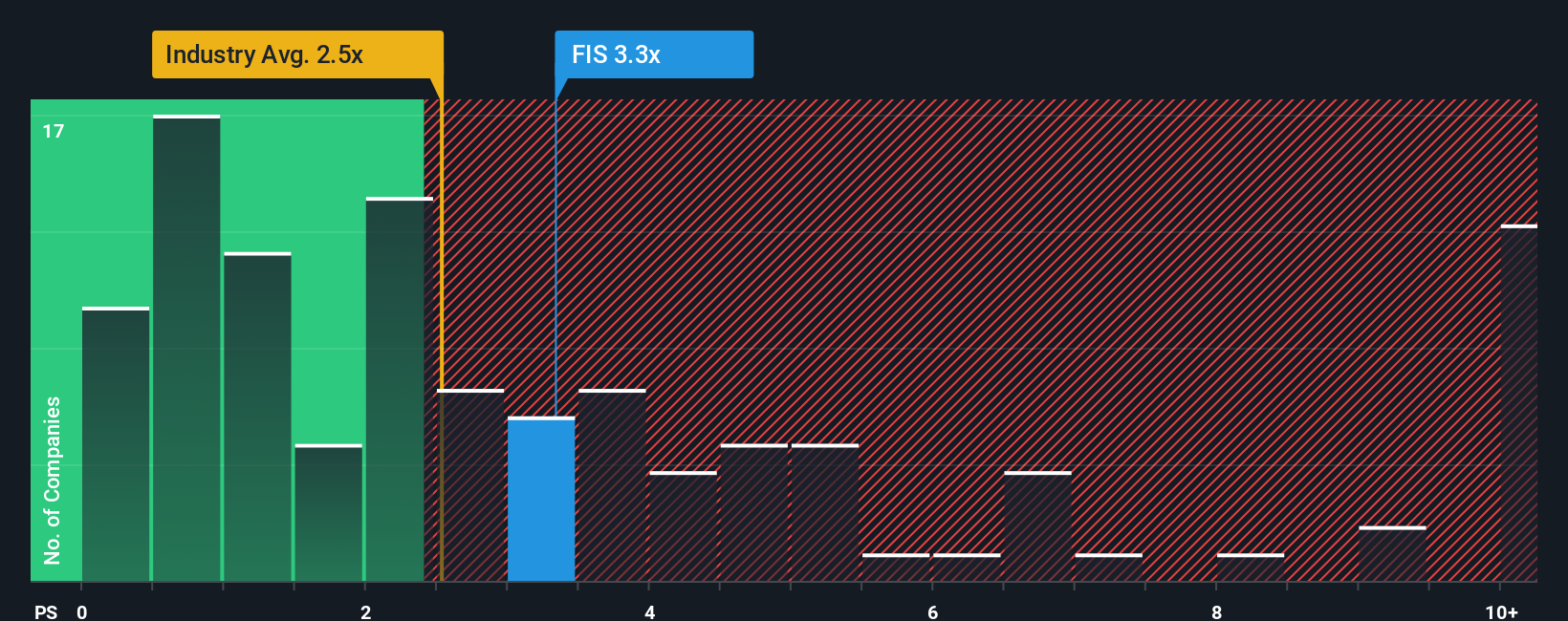

While the main narrative points to FIS being undervalued, a glance at market ratios tells a different story. According to this method, FIS appears more expensive than its sector. Do these approaches point to two different futures for the stock?

Build Your Own Fidelity National Information Services Narrative

If you see the outlook differently or want to dig into the details on your own, the tools are there for you to piece together your own perspective in just a few minutes. Do it your way.

A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your portfolio? Take charge of your next smart move by tapping into stocks that are reshaping tomorrow’s markets. The Simply Wall Street screener helps you spot the strongest opportunities right now.

- Zero in on stocks that are currently undervalued and poised for growth with our tool for uncovering undervalued stocks based on cash flows before the crowd does.

- Target companies making waves in artificial intelligence advancements by checking out our picks for tomorrow’s hottest AI penny stocks innovators.

- Get ahead of the curve with global leaders driving progress in digital money and blockchain by exploring a curated set of cryptocurrency and blockchain stocks primed for the future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.