Please use a PC Browser to access Register-Tadawul

Evaluating loanDepot (LDI) Valuation Following Shelf Registration Linked to Employee Stock Ownership Plan

loanDepot, Inc. Class A LDI | 2.60 | -6.47% |

Most Popular Narrative: 164% Overvalued

The most widely followed narrative sees loanDepot trading at a significant premium to its estimated fair value. Analysts project that the current share price is well above where fundamentals suggest it should be.

“Investors appear to be pricing in overly optimistic expectations of sustained high mortgage demand from Millennials and Gen Z. However, demographic trends suggest U.S. household formation is slowing and affordability challenges are likely to weigh on mortgage originations, potentially constraining long-term revenue growth.”

Is this rally built on solid foundations, or are investors ignoring critical numbers? There is a bold roadmap baked into expectations, the kind that relies on sharply higher revenue and a total reversal in profitability. What assumptions are driving that sky-high price target, and how do future margins and growth stack up? Get ready to be surprised: the path to the narrative’s fair value is built on projections few would expect from a mortgage lender.

Result: Fair Value of $1.62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if loanDepot’s technology and direct lending strategies drive efficiency or if a refinancing boom arrives, these expectations could quickly change.

Find out about the key risks to this loanDepot narrative.Another View: Market Value Through a Different Lens

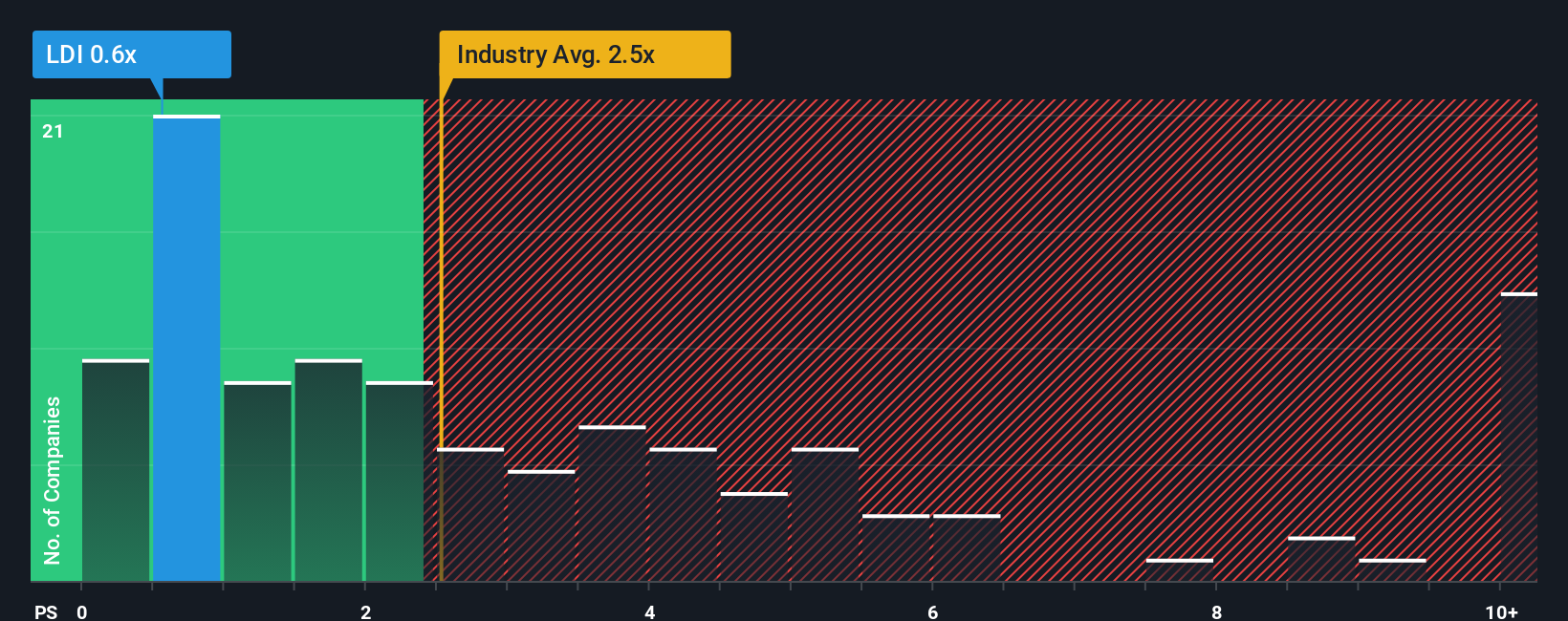

Taking a step back from growth projections, another common approach is to look at the company’s price compared to its sales. In this context, loanDepot screens as solid value against its industry. But is the stock’s recent run already pricing in all the good news?

Build Your Own loanDepot Narrative

If you see the story differently or want to shape your own insights, you can dive in and build a personalized take in just minutes. Do it your way.

A great starting point for your loanDepot research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let other compelling opportunities pass you by. The Simply Wall Street screener unlocks tailored ideas designed to give your portfolio an edge right now.

- Accelerate your returns by targeting innovative businesses in artificial intelligence with our shortcut to AI penny stocks.

- Maximize your search for long-term value and stable growth with companies focused on consistent dividend payouts. Start your hunt at dividend stocks with yields > 3%.

- Tap into overlooked stocks offering remarkable upside based on cash flow analysis, thanks to the power of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.