Please use a PC Browser to access Register-Tadawul

Evaluating the Value of TDS (NYSE:TDS) After Recent Share Price Momentum Shift

Telephone and Data Systems, Inc. TDS | 38.45 | 0.00% |

Telephone and Data Systems (TDS) has seen its stock climb steadily in the past three months, gaining over 5%. Investors are watching for shifts in the company’s long-term growth strategy, and are curious about what might be driving recent momentum.

While Telephone and Data Systems posted modest share price gains of nearly 6% over the past quarter, the real story is its significant momentum shift. Total shareholder return for the past year now stands at over 32%, and an impressive 172% over three years. This hints at a renewed sense of growth potential and improved outlook among investors.

If you’re curious about what other stocks have been on the move, now’s a perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares still trading about 35% below analyst targets, it begs the question: is there real value yet to be unlocked here, or has the market already accounted for every bit of future growth in TDS’s price?

Most Popular Narrative: 26% Undervalued

With the narrative consensus placing fair value for Telephone and Data Systems at $52, well above its last close, the implied upside is hard to miss. The big question for investors is: are the story’s bold growth drivers credible enough to close that gap?

The divestiture of UScellular and major spectrum assets has substantially deleveraged TDS's balance sheet, freeing up capital for aggressive expansion in fiber infrastructure and providing flexibility for opportunistic M&A, both of which are positioned to drive long-term revenue and earnings growth as broadband demand intensifies.

Want to know what justifies that higher target? The core of this narrative relies on sweeping business model changes, dramatic margin shifts, and a future profit trajectory that few would expect. Intrigued by which assumptions back this calculation? Dive in to see what is fueling this value and why it could be a real game changer.

Result: Fair Value of $52 (UNDERVALUED)

However, ongoing declines in legacy business segments and the risk of aggressive broadband competition could weaken the anticipated growth story for TDS.

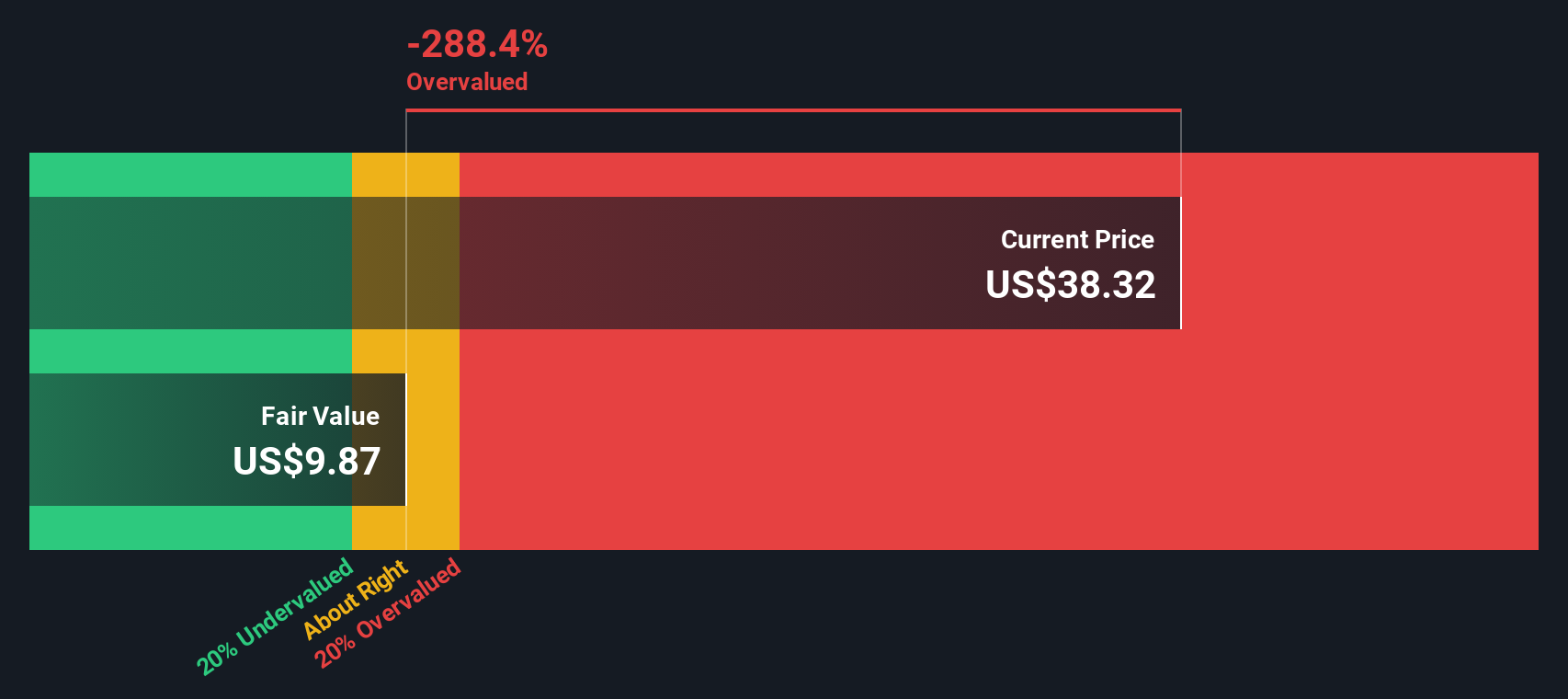

Another View: DCF Valuation Paints a Different Picture

While analysts pin TDS’s fair value at $52 based on future profit potential, our DCF model paints a less optimistic scenario. According to this cash flow-based method, TDS shares actually trade well above fair value. This raises questions about whether the true upside matches recent optimism. Could the consensus be too bullish?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Telephone and Data Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Telephone and Data Systems Narrative

If this story doesn't match your outlook or you want to form an independent view, you can explore the numbers and shape your own perspective in minutes with Do it your way.

A great starting point for your Telephone and Data Systems research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step beyond TDS and level up your watchlist with targeted opportunities you might be missing out on. Put your money where the smartest trends are heading.

- Capture yield potential and add stability to your portfolio by checking out these 18 dividend stocks with yields > 3% with impressive yields and consistent payouts.

- Grow your edge in artificial intelligence by scouting these 24 AI penny stocks that are redefining industries and accelerating innovation worldwide.

- Supercharge your returns by seizing value with these 878 undervalued stocks based on cash flows based on strong cash flows and compelling upside stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.