Please use a PC Browser to access Register-Tadawul

Evaluating Tradeweb Markets (TW): Is the Stock’s Recent Slide an Opportunity or Overstated?

Tradeweb Markets TW | 105.97 | -1.12% |

What’s behind Tradeweb Markets' recent swing?

If you’ve had Tradeweb Markets (TW) on your watchlist lately, you may have noticed the stock’s movement catching investor attention. Though there’s no headline-grabbing event to point to, the recent shift is enough to make investors pause and wonder whether the underlying value has really changed or if this is a temporary blip. When a stock as established as Tradeweb moves without a clear trigger, it presents a puzzle investors need to solve.

Over the past year, Tradeweb’s share price has been mostly flat, slipping less than 1% despite the company’s steady financial performance and growing revenues. Momentum has faded in recent months, with the stock declining 10% year to date and nearly 16% in the past quarter. That comes even as the company posted annual revenue growth of 9% and net income growth over 15%, suggesting that the market’s mood has shifted despite solid fundamentals.

So, is this recent pullback a sign that Tradeweb is trading at a bargain or is the market simply baking in every ounce of expected growth ahead?

Most Popular Narrative: 22.5% Undervalued

According to the most widely followed narrative, Tradeweb Markets is currently undervalued by over 22% compared to its calculated fair value.

"Tradeweb is poised to benefit from the ongoing migration of fixed income and derivatives trading from manual and voice channels to electronic platforms. This shift is evidenced by record electronic trading volumes and expanding adoption of automated tools like AiEX and Portfolio Trading. These factors can support sustained transaction growth and fee revenue expansion."

Wondering what’s really powering this bullish valuation? The main drivers are a standout combination of rapid digital adoption, high-margin growth, and bold future profit assumptions. Interested in just how ambitious those financial forecasts are, and what’s expected of Tradeweb in the years ahead? The numbers behind this price target may surprise you.

Result: Fair Value of $152.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent reliance on traditional trading and increased pressure on fees could slow Tradeweb’s growth. This could challenge even the most optimistic projections.

Find out about the key risks to this Tradeweb Markets narrative.Another View: Looking at Market Value

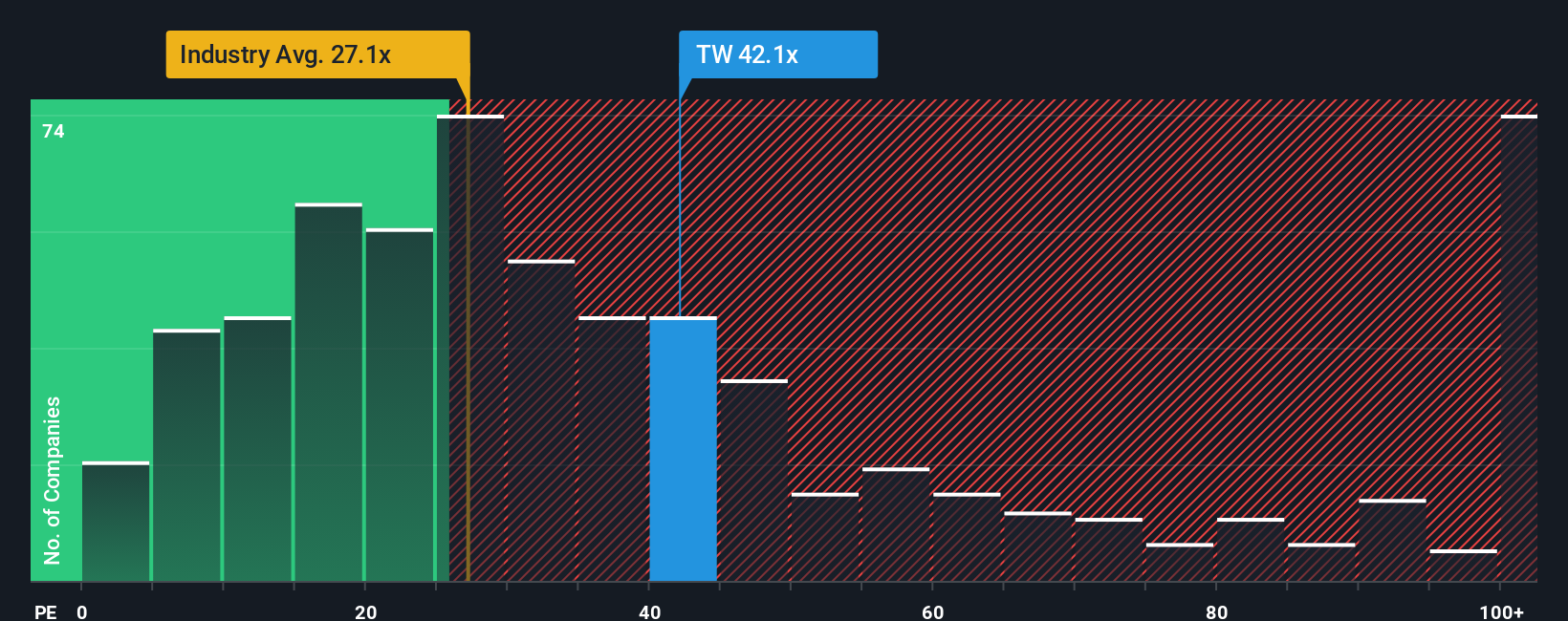

While some see value based on growth forecasts, a different view emerges when comparing Tradeweb’s current price to others in its industry using a common valuation ratio. This approach actually points to the stock being expensive. Could the market be getting ahead of itself?

Build Your Own Tradeweb Markets Narrative

Keep in mind, if you see things differently or want to dive deeper into the numbers, you can build your own narrative in just a few minutes. All it takes is a closer look. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tradeweb Markets.

Looking for more investment ideas?

Smart investors stay ahead by seeking out fresh opportunities beyond a single stock. Don’t let potential winners slip through your fingers. Make these screens your secret weapon.

- Tap into high-growth frontiers shaped by next-level computing with our selection of quantum computing stocks powering breakthroughs well beyond today’s tech status quo.

- Capture passive income opportunities from reliable companies offering strong yields when you review our picks for dividend stocks with yields > 3% that reward you for longevity and resilience.

- Spot standout businesses leading a revolution in healthcare by leveraging advanced algorithms with our shortlist of healthcare AI stocks paving the way in transformative medicine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.