Please use a PC Browser to access Register-Tadawul

Evertec Dimensa Deal Shifts Brazil Exposure And Valuation Opportunity

EVERTEC, Inc. EVTC | 27.54 | +1.62% |

- EVERTEC (NYSE:EVTC) has entered into a definitive agreement to acquire Dimensa, a B2B technology provider in Brazil.

- The deal will expand EVERTEC's reach into the Brazilian market and broaden its financial technology offerings.

- The transaction is subject to regulatory approvals and other customary closing conditions.

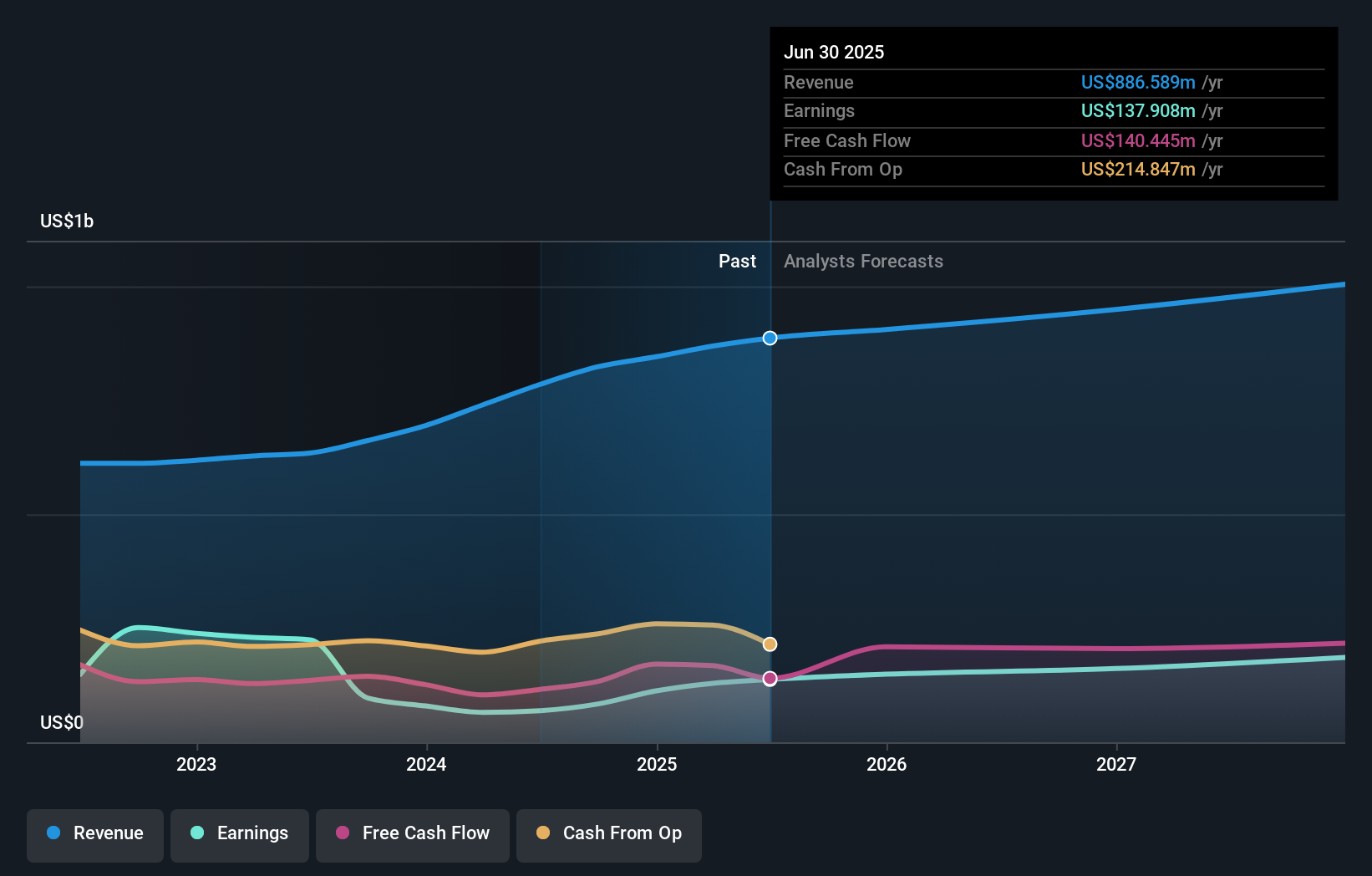

For investors watching NYSE:EVTC, this move comes with the stock recently trading at $30.21 and mixed multi year returns, including a 5.3% gain year to date and a 16.3% decline over three years. The transaction puts a spotlight on how EVERTEC is positioning itself within Latin American payments and financial technology services.

Acquiring Dimensa introduces new exposure to Brazil and adds B2B solutions across several financial segments, which could reshape how EVERTEC earns revenue over time. As regulatory reviews progress, investors may focus on integration execution, potential synergies and how the combined business might change EVERTEC's risk and opportunity profile in the region.

Stay updated on the most important news stories for EVERTEC by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on EVERTEC.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$30.21 versus a consensus target of US$32.80, the price is about 8% below analysts' view.

- ✅ Simply Wall St Valuation: Shares are flagged as undervalued, trading 52.6% below the estimated fair value.

- ✅ Recent Momentum: The stock has a positive 30 day return of roughly 5.3%.

Check out Simply Wall St's in-depth valuation analysis for EVERTEC.

Key Considerations

- 📊 The Dimensa deal increases EVERTEC's exposure to Brazilian B2B financial technology, which could change its revenue mix and competitive position in Latin America.

- 📊 Monitor how management discusses integration costs, cross-selling opportunities and whether Dimensa affects earnings per share projections around the US$2.54 to US$4.23 range.

- ⚠️ One identified risk is EVERTEC's high level of debt, which may be more important if the acquisition adds financing needs or delays expected benefits.

Dig Deeper

For a fuller picture including more risks and potential rewards, see the complete EVERTEC analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.