Please use a PC Browser to access Register-Tadawul

Examining IDEX Stock After Supply Chain Improvements and Recent Price Movements

IDEX Corporation IEX | 212.94 | +0.33% |

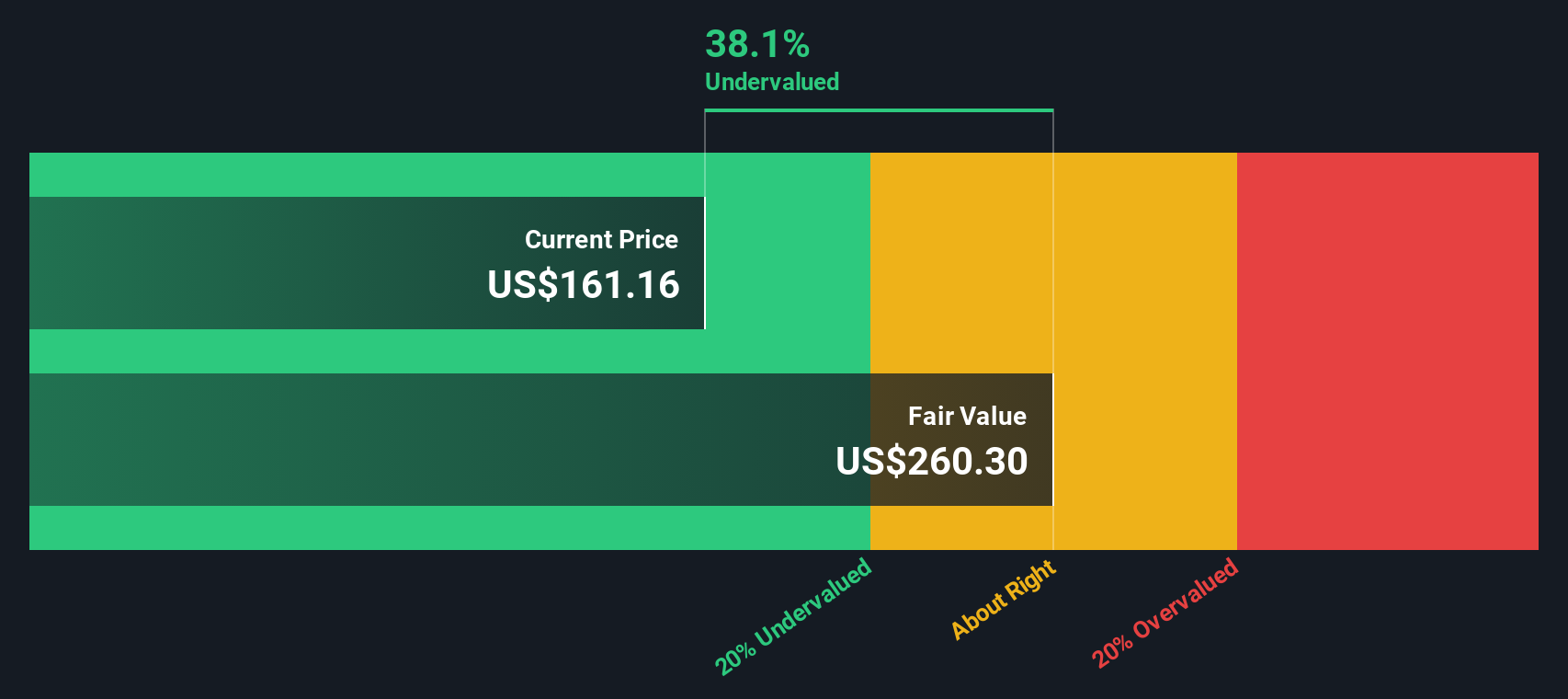

- Curious whether IDEX is attractively priced or trading above its worth? Let’s explore what the numbers and recent market trends reveal about its value proposition.

- The stock has seen some short-term movement, gaining 1.9% in the last week. It remains down 23.4% over the past year, which may suggest shifting investor sentiment as well as possible opportunities or risks.

- Recent news related to industry-wide supply chain improvements and IDEX’s ongoing strategic investments has attracted investor interest. These developments help provide context to the recent fluctuations in the share price.

- In terms of valuation, IDEX scores just 1 out of 6 on our checklist for undervaluation signals. This means it is important to look beyond the surface. We will break down what this means through various valuation methods, and provide an even more insightful way to evaluate the company’s worth by the end of the article.

IDEX scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: IDEX Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach is widely used because it attempts to capture the core drivers of value: how much cash IDEX is likely to generate and what those future cash flows are worth now.

For IDEX, the most recent reported Free Cash Flow stands at $567.9 Million. Analysts provide explicit estimates for the next five years, with IDEX’s Free Cash Flow projected to rise steadily, reaching $942.9 Million by 2029. Beyond this, Simply Wall St extrapolates further annual growth, indicating sustained momentum in cash generation.

Based on these projections, the DCF methodology calculates a fair value for IDEX shares of $210.46. With the model implying the stock is trading at a 17.4% discount to this intrinsic value, it indicates that IDEX is currently undervalued according to the cash flow expectations and discount assumptions used in this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests IDEX is undervalued by 17.4%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

Approach 2: IDEX Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular metric for valuing profitable companies like IDEX because it quickly summarizes how much investors are willing to pay for each dollar of current earnings. It is a useful starting point for comparing companies within the same industry and understanding if the stock is trading at a premium or discount in the market.

However, what counts as a “normal” or “fair” PE ratio can vary. Faster-growing companies, or those with higher profit margins and lower risk, often deserve higher PE multiples. In contrast, slower growth or higher risk can justify a lower ratio. It is important to factor in these elements when making comparisons.

IDEX currently trades at a PE ratio of 27.2x. Compared to the Machinery industry average of about 24.9x and a peer average of 24.6x, the company’s PE is slightly elevated. Rather than comparing only with peers, Simply Wall St’s proprietary “Fair Ratio” adjusts for IDEX’s specific characteristics such as earnings growth prospects, margins, industry position, and market capitalization. For IDEX, the Fair Ratio is calculated at 24.8x, providing a more customized benchmark.

The Fair Ratio offers an improved assessment because it goes beyond averages and tailors the valuation to reflect IDEX’s actual strengths, risks, and opportunities. When comparing IDEX’s 27.2x PE to its 24.8x Fair Ratio, the stock appears to be trading somewhat above fair value.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your IDEX Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple framework that allows you to combine your personal view of IDEX’s story with informed financial forecasts, so you can estimate your own fair value based on your beliefs about its future.

Instead of relying just on generic models or external analyst targets, Narratives encourage you to link what you think will happen (like accelerating innovation or cost-saving measures) directly to assumptions about revenue growth, margins, and future earnings. This approach connects your unique perspective with valuation models, making your reasoning more transparent and actionable.

On Simply Wall St’s Community page, Narratives have become an increasingly popular tool, used by millions of investors globally. They make it straightforward for you to compare your own fair value—the price you think IDEX is worth—to the current market price. This can help you decide when it might be a good time to make an investment decision.

A powerful advantage is that Narratives update automatically as new developments occur, such as changes from earnings reports, acquisitions like Mott, or leadership shifts. For example, one investor might see IDEX as worth $213 per share due to rapid expansion into energy and tech, while another, cautious of tariff risks and sector vulnerability, values it at just $170. Narratives empower you to see, compare, and refine your own investment story so your decisions reflect both the numbers and your personal convictions.

Do you think there's more to the story for IDEX? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.