Please use a PC Browser to access Register-Tadawul

Examining Intercontinental Exchange’s Valuation After Record Q3 Results and New AI-Driven Initiatives

Intercontinental Exchange, Inc. ICE | 163.21 | +0.07% |

Intercontinental Exchange (ICE) has just reported record third-quarter results, supported by expansion in mortgage technology, data services, and new AI initiatives through its ICE Aurora platform. The company also reinforced its growth with a higher dividend and share repurchases.

Despite a tough few months for financial stocks, Intercontinental Exchange’s momentum has not gone unnoticed. After a 22% drop in share price over the past quarter and a modest decline of 2% year-to-date, ICE has still delivered an impressive 56% total shareholder return over three years and has nearly matched that over five years. This shows that long-term investors continue to be rewarded even as recent volatility persists.

If strategic tech moves like ICE Aurora have your attention, now is a great time to explore what else is out there and discover fast growing stocks with high insider ownership

With the stock trading below analyst price targets and seeing mixed momentum, it begs the question: Is ICE undervalued right now, or has the market already priced in its next chapter of growth?

Most Popular Narrative: 26.6% Undervalued

With the narrative fair value at $199.25 and Intercontinental Exchange’s last close at $146.21, the narrative points to considerable upside from current levels. This creates a compelling opportunity for investors if the projections hold true.

"Intensifying demand for high-quality, real-time market data and analytics, especially to power AI-driven trading and workflow automation, has resulted in consistent growth of ICE's data and analytics businesses, supporting higher-margin, recurring revenues and improved net margins."

Which hidden factor fuels these bold forecasts? The narrative is built on surprisingly robust growth rates and ambitious profit projections, driven by expanding tech-driven revenues. But what numbers justify this optimism? Dive into the full story behind this valuation before making your next move.

Result: Fair Value of $199.25 (UNDERVALUED)

However, continued volatility in trading volumes and integration challenges from recent acquisitions could quickly shift the outlook for Intercontinental Exchange’s future growth.

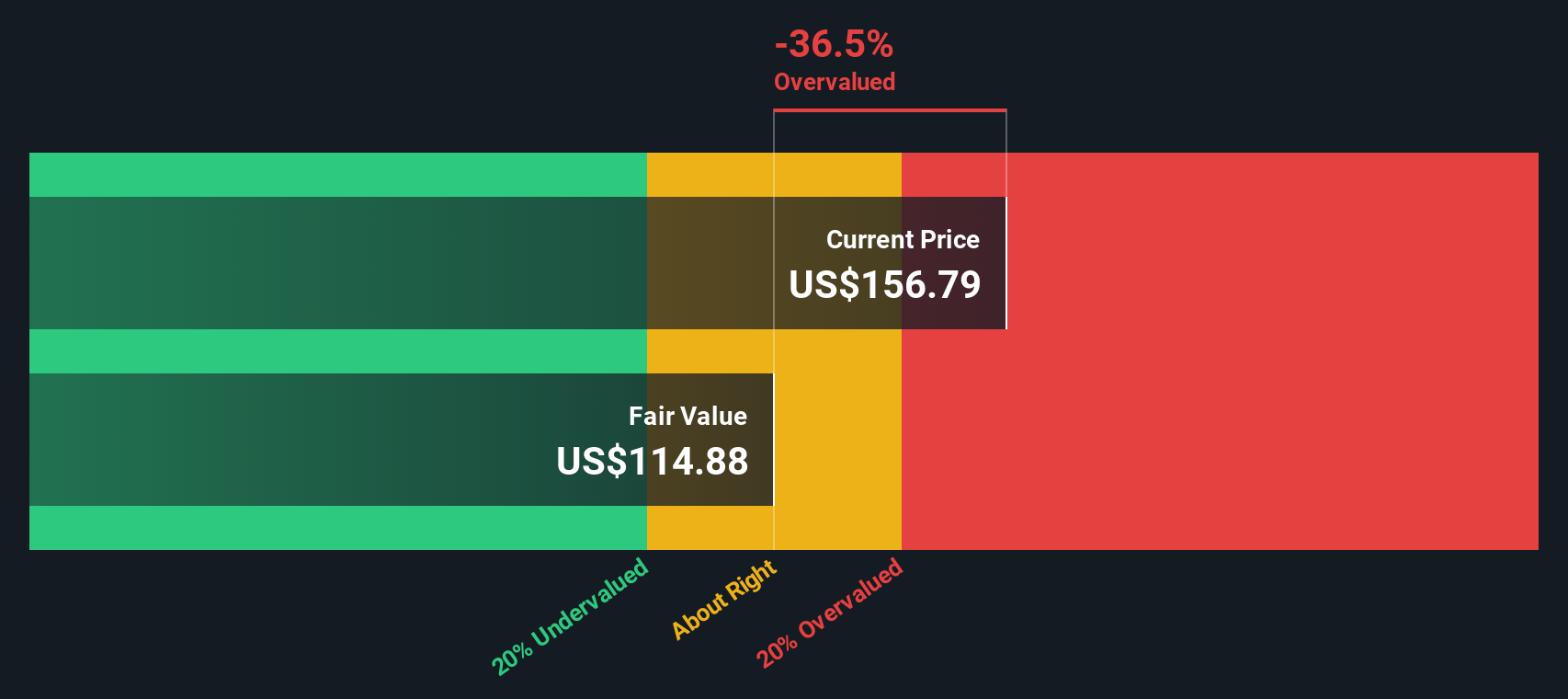

Another View: SWS DCF Model Sends a Caution Signal

Taking another angle, our DCF model currently suggests that Intercontinental Exchange may be trading above its estimated fair value of $118, rather than being undervalued. This challenges the upbeat narrative valuation and highlights how different assumptions can steer investors toward opposite conclusions. Which method best suits your expectations for ICE?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Intercontinental Exchange for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Intercontinental Exchange Narrative

If you want to dig deeper, challenge the consensus, or follow your own instincts, you can shape your own narrative in just a few minutes: Do it your way

A great starting point for your Intercontinental Exchange research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment opportunities?

Why limit yourself to one winner when there are so many unique paths to strong returns? Let Simply Wall Street Screener point you toward fresh ideas you’d hate to miss.

- Uncover companies paying out consistent income and tap into growth potential with these 20 dividend stocks with yields > 3%, offering yields above 3% for income-focused investors.

- Leap ahead of mainstream trends by checking out these 26 AI penny stocks, where emerging AI leaders are redefining innovation and market leadership.

- Position yourself at the forefront of technology by exploring these 27 quantum computing stocks, packed with cutting-edge quantum computing stocks pushing industry boundaries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.