Please use a PC Browser to access Register-Tadawul

Exelixis (EXEL) Valuation in Focus as New Adagene Partnership Expands Oncology Pipeline Potential

Exelixis, Inc. EXEL | 43.90 | +3.61% |

If you have been tracking Exelixis (EXEL), the company's decision to amend its 2021 agreement with Adagene is more than just another announcement. By tapping into Adagene's SAFEbody technology to develop a masked monoclonal antibody, Exelixis is signaling real intent to expand its pipeline into next-generation antibody-drug conjugate (ADC) therapies for solid tumors. The collaboration could shape future prospects, and investors are naturally wondering what this might mean for the company's growth narrative.

In the broader context, Exelixis has delivered strong results over the year, with the share price up 51% in the past twelve months and 17% year to date. The stock gained 1.7% in the past week and 3% over the last month, though momentum faded slightly in the past 3 months. Pipeline updates and recent conference presentations underscore management's ongoing push to innovate in oncology and diversify revenue streams.

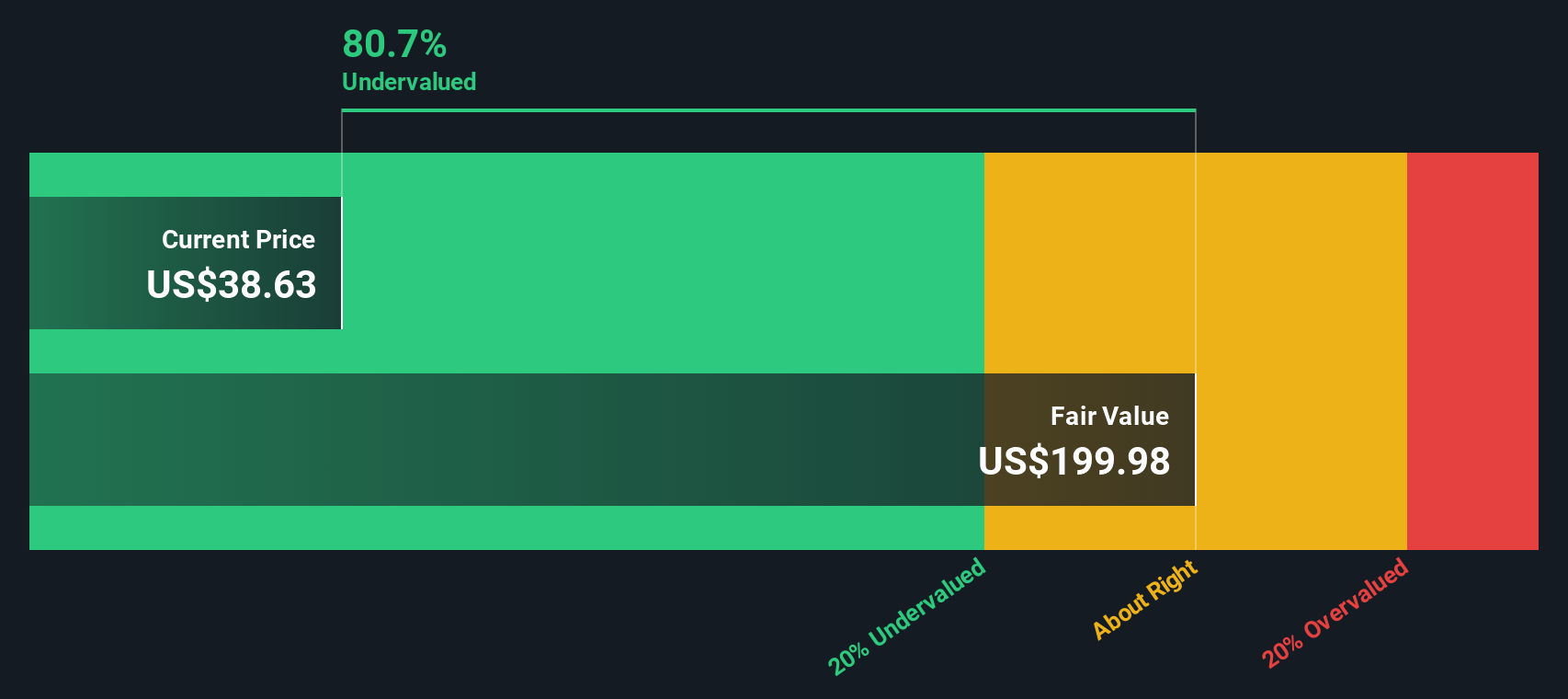

After this year’s rally and the new technology partnership, is Exelixis trading at an attractive entry point, or is the market already pricing in these future ambitions?

Most Popular Narrative: 9.6% Undervalued

The leading narrative currently sees Exelixis trading below its estimated fair value, with analysts identifying the stock as undervalued by nearly 10%. This view incorporates expectations around growth, margins, and future product wins, providing a bullish outlook for potential long-term upside if forecasts hold true.

"Positive top-line results from pivotal trials (e.g., STELLAR-303 for zanzalintinib in colorectal cancer) and an advancing late-stage pipeline provide significant potential for new product approvals and label expansions, supporting future earnings growth and further diversifying revenue streams as precision medicine and targeted therapy adoption accelerates across global oncology markets."

Exelixis’s valuation story is a magnet for investor curiosity. What if this supposedly “undervalued” stock is primed for a breakthrough, powered by expanding margins and analyst projections that go beyond mere wishful thinking? Behind the narrative lies a set of financial triggers: think surging revenues, ambitious profit targets, and a game-changing multiple that could change the game for this biotech. Ready to discover the precise numbers and hidden mechanics turning heads on Wall Street?

Result: Fair Value of $44.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained reliance on Cabometyx and intensifying competition in core markets could quickly challenge Exelixis’s growth trajectory if not addressed.

Find out about the key risks to this Exelixis narrative.Another View: Sizing Up Value In A Different Light

Looking at Exelixis through our DCF model, a different perspective on value emerges. This approach weighs long-term cash flows instead of current earnings multiples, often leading to a very different read on what is considered “fair.” Which picture really tells the story: market multiples, or cash flow models?

Build Your Own Exelixis Narrative

If you want to dig a little deeper or prefer charting your own course, you can build a fresh narrative from scratch in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Exelixis.

Looking for More Smart Investment Moves?

You’re not limited to one opportunity. The smartest investors cast a wider net, regularly spotting overlooked gems and sector trends others miss. Try these curated idea generators before the next market surge leaves you behind:

- Snap up tomorrow’s winners among affordable stocks with strong financials. Your next big breakout could be just a click away with penny stocks with strong financials.

- Uncover the potential of artificial intelligence innovators. See which companies are shaping entire industries now through AI penny stocks.

- Make your portfolio work harder by targeting undervalued companies backed by impressive cash flow metrics. Track down these opportunities with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.