Please use a PC Browser to access Register-Tadawul

EXL Patents New AI Data Tools As Shares Trade Below Targets

ExlService Holdings, Inc. EXLS | 30.07 | -1.12% |

- ExlService Holdings (NasdaqGS:EXLS) has received 10 new U.S. patents covering AI and data-focused solutions.

- The patents span multiple sectors, including insurance, healthcare, retail, utilities, and financial services.

- Newly protected capabilities target data readiness for AI, workflow automation, and tuning large language models for enterprise use.

For shareholders watching NasdaqGS:EXLS, this patent batch lands after a challenging stretch for the stock, with the share price at $30.25 and a 40.7% decline over the past year. Even with that pullback, the 5 year return of 84.2% shows how different time horizons can tell very different stories about the same company.

If you are tracking EXL, these patents may be worth watching as a signal of where management is focusing its product and platform efforts. The real test will be how effectively the company converts this IP into adoption, long term contracts, and stickier client relationships across its core sectors.

Stay updated on the most important news stories for ExlService Holdings by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on ExlService Holdings.

Quick Assessment

- ✅ Price vs Analyst Target: At US$30.25 versus a consensus target of US$52.14, the price sits about 42% below where analysts cluster.

- ✅ Simply Wall St Valuation: Simply Wall St flags EXL as undervalued, trading roughly 49.1% below its estimated fair value.

- ❌ Recent Momentum: The 30 day return of 28.4% decline shows recent sentiment has been weak despite the patent news.

There's only one way to know the right time to buy, sell or hold ExlService Holdings. Head to the Simply Wall St company report for the latest analysis of ExlService Holdings's fair value.

Key Considerations

- 📊 The 10 new U.S. patents in AI and data solutions strengthen EXL's IP footprint across insurance, healthcare and other sectors, which could matter for long term competitiveness.

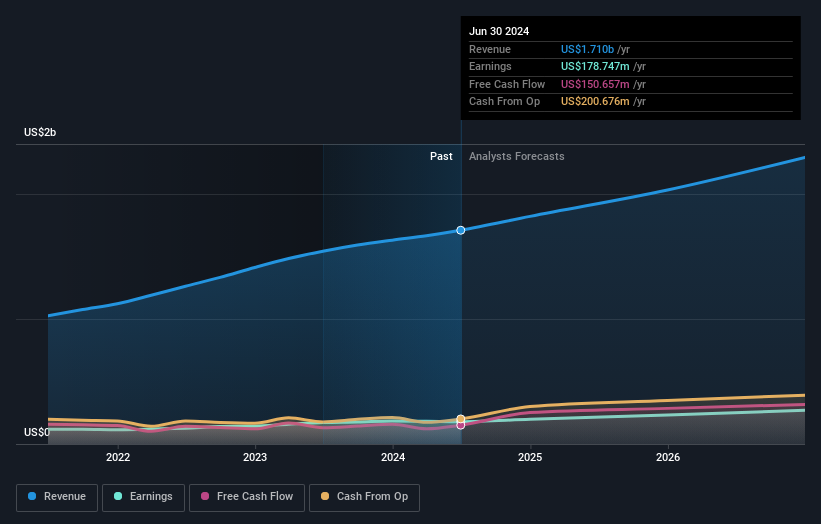

- 📊 Keep an eye on whether revenue and EPS, currently US$2,026.49m and US$1.54 per share, track closer to the latest future EPS estimate of US$2.36 as these patents are incorporated into products.

- ⚠️ One flagged risk is significant insider selling over the past 3 months, which some investors may weigh against the broader rewards profile.

Dig Deeper

For the full picture including more risks and rewards, check out the complete ExlService Holdings analysis. Alternatively, you can visit the community page for ExlService Holdings to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.