Please use a PC Browser to access Register-Tadawul

Expedia Group (NasdaqGS:EXPE) Sees 13% Dip Amid New Partnership With Southwest Airlines

Expedia Group EXPE | 274.21 | -2.47% |

Expedia Group's (NasdaqGS:EXPE) recent partnership with Southwest Airlines and the launch of Quill Rewards reflect efforts to expand its offerings and customer engagement. Despite these initiatives aimed at enhancing customer experience and brand alignment, the company's stock experienced a decline of 13.22% over the past week. This decrease occurred against a backdrop of broader market volatility, where major indices like the Nasdaq fell due to concerns over tariffs and a possible recession. Moreover, while the S&P 500 and Nasdaq initially rose, tech sector concerns influenced market sentiment, with mixed investor reactions likely impacting stocks like Expedia. Additionally, changes in public offering lead underwriters also shaped investor perceptions, which could have contributed to pressure on the stock amidst tightening financial conditions. Overall, fingers are pointing towards a mixture of broader economic concerns beyond the company's control and mixed investor reception to strategic moves made by this travel giant.

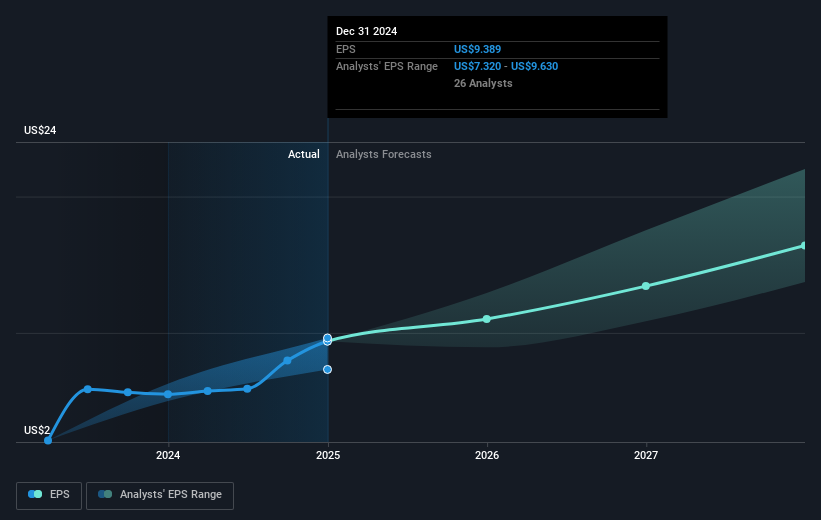

Over the past five years, Expedia Group's total return, including share price and dividends, rose 203.20%. This return reflects favourable long-term trends as the company outpaced both the U.S. Hospitality industry and broader market over the last year. Key drivers behind this performance include a robust earnings growth, averaging 59.6% annually, and smart use of share buybacks, reducing equity by 9.78% by end-2024. This focus on improving shareholder value through buybacks often boosts per-share metrics, which can positively influence market perception.

Expedia's attractive valuation, based on trading at approximately 59.7% below estimated fair value, also likely played a role. Despite challenges such as legal issues and high debt levels, efforts to enhance financial health and value positioning, such as reinstating the quarterly dividend, signal confidence in future cash flows. The appointment of a permanent CFO in February 2025 further underscores a commitment to stable financial governance, enhancing investor confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.