Please use a PC Browser to access Register-Tadawul

Exploring Axsome Therapeutics (AXSM) Valuation as Investors Notice Steady Upswing in Biotech Momentum

Axsome Therapeutics, Inc. AXSM | 146.66 | +0.29% |

Axsome Therapeutics (AXSM) has been turning heads lately, and for good reason. Investors watching the biotech sector might have noticed an uptick in questions about whether this company’s recent progress marks the beginning of a new chapter. There hasn’t been a high-profile event to kick off this buzz, but sometimes that steady undercurrent of activity can be just as important for those deciding where to place their next bet.

Over the past year, Axsome Therapeutics shares have climbed an impressive 26%, with momentum building steadily. Shares are up 14% in the past three months and 36% year to date. In the context of a volatile biotech market, this upward trend signals that investors’ risk appetite for the company could be growing. Elsewhere, Axsome has recorded strong annual revenue and net income growth, giving spectators more to consider as they debate what’s next.

The question now is whether this run makes Axsome Therapeutics a compelling buy at its current valuation, or if the market is already pricing in the next phase of the company’s growth story. What do you think?

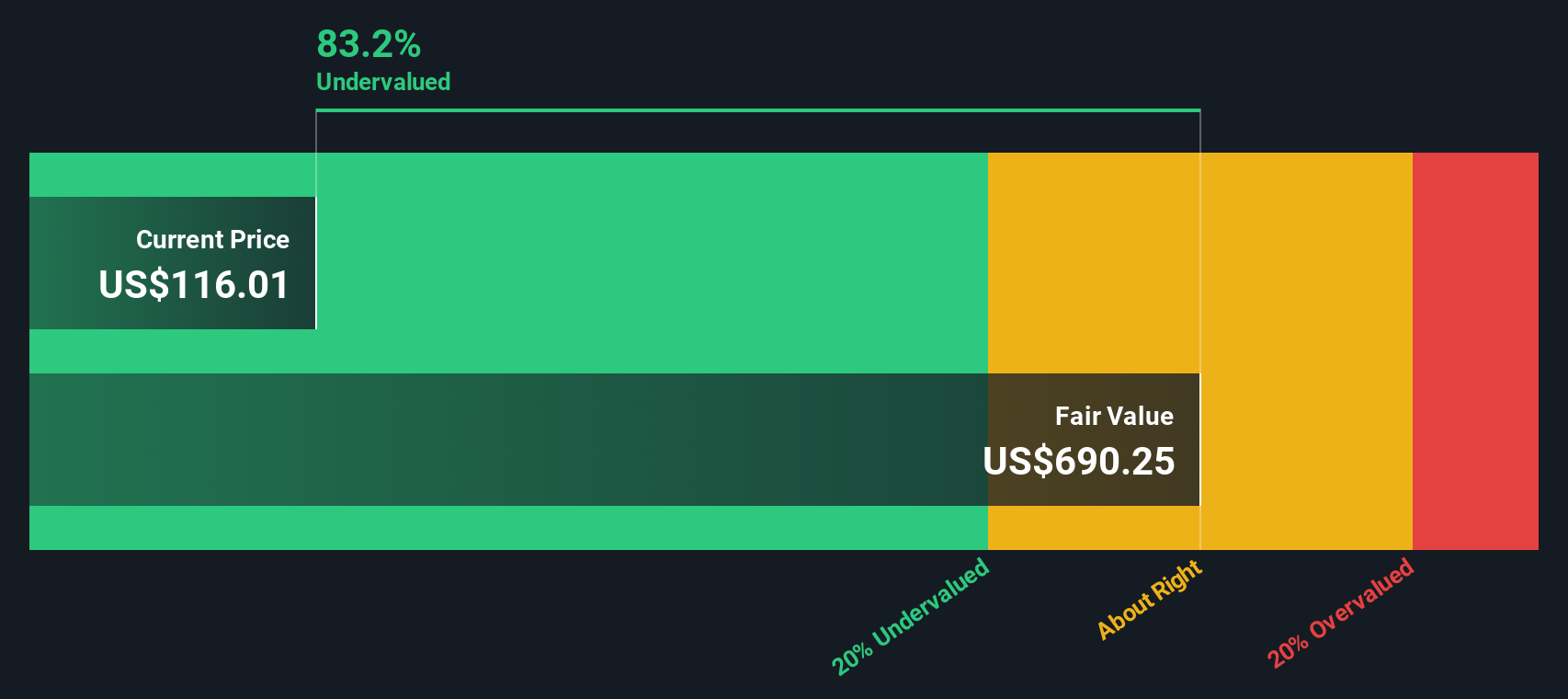

Most Popular Narrative: 33% Undervalued

The prevailing valuation narrative suggests Axsome Therapeutics is trading at a sizable discount compared to its calculated fair value. Analysts estimate the stock is undervalued by approximately one-third, projecting substantial upside potential if key assumptions prove accurate.

Broader payer coverage and formulary wins (e.g., Auvelity's access to 83% of covered lives, expanding SYMBRAVO coverage) are improving patient access, supporting greater product adoption. This is expected to positively impact net sales and support operating leverage as commercial infrastructure scales.

What exactly fuels this bullish outlook? The narrative is built around striking revenue acceleration, transformative margin projections, and much higher future earnings multiples than many expect. What is the bold growth lever at the heart of this valuation? The full assumptions might surprise you. Uncover the core drivers and see how this price target is justified by deep financial forecasts and key industry trends.

Result: Fair Value of $176.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent losses and reliance on just a few key products could quickly reverse momentum if revenue or product uptake fails to meet expectations.

Find out about the key risks to this Axsome Therapeutics narrative.Another View: Our DCF Model Perspective

Looking at Axsome Therapeutics through the lens of our SWS DCF model, the analysis also points to undervaluation. This approach places greater emphasis on future cash flows rather than current headlines. How much trust do you put in long-range forecasts?

Build Your Own Axsome Therapeutics Narrative

If you see things differently or enjoy hands-on analysis, take a moment to explore the numbers yourself and shape your own conclusion in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Axsome Therapeutics.

Looking for more investment ideas?

Stay a step ahead by tapping into other emerging opportunities. Don’t let the smartest picks pass you by; your next big winner could be hiding in plain sight.

- Capture fast-moving opportunities with companies making waves in the AI space by checking out AI penny stocks.

- Target reliable income streams by finding shares offering attractive yields and steady dividends through dividend stocks with yields > 3%.

- Spot value where others overlook it, browsing stocks that stand out for their strong fundamentals using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.