Please use a PC Browser to access Register-Tadawul

Exploring High Growth Tech Stocks In The US This June 2025

Vertex Pharmaceuticals Incorporated VRTX | 434.58 | +0.09% |

The United States market has remained flat over the last week but has shown a 9.9% increase over the past year, with earnings forecasted to grow by 14% annually. In this context, identifying high-growth tech stocks involves looking for companies that demonstrate robust innovation and potential to capitalize on expanding market opportunities.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 20.78% | 59.46% | ★★★★★★ |

| Legend Biotech | 26.68% | 57.96% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.36% | 60.93% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.63% | 60.71% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 22.99% | 103.97% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Pagaya Technologies (PGY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pagaya Technologies Ltd. is a technology company that utilizes data science and proprietary AI technology to serve financial services, other service providers, their customers, and asset investors across the United States, Israel, and the Cayman Islands with a market cap of approximately $1.36 billion.

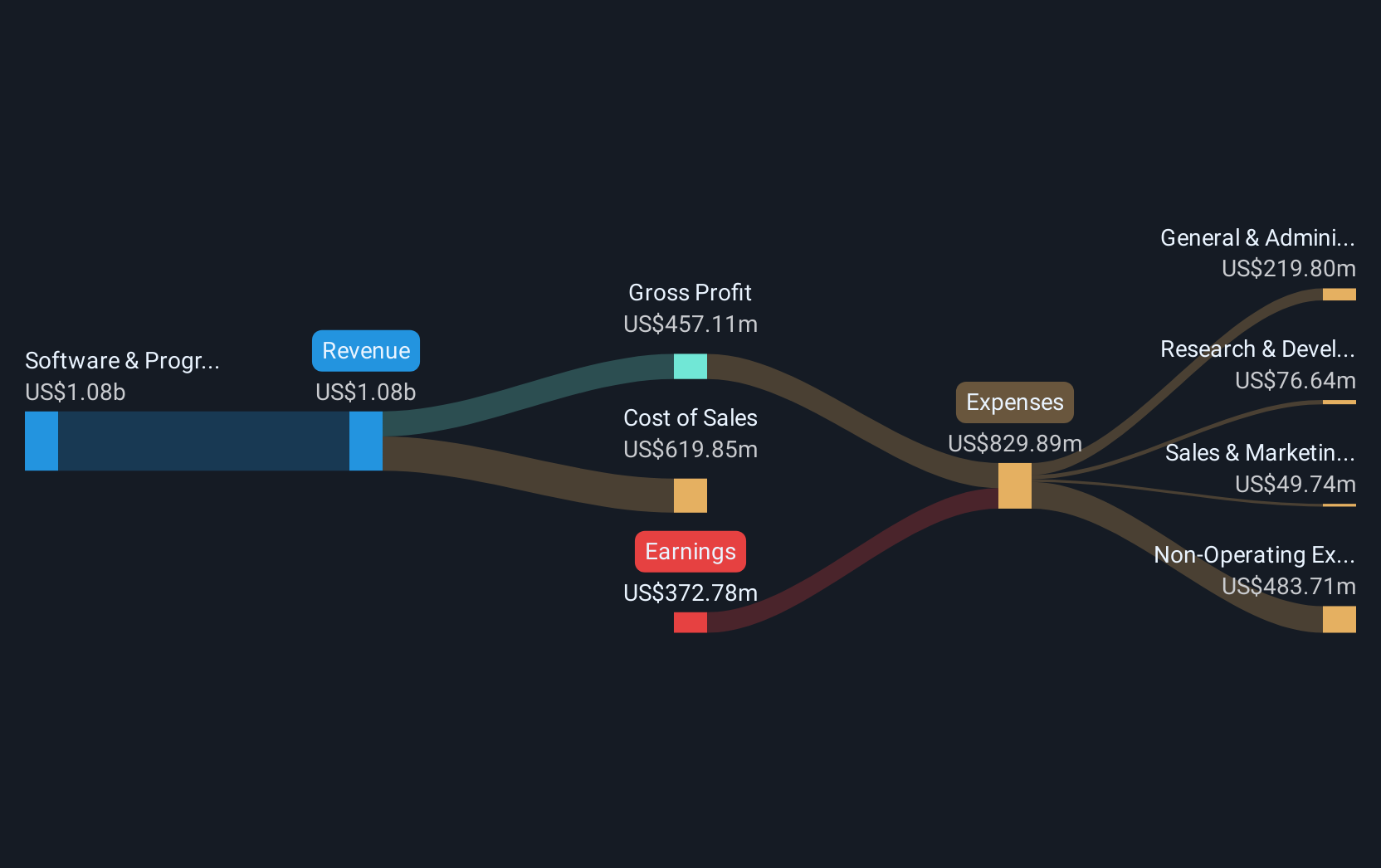

Operations: Pagaya leverages its proprietary AI technology to generate revenue primarily from the Software & Programming segment, which contributes $1.08 billion. The company's operations are concentrated in financial services and related sectors across key regions including the United States, Israel, and the Cayman Islands.

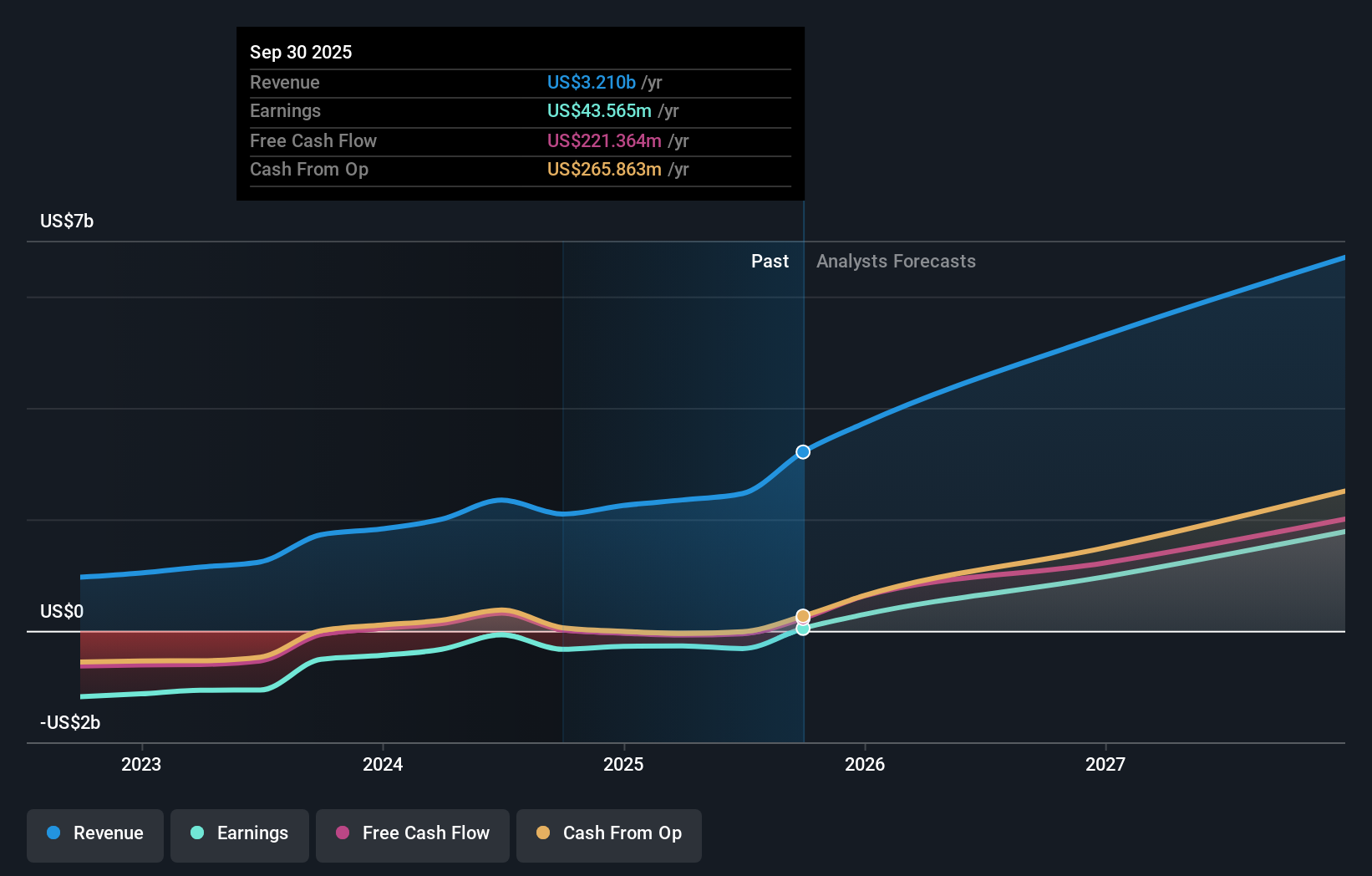

Pagaya Technologies, amidst a flurry of conference presentations and the recent launch of its POSH program, underscores its innovative approach in the fintech space. The company's strategic focus on point-of-sale financing through AI-driven underwriting technology not only enhances lender capabilities but also drives merchant satisfaction and broader market adoption. With an inaugural $300 million deal expected to close soon, Pagaya is expanding its lending capacity significantly. This move aligns with their raised full-year earnings guidance for 2025, projecting revenues between $1.175 billion and $1.3 billion and net income up to $45 million. Such initiatives are pivotal as Pagaya navigates the competitive landscape of tech-driven financial solutions, aiming to outpace average market growth with a forecasted annual revenue increase of 13.7% and an impressive profit surge projection of 140%.

Alnylam Pharmaceuticals (ALNY)

Simply Wall St Growth Rating: ★★★★★★

Overview: Alnylam Pharmaceuticals, Inc. focuses on the discovery, development, and commercialization of therapeutics utilizing ribonucleic acid interference technology, with a market cap of $40.16 billion.

Operations: The company generates revenue of $2.35 billion from its activities in discovering, developing, and commercializing RNA interference-based therapeutics.

Alnylam Pharmaceuticals, with a notable 23.6% forecasted annual revenue growth, is positioning itself as a leader in RNAi therapeutics, particularly for ATTR amyloidosis treatments. Recently securing European Commission approval for AMVUTTRA® to treat cardiomyopathy manifestations of ATTR amyloidosis highlights their pioneering role in addressing rare diseases. Their commitment to innovation is further underscored by an R&D expense ratio that has consistently aligned with or exceeded industry benchmarks, reflecting a strategic emphasis on advancing their drug pipeline and maintaining competitive advantage in biotechnology. This focus on specialized, high-impact treatments suggests promising prospects as they expand into new markets and continue to navigate the complexities of drug development and regulatory approvals efficiently.

Vertex Pharmaceuticals (VRTX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for cystic fibrosis, with a market cap of approximately $116.96 billion.

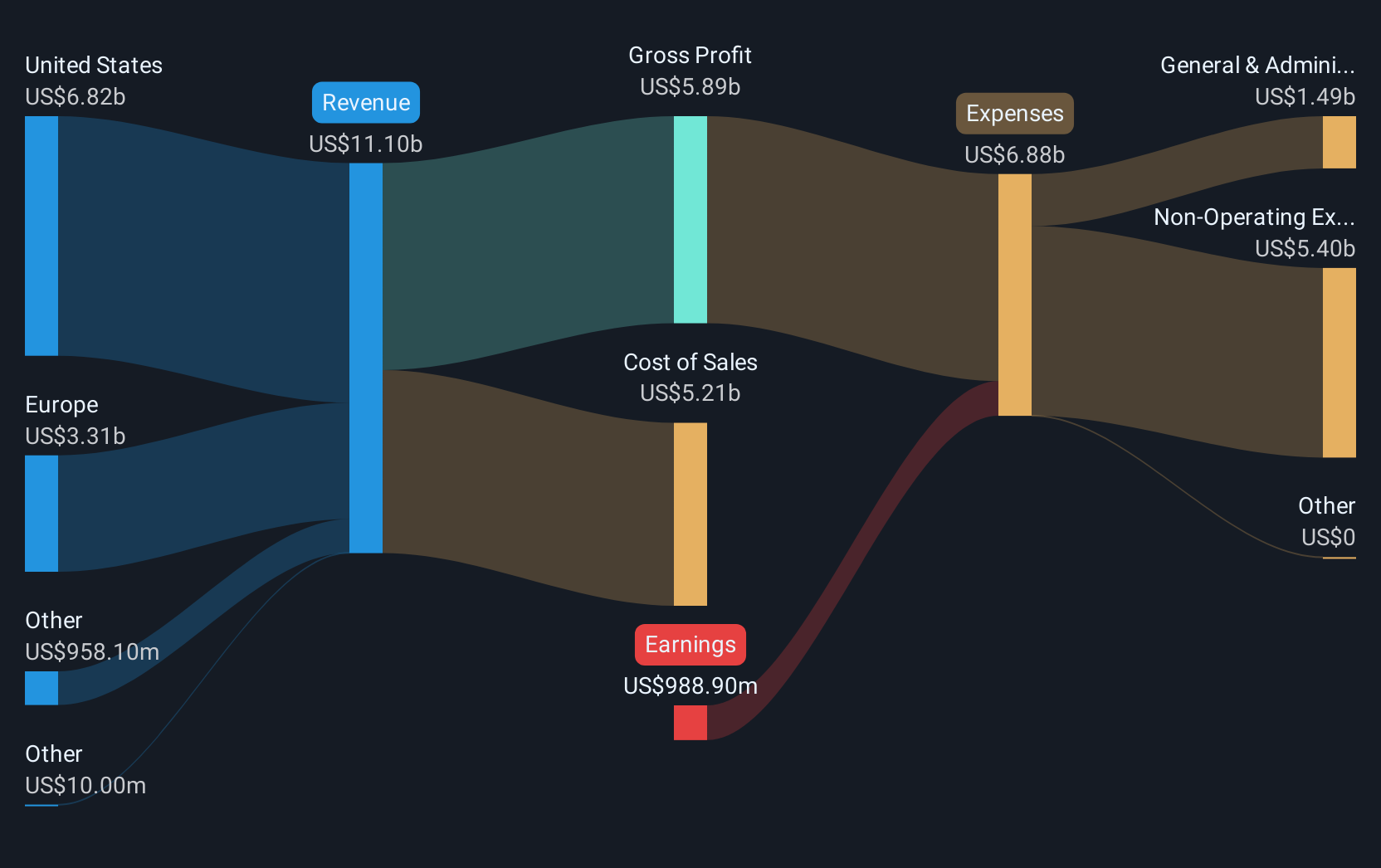

Operations: Vertex generates revenue primarily from its pharmaceutical segment, which reported $11.10 billion in sales. The company's focus is on therapies for cystic fibrosis, contributing significantly to its financial performance.

Vertex Pharmaceuticals, amidst a robust schedule of conference presentations and clinical updates, continues to demonstrate its commitment to advancing treatment options in cystic fibrosis with its CFTR modulators. Recent presentations highlighted the clinical benefits of ALYFTREK®, showing significant improvements in patient outcomes, which aligns with their strategic focus on innovative therapies for complex genetic diseases. Notably, the company has also been active in share repurchases, investing $416.86 million to buy back 932,510 shares in early 2025. This financial maneuver underscores their confidence in ongoing projects and future profitability rooted in scientific advancements and market expansion.

Summing It All Up

- Click this link to deep-dive into the 233 companies within our US High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.