Please use a PC Browser to access Register-Tadawul

Exploring Micron Technology's Earnings Expectations

Micron Technology, Inc. MU | 241.14 243.00 | -6.70% +0.77% Pre |

Micron Technology (NASDAQ:MU) is preparing to release its quarterly earnings on Wednesday, 2025-06-25. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Micron Technology to report an earnings per share (EPS) of $1.59.

The market awaits Micron Technology's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

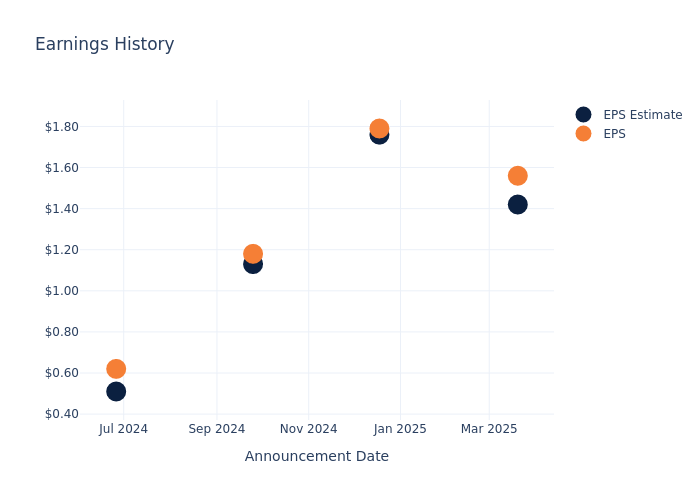

Overview of Past Earnings

The company's EPS beat by $0.14 in the last quarter, leading to a 8.04% drop in the share price on the following day.

Here's a look at Micron Technology's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.42 | 1.76 | 1.13 | 0.51 |

| EPS Actual | 1.56 | 1.79 | 1.18 | 0.62 |

| Price Change % | -8.0% | -16.0% | 15.0% | -7.000000000000001% |

Performance of Micron Technology Shares

Shares of Micron Technology were trading at $122.08 as of June 23. Over the last 52-week period, shares are down 10.15%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Opinions on Micron Technology

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Micron Technology.

Analysts have given Micron Technology a total of 12 ratings, with the consensus rating being Buy. The average one-year price target is $117.92, indicating a potential 3.41% downside.

Peer Ratings Comparison

The following analysis focuses on the analyst ratings and average 1-year price targets of and Micron Technology, three prominent industry players, providing insights into their relative performance expectations and market positioning.

Peer Metrics Summary

Within the peer analysis summary, vital metrics for and Micron Technology are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Micron Technology | Buy | 38.27% | $2.96B | 3.32% |

Key Takeaway:

Micron Technology ranks at the top among its peers in terms of revenue growth, with a strong 38.27% growth rate. It also leads in gross profit at $2.96B. However, its return on equity is at the bottom compared to its peers, standing at 3.32%. Overall, Micron Technology demonstrates robust revenue growth and gross profit performance, but lags behind in return on equity.

Delving into Micron Technology's Background

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

Micron Technology: Financial Performance Dissected

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Micron Technology's revenue growth over a period of 3 months has been noteworthy. As of 28 February, 2025, the company achieved a revenue growth rate of approximately 38.27%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Micron Technology's net margin excels beyond industry benchmarks, reaching 19.66%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Micron Technology's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 3.32%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 2.19%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.31, Micron Technology adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Micron Technology visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.