Please use a PC Browser to access Register-Tadawul

Exploring Undiscovered Gems In The US Market

Amalgamated Bank AMAL | 31.99 | -0.93% |

The United States market has experienced a modest climb of 1.3% over the past week and is up 13% over the last year, with earnings projected to grow by 14% annually. In this dynamic environment, identifying stocks that are not only underappreciated but also poised for growth can offer intriguing opportunities for investors seeking to capitalize on the current market momentum.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Burke & Herbert Financial Services (BHRB)

Simply Wall St Value Rating: ★★★★★★

Overview: Burke & Herbert Financial Services Corp. is the bank holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland, with a market cap of $864.76 million.

Operations: BHRB generates revenue primarily through its community banking segment, which brought in $288.68 million. The company's market capitalization stands at approximately $864.76 million.

Burke & Herbert Financial Services, with assets totaling US$7.8 billion and equity of US$758 million, is carving a niche in the financial sector. Its earnings surged by 178.7% last year, outpacing the industry growth of 5.4%. The bank's total deposits stand at US$6.5 billion against loans of US$5.6 billion, reflecting strong customer trust and low-risk funding sources comprising 92% liabilities from deposits. Despite a one-off loss of US$36.5 million affecting recent results, it maintains an appropriate bad loan ratio at 1.1%. A new share repurchase program worth up to US$50 million signals confidence in its market value proposition.

Amalgamated Financial (AMAL)

Simply Wall St Value Rating: ★★★★★★

Overview: Amalgamated Financial Corp. is the bank holding company for Amalgamated Bank, offering commercial and retail banking, investment management, and trust and custody services across the United States with a market capitalization of approximately $937.58 million.

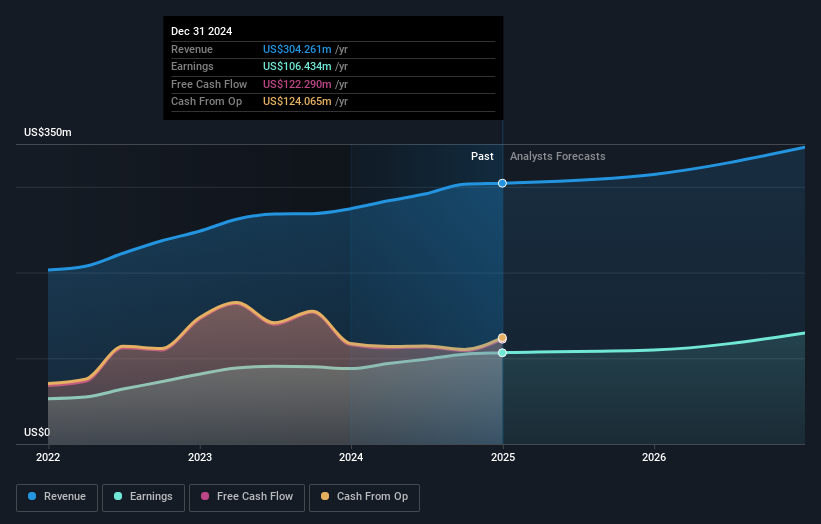

Operations: Amalgamated Financial generates revenue primarily from its banking segment, which amounts to $303.97 million. The company's financial performance can be analyzed through its net profit margin, reflecting the efficiency of its operations and cost management strategies.

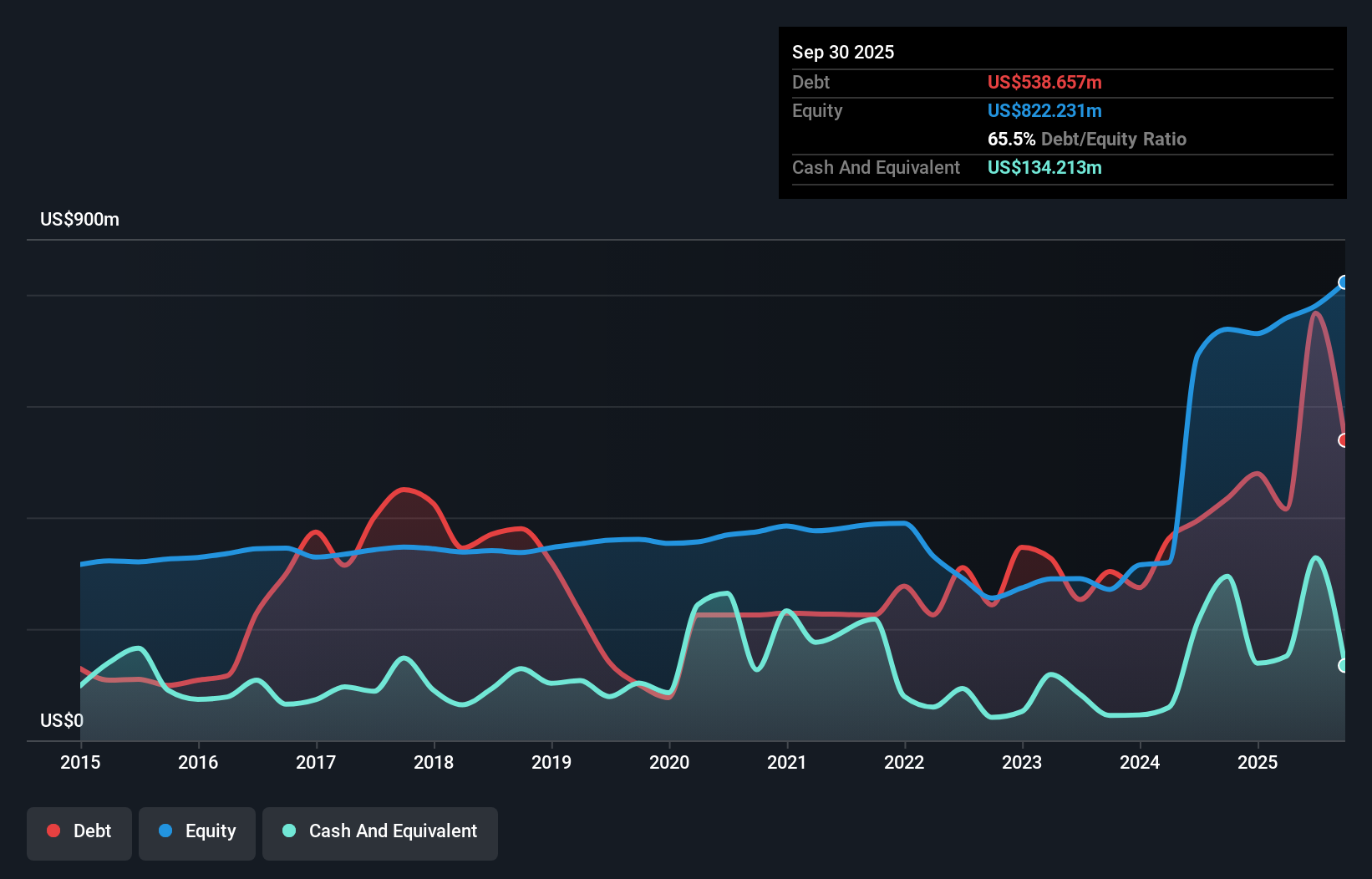

Amalgamated Financial, a bank holding company, stands out with its solid financial foundation. With total assets of US$8.3 billion and equity of US$736 million, it showcases a robust balance sheet. The firm holds deposits amounting to US$7.4 billion and loans totaling US$4.6 billion, supported by an allowance for bad loans at 0.7%—well within industry norms. Recent strategic moves include share repurchases totaling 180,000 shares in the first quarter of 2025 for about US$5.59 million, enhancing shareholder value amidst macroeconomic challenges and revenue growth initiatives like C-PACE originations and NYC headquarters investment efforts.

IDT (IDT)

Simply Wall St Value Rating: ★★★★★★

Overview: IDT Corporation offers communications and payment services across the United States, the United Kingdom, and internationally, with a market cap of $1.64 billion.

Operations: IDT generates revenue primarily from its communications and payment services. The company's net profit margin has shown variability, reflecting fluctuations in operational efficiency and cost management.

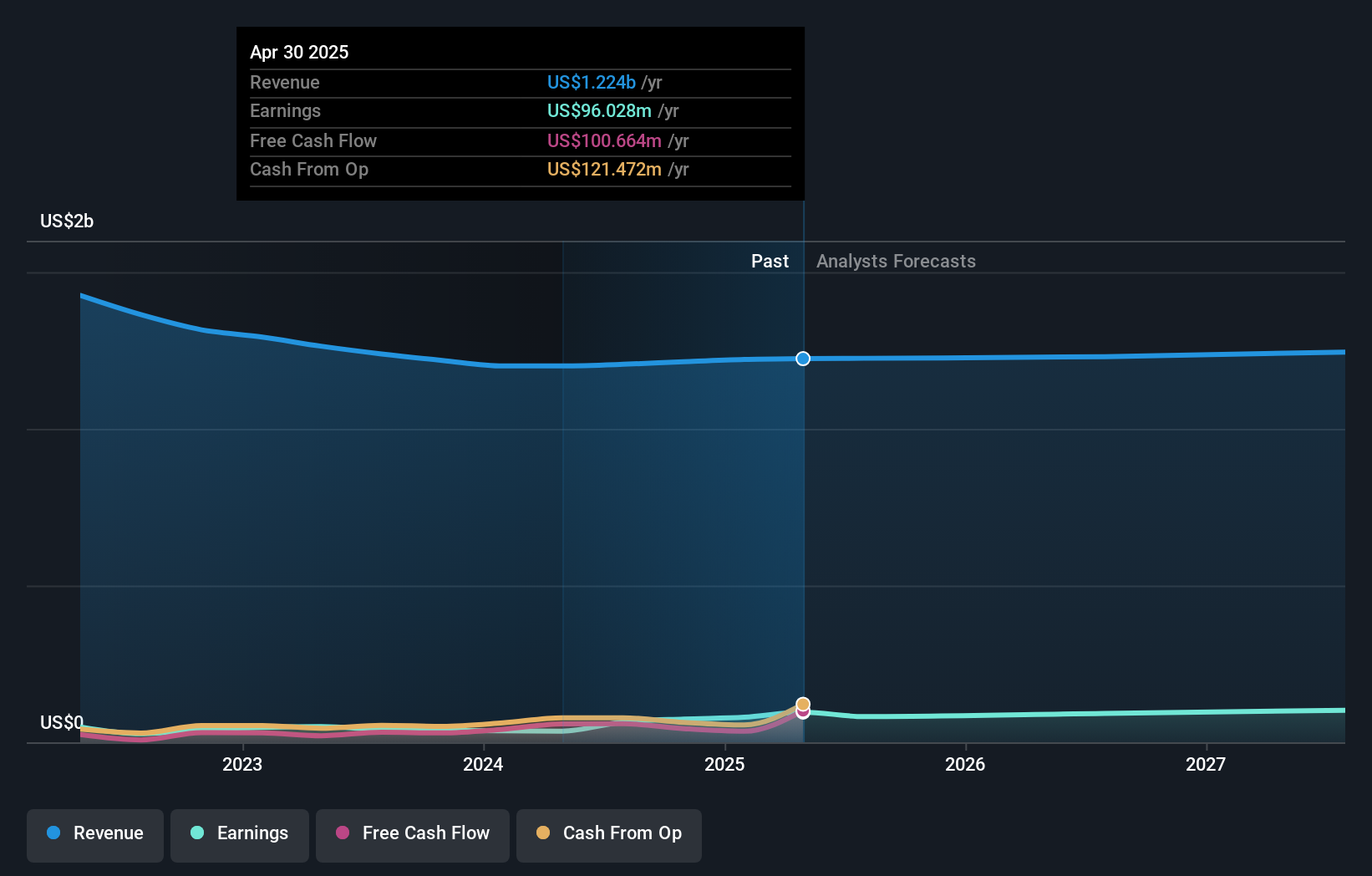

IDT has demonstrated impressive growth, with earnings surging 169.7% over the past year, significantly outpacing the telecom industry's 57.3%. The company remains debt-free, enhancing its financial stability and reducing risk exposure. Recent earnings show net income for Q3 at US$21.69 million compared to US$5.55 million a year earlier, while sales increased slightly to US$301.99 million from US$299.64 million in the same period last year. With a quarterly dividend of $0.06 per share declared and trading at 48% below fair value estimates, IDT appears undervalued with room for future appreciation despite insider selling concerns recently noted.

Taking Advantage

- Click here to access our complete index of 282 US Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.