Please use a PC Browser to access Register-Tadawul

Exploring US High Growth Tech Stocks with Promising Potential

Soleno Therapeutics Inc SLNO | 52.00 52.00 | +5.07% 0.00% Pre |

As the United States market experiences fluctuations amid President Trump's ongoing tensions with Fed Chair Powell and mixed earnings reports from major banks, investors are closely watching how these dynamics impact high-growth tech stocks. In this environment, identifying promising tech stocks involves assessing their potential for innovation and adaptability in response to evolving economic conditions and geopolitical developments.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.14% | 38.20% | ★★★★★★ |

| Circle Internet Group | 30.80% | 60.64% | ★★★★★★ |

| Ardelyx | 21.16% | 61.61% | ★★★★★★ |

| TG Therapeutics | 26.05% | 39.12% | ★★★★★★ |

| AVITA Medical | 27.39% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.97% | 59.24% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 34.90% | 59.91% | ★★★★★★ |

| Caris Life Sciences | 24.80% | 72.64% | ★★★★★★ |

| Lumentum Holdings | 21.30% | 105.07% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Pagaya Technologies (PGY)

Simply Wall St Growth Rating: ★★★★★☆

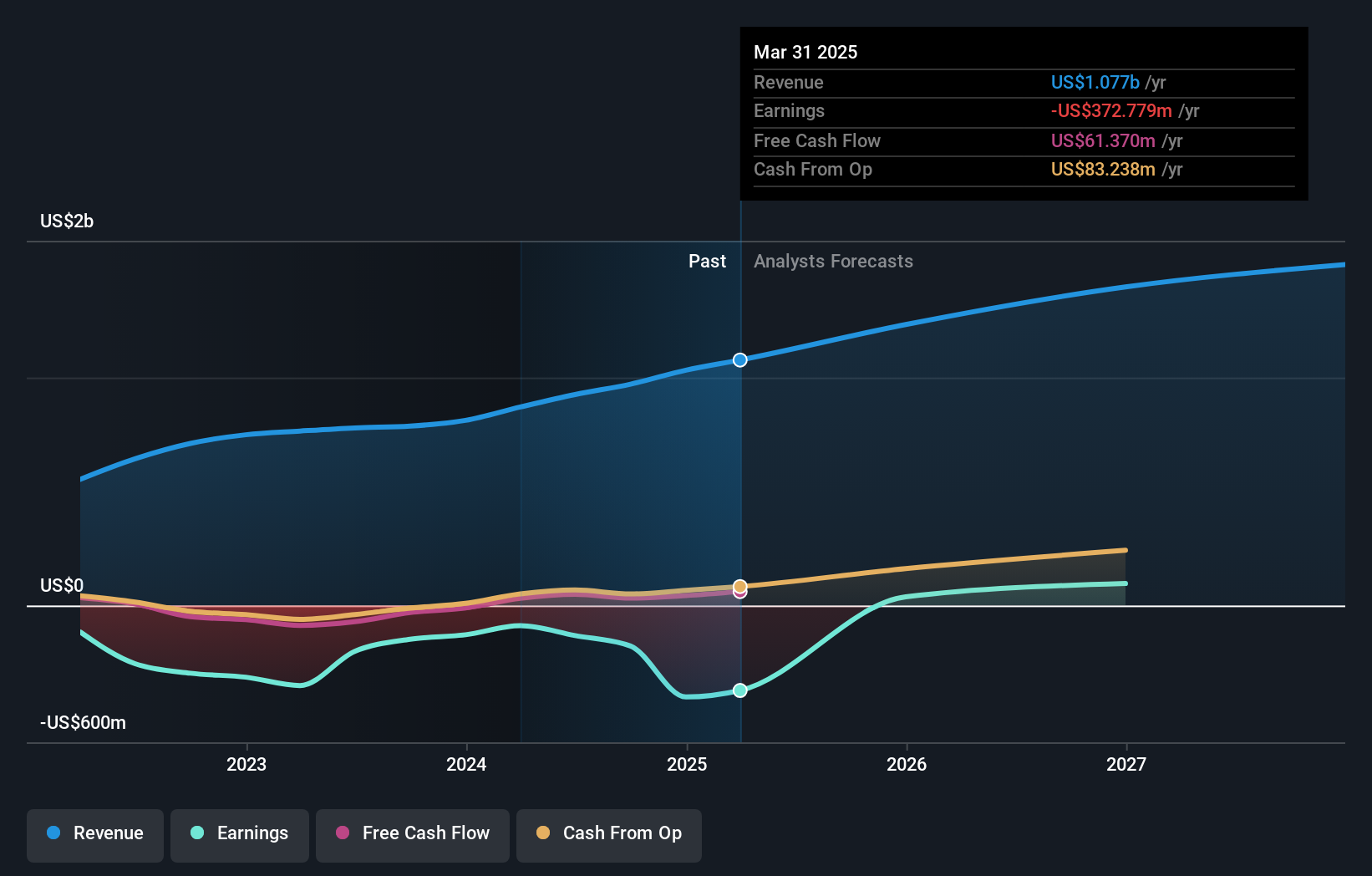

Overview: Pagaya Technologies Ltd. is a technology company that utilizes data science and AI-powered technology to serve financial services, service providers, customers, and asset investors across the United States, Israel, and the Cayman Islands with a market cap of $1.79 billion.

Operations: Pagaya leverages its proprietary AI technology to generate revenue primarily from its Software & Programming segment, which contributed $1.08 billion. The company focuses on providing innovative solutions to financial services and asset investors in key markets including the United States, Israel, and the Cayman Islands.

Pagaya Technologies, recently reclassified to growth indexes like the Russell 3000 and 2000 Growth, underscores a strategic pivot reflecting its dynamic market positioning. Despite being dropped from several value benchmarks, the company's inclusion in growth-oriented indices aligns with its robust revenue uptick of 14.8% annually and an impressive forecasted earnings surge of 119%. This transition is bolstered by innovative product launches such as POSH, enhancing point-of-sale financing through AI-driven solutions that promise expanded lending capacities and higher capital efficiency. These strategic moves not only highlight Pagaya's adaptability but also position it well within the high-growth tech landscape, leveraging cutting-edge technology to meet evolving market demands effectively.

Soleno Therapeutics (SLNO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Soleno Therapeutics, Inc. is a clinical-stage biopharmaceutical company dedicated to developing and commercializing innovative treatments for rare diseases, with a market cap of $4.37 billion.

Operations: Soleno Therapeutics focuses on developing and commercializing novel therapeutics for rare diseases. As a clinical-stage company, it does not currently generate revenue from its operations.

Soleno Therapeutics, recently spotlighted for its innovative VYKAT XR treatment, is navigating the high-growth tech landscape with strategic finesse. Amidst a series of follow-on equity offerings totaling nearly $200 million and robust conference presentations, the company's focus on addressing Prader-Willi syndrome (PWS) through advanced biotechnology is evident. The recent FDA approval of VYKAT XR underscores Soleno's commitment to pioneering treatments that significantly improve quality of life for PWS patients. This dedication not only enhances its market position but also promises substantial growth potential in a niche yet crucial medical field.

Kiniksa Pharmaceuticals International (KNSA)

Simply Wall St Growth Rating: ★★★★☆☆

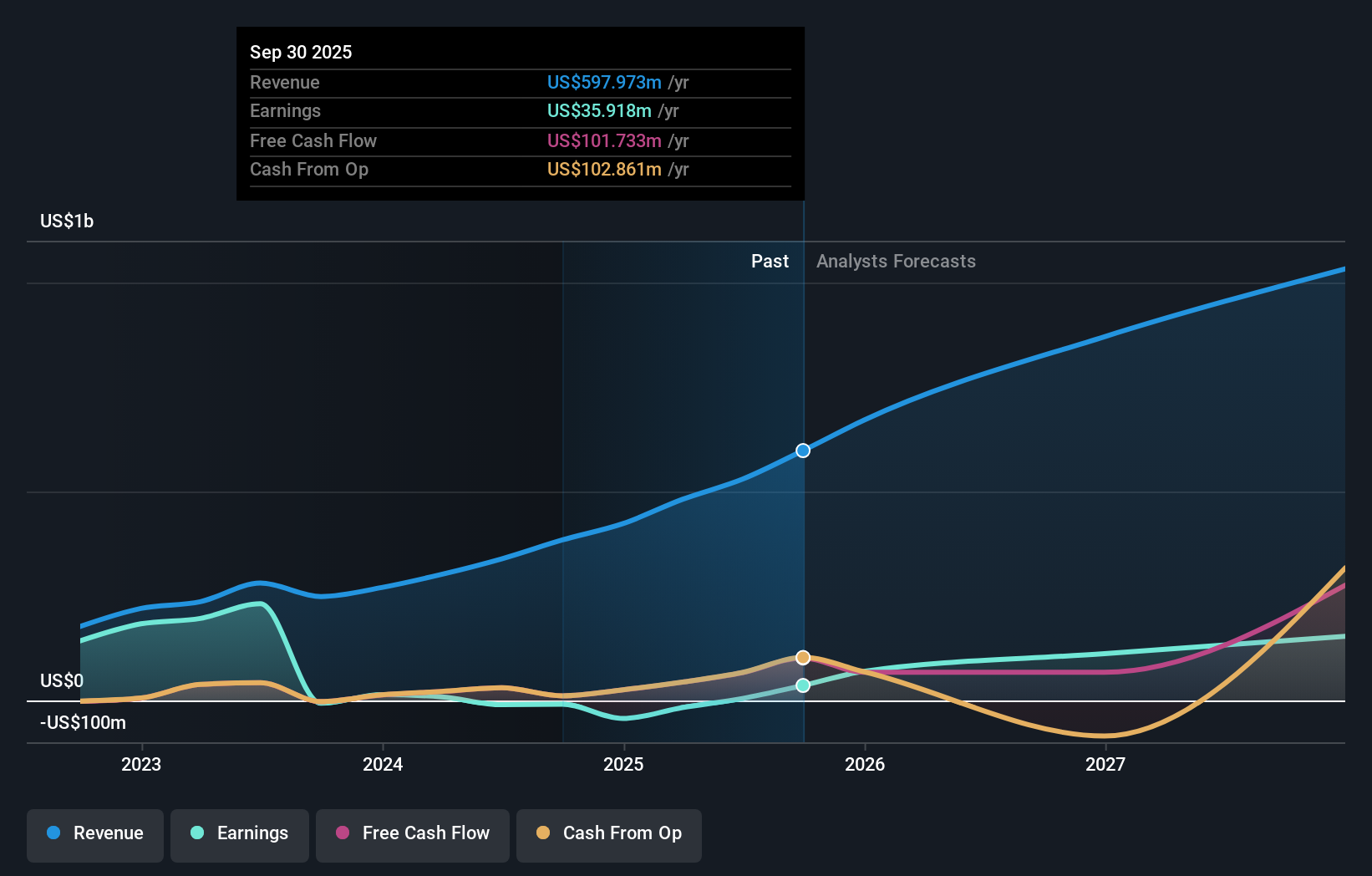

Overview: Kiniksa Pharmaceuticals International, plc is a biopharmaceutical company that develops and commercializes novel therapies for diseases with unmet needs, focusing on cardiovascular indications globally, with a market cap of $2.10 billion.

Operations: Kiniksa Pharmaceuticals generates revenue primarily from developing and delivering therapeutic medicines, amounting to $481.17 million. The company focuses on cardiovascular indications worldwide.

Kiniksa Pharmaceuticals International is poised for significant growth, with a projected annual revenue increase of 16.5% and an expected transition to profitability within three years, showcasing a robust upward trajectory compared to the broader US market's 8.8%. The company recently revised its 2025 revenue forecasts upwards to between $590 million and $605 million, reflecting strong demand for its products. Additionally, Kiniksa's strategic R&D investments are focused on developing monoclonal antibodies like KPL-387 for recurrent pericarditis, with a Phase 2/3 trial set to commence soon. This focus not only highlights their innovative approach in biotechnology but also aligns with industry trends towards targeted therapies, potentially setting the stage for sustained long-term growth.

Make It Happen

- Explore the 226 names from our US High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.