Please use a PC Browser to access Register-Tadawul

Fed Rate Cut Could Be a Game Changer for Customers Bancorp (CUBI)

Customers Bancorp, Inc. CUBI | 76.28 | -0.55% |

- Earlier this week, the Federal Reserve cut its benchmark interest rate by 25 basis points and indicated the possibility of additional reductions before year-end, sparking optimism across regional bank stocks such as Customers Bancorp.

- This policy shift arrives as regional banks, including Customers Bancorp, are positioned to benefit from potentially improved lending conditions and stronger credit demand as borrowing costs decline.

- We’ll examine how the Federal Reserve’s interest rate cut could influence Customers Bancorp’s investment narrative and earnings outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Customers Bancorp Investment Narrative Recap

To consider holding Customers Bancorp shares, investors should believe in the bank’s ability to leverage digitization in banking, expand its fee and deposit base through platforms like cubiX, and manage risks tied to its concentration in digital asset-related deposits. While the Federal Reserve’s rate cut supports improved lending conditions, a meaningful short-term catalyst, it may not materially alter the company’s largest risk, which remains tied to potential earnings volatility if digital asset markets experience disruption and affect deposit stability.

Among the company’s recent updates, the successful completion of a US$149.9 million follow-on equity offering earlier this month stands out. This action reinforces the bank’s capital position, supporting its ability to pursue growth opportunities arising from increased credit demand, which aligns well with the short-term optimism fueled by the Fed’s interest rate policy shift.

By contrast, investors should be aware of how heightened regulatory scrutiny on digital asset platforms could quickly shift...

Customers Bancorp's outlook anticipates $977.5 million in revenue and $424.9 million in earnings by 2028. This implies a 17.9% annual revenue growth rate and a $293.3 million increase in earnings from the current $131.6 million level.

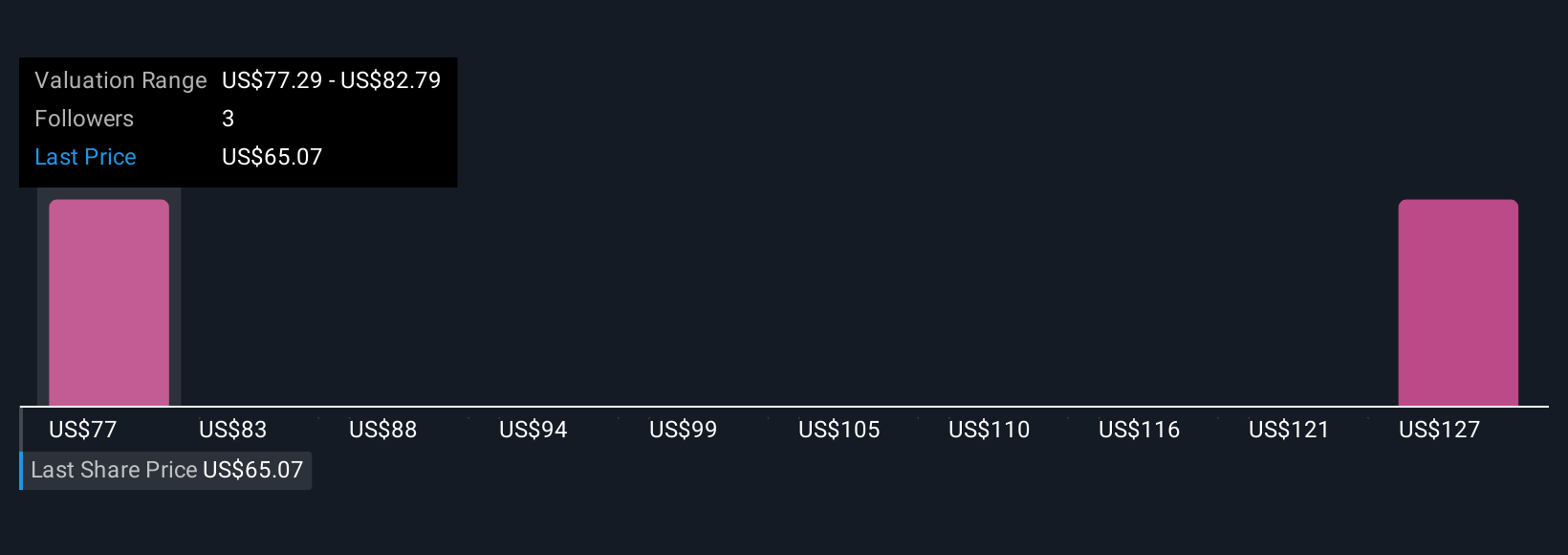

Uncover how Customers Bancorp's forecasts yield a $77.29 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Fair value estimates from two members of the Simply Wall St Community range from US$77.29 to US$123.83 per share. While opinions differ, ongoing growth in Customers Bancorp’s technology-focused platforms remains a key area to watch for future performance.

Explore 2 other fair value estimates on Customers Bancorp - why the stock might be worth as much as 86% more than the current price!

Build Your Own Customers Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Customers Bancorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Customers Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Customers Bancorp's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.