Please use a PC Browser to access Register-Tadawul

Femasys (NASDAQ:FEMY) Has Debt But No Earnings; Should You Worry?

Femasys Inc Ordinary Shares FEMY | 0.86 | +0.19% |

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Femasys Inc. (NASDAQ:FEMY) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

How Much Debt Does Femasys Carry?

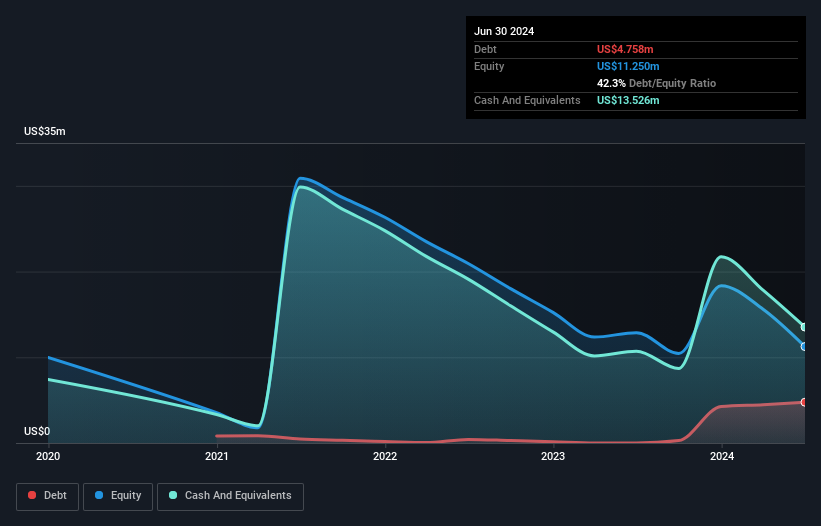

As you can see below, at the end of June 2024, Femasys had US$4.76m of debt, up from none a year ago. Click the image for more detail. However, its balance sheet shows it holds US$13.5m in cash, so it actually has US$8.77m net cash.

How Strong Is Femasys' Balance Sheet?

According to the last reported balance sheet, Femasys had liabilities of US$2.46m due within 12 months, and liabilities of US$6.56m due beyond 12 months. Offsetting these obligations, it had cash of US$13.5m as well as receivables valued at US$92.5k due within 12 months. So it can boast US$4.59m more liquid assets than total liabilities.

This surplus suggests that Femasys has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Femasys has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Femasys can strengthen its balance sheet over time.

In the last year Femasys had a loss before interest and tax, and actually shrunk its revenue by 21%, to US$950k. To be frank that doesn't bode well.

So How Risky Is Femasys?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Femasys lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of US$15m and booked a US$17m accounting loss. With only US$8.77m on the balance sheet, it would appear that its going to need to raise capital again soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example Femasys has 6 warning signs (and 2 which shouldn't be ignored) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.