Please use a PC Browser to access Register-Tadawul

Financial Morning Summary | Aramco Commits $100M for KAUST R&D Funding; OPEC Lowers 2024 Global Oil Demand Growth Forecast; Baazeem Announces H1 2024 Dividend

Tadawul All Shares Index TASI.SA | 10414.06 | -0.37% |

Parallel Market Capped Index (NomuC) NOMUC.SA | 23428.67 | -0.18% |

Dow Jones Industrial Average DJI | 48114.26 | -0.62% |

S&P 500 index SPX | 6800.26 | -0.24% |

NASDAQ IXIC | 23111.46 | +0.23% |

Most Important News

- OPEC Lowers 2024 Global Oil Demand Growth Forecast;

- Aramco Plans $100M Funding for KAUST to Support Cutting-Edge R&D;

- Baazeem Trading Co Declares Dividend for H1 2024;

1. Market Summary

On Monday, the Tadawul All Shares Index(TASI.SA) experienced a decline, falling by 31.03 points, or 0.26 percent, to finish at 11,740.66.

Meanwhile, the Kingdom’s parallel market, Parallel Market Capped Index (NomuC)(NOMUC.SA) , saw a decrease of 237 points, or 0.93 percent, closing at 25,284.32.

US stock indices closed mixed. The S&P 500 and Nasdaq narrowed earlier gains to close slightly higher, while the Dow and Russell small-cap stocks deepened losses, reflecting risk-averse sentiment. Dow Jones Industrial Average(DJI.US) fell 0.36%, the S&P 500 index(SPX.US) ended flat, and the NASDAQ(IXIC.US) rose 0.21%.

2. Quick News

OPEC Lowers 2024 Global Oil Demand Growth Forecast

On Monday, OPEC released its monthly oil report, reducing the 2024 global oil demand growth forecast by 135,000 barrels per day to approximately 2.11 million barrels per day, down from June's projection of 2.25 million barrels per day. Though the adjustment is minor, it marks OPEC's first downward revision of its relatively optimistic outlook since first issuing the 2024 forecast in July 2023.

The full story, Notable Adjustment: OPEC Reduces 2024 Global Crude Oil Demand Forecast

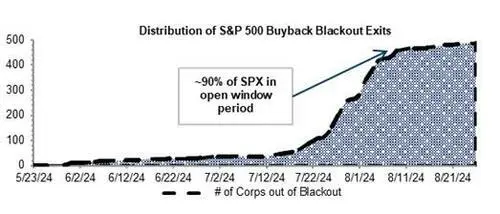

Goldman Sachs: Corporate Buybacks Support US Market

Share repurchase volumes have doubled since last week, with 93% of S&P 500 companies expected to be in the buyback window by this weekend. The repurchases are anticipated to continue until September 6. Goldman Sachs technical expert, Scott Rubner, who accurately predicted the current stock market correction, said investors will see a brief buying opportunity for US stocks by late August.

3. Stocks To Watch

KSA Stocks

Aramco Plans $100M Funding for KAUST to Support Cutting-Edge R&D

Saudi Arabian Oil Co.(2222.SA) has signed a $100 million, ten-year MoU with King Abdullah University of Science and Technology (KAUST) to fund research in areas including energy transition, sustainability, upstream technologies, and digital solutions. Projects will focus on hydrogen, carbon capture, renewables, and low-carbon aviation fuels. Aramco CEO Amin H. Nasser and KAUST President Tony Chan emphasized the partnership’s goal of driving innovation and delivering environmental and commercial benefits.

Jamjoom Pharma CEO: Company Boosts Outlook, Focuses on Portfolio Optimization

CEO Tarek Hosni said that Jamjoom Pharmaceuticals Factory Co.(4015.SA) (Jamjoom Pharma) is experiencing significant growth in Saudi Arabia due to a focus on high-potential products, precise demand planning, and portfolio optimization. The company aims to maximize shareholder value through dividends, CAPEX, and exploring inorganic growth opportunities. Jamjoom reported that its main facility in Jeddah produced over 72 million units, with 9.2 million units contributed from Egypt, targeting key markets like Saudi Arabia, the GCC, Iraq, and Egypt. The firm expects EBITDA margins of 31-32.5% for H2 2024, up from previous guidance. Jamjoom's net profit for H1 2024 rose 23% to SAR 209.9 million. Notably, its Q2 2024 net earnings reached SAR 107 million.

Baazeem Trading Co Declares Dividend for H1 2024

Baazeem Trading Co.(4051.SA) has declared a cash dividend distribution for the first half of 2024, amounting to SAR 7,008,750. The decision was made on August 12, 2024, with dividends set at 0.07 SAR per share for 100,125,000 eligible shares, representing 7% of the share's par value. Shareholders holding shares at the end of trading on August 25, 2024, will qualify for dividends, which will be distributed on September 6, 2024, via direct bank transfer. Shareholders are advised to update their bank details to ensure seamless transactions.

Saudi VCP Partners with Qatar's LPF in 45/55 JV for High-Density Pipes

Saudi Vitrified Clay Pipes Co.(2360.SA) (SVCP) signed a partnership agreement with Qatar-based Laffan Pipes Factory Co. (LPF), granting LPF a 45% stake in Laffan Pipes Co. (Laffan Co. Saudi). LPF will transfer its Doha plant's production lines for high-density plastic pipes and accessories to Laffan Co. Saudi. SVCP will retain a 55% stake in the venture. The agreement follows a February MoU to establish an industrial joint venture for high-density pipe products. LPF specializes in manufacturing and managing advanced plastic and rubber pipe products.

USA Stocks

Bank of America: Nvidia a Top Pick as Semiconductor Rebound Looms

Bank of America said if the semiconductor industry rebounds, NVIDIA Corporation(NVDA.US) would be a good choice. They expect a rebound in Q4 as seasonal headwinds may fade. Investors are awaiting Nvidia's earnings later this month. They believe Q4 and Q1 are usually better for chip stocks, making Nvidia, Broadcom Limited(AVGO.US) , and KLA-Tencor Corporation(KLAC.US) top picks. Nvidia rose over 4% overnight, adding more than US$100 billion in market value.

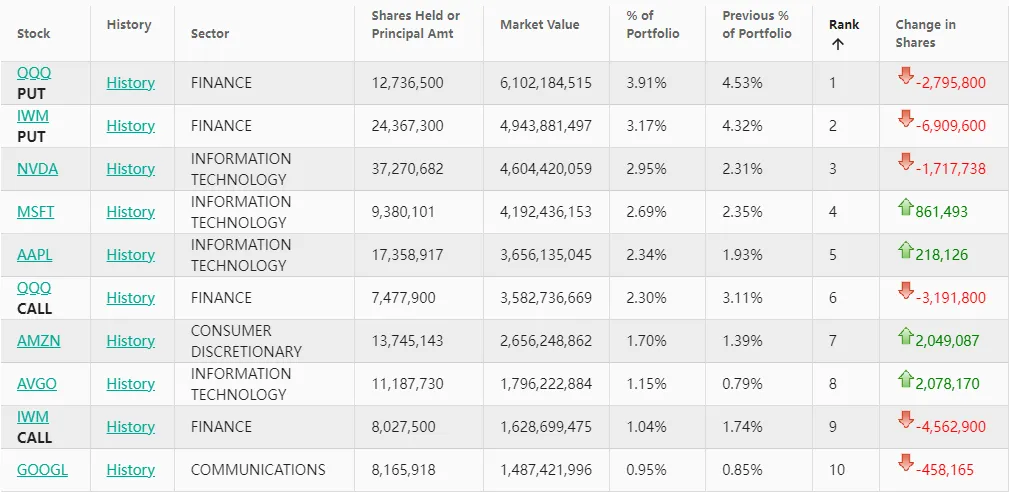

Citigroup Increases Apple Holdings in Q2, Nvidia Remains Top Position

A 13F report shows Citigroup increased its holdings in Apple Inc.(AAPL.US) in Q2. NVIDIA Corporation(NVDA.US) is in its top position. Other major holdings include Microsoft Corporation(MSFT.US) , Apple Inc.(AAPL.US) , Amazon.com, Inc.(AMZN.US) , and Broadcom Limited(AVGO.US).

Barrick Gold Surges 9% on Strong Q2 Earnings, Beating Expectations

Canadian mining giant Barrick Gold Corp.(GOLD.US) surged over 9%. Its Q2 earnings report shows a revenue of US$3.162 billion, up 11.7% year-over-year, exceeding market expectations. Net profit reached US$370 million, a 25% increase from the previous year. Adjusted earnings per share were US$0.32, surpassing the expected US$0.27 and last year's US$0.19.