Please use a PC Browser to access Register-Tadawul

First Hawaiian (NASDAQ:FHB) Will Pay A Dividend Of $0.26

First Hawaiian, Inc. FHB | 26.01 | -0.57% |

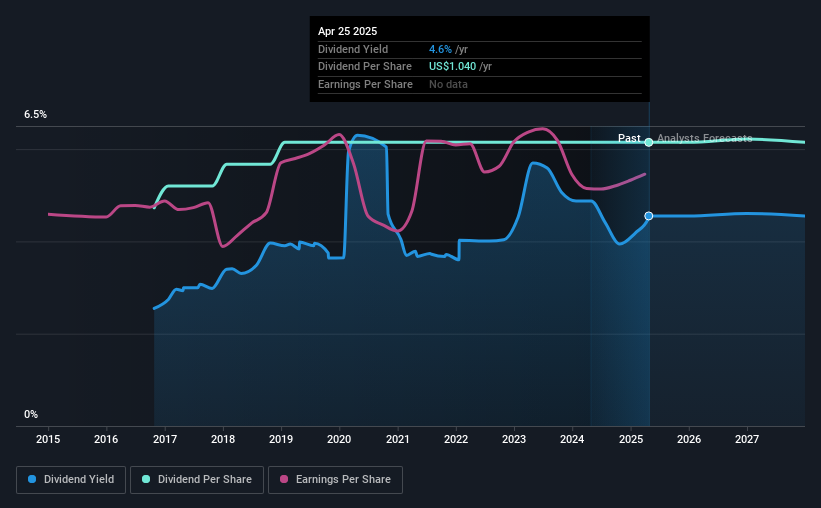

First Hawaiian, Inc.'s (NASDAQ:FHB) investors are due to receive a payment of $0.26 per share on 30th of May. Based on this payment, the dividend yield on the company's stock will be 4.6%, which is an attractive boost to shareholder returns.

We check all companies for important risks. See what we found for First Hawaiian in our free report.First Hawaiian's Earnings Will Easily Cover The Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable.

First Hawaiian has established itself as a dividend paying company, given its 8-year history of distributing earnings to shareholders. Taking data from its last earnings report, calculating for the company's payout ratio of 56%shows that First Hawaiian would be able to pay its last dividend without pressure on the balance sheet.

Over the next 3 years, EPS is forecast to expand by 16.5%. Analysts estimate the future payout ratio will be 49% over the same time period, which is in the range that makes us comfortable with the sustainability of the dividend.

First Hawaiian Doesn't Have A Long Payment History

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. Since 2017, the dividend has gone from $0.80 total annually to $1.04. This works out to be a compound annual growth rate (CAGR) of approximately 3.3% a year over that time. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

First Hawaiian May Find It Hard To Grow The Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, things aren't all that rosy. Although it's important to note that First Hawaiian's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

Our Thoughts On First Hawaiian's Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments First Hawaiian has been making. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Given that earnings are not growing, the dividend does not look nearly so attractive. See if the 7 analysts are forecasting a turnaround in our free collection of analyst estimates here. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.