Please use a PC Browser to access Register-Tadawul

First Interstate BancSystem (FIBK) Net Interest Margin Strengthens Bullish Earnings Narrative

First Interstate BancSystem, Inc. FIBK | 37.44 | +0.81% |

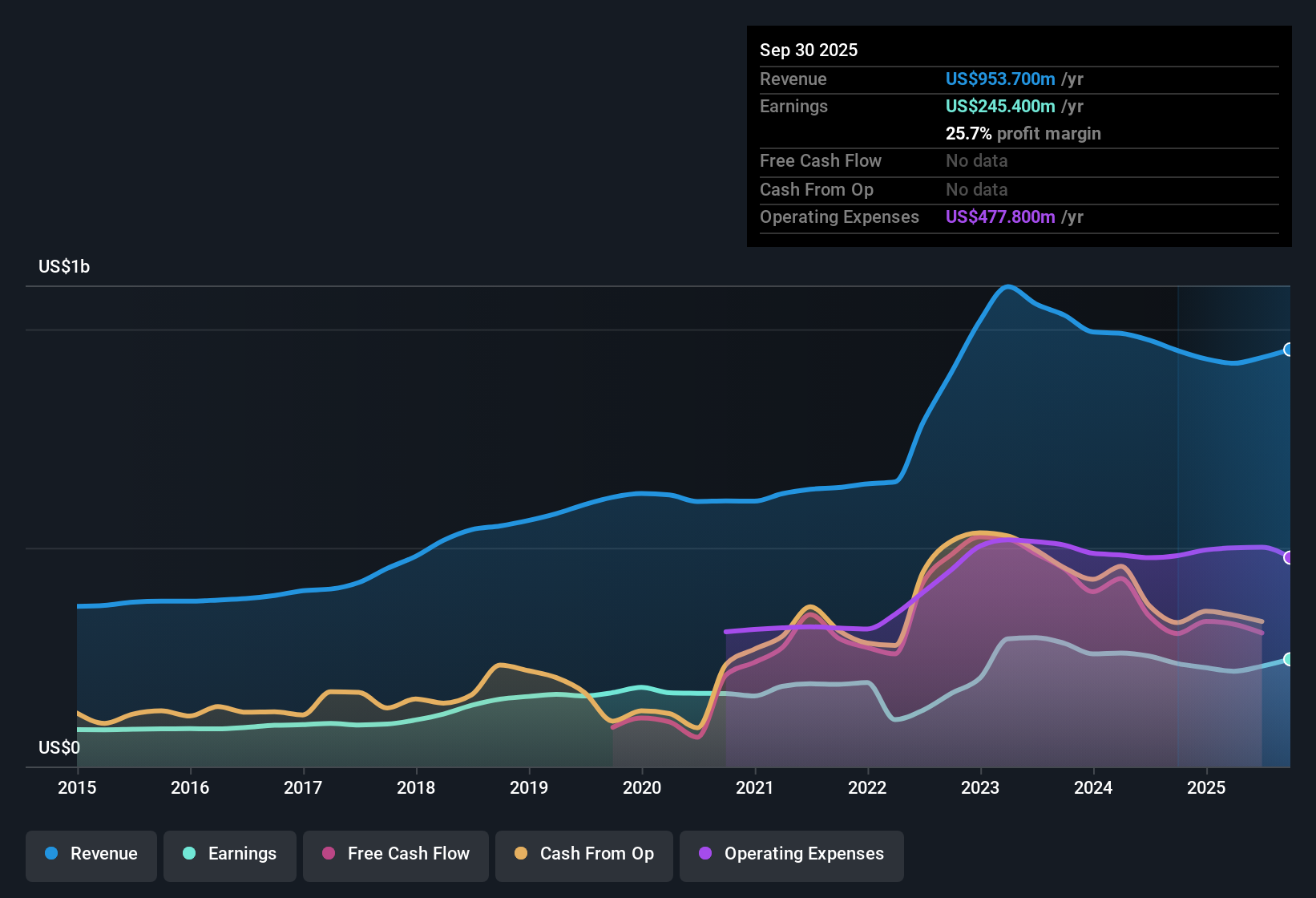

First Interstate BancSystem (FIBK) just wrapped up FY 2025 with Q4 revenue of US$305.9 million and basic EPS of US$1.08, setting the tone for a year where trailing twelve month revenue came in at US$1.0 billion and EPS reached US$2.95. Over the past six quarters, revenue has moved from US$232.1 million in Q3 2024 to US$305.9 million in Q4 2025, while quarterly EPS has ranged from US$0.51 in Q4 2024 to US$1.08 in the latest quarter. This gives investors a clear view of how the top and bottom lines have tracked together. With a trailing net margin of 29.3% and a 5.2% dividend yield, the focus this season is on how earnings power and income characteristics align for shareholders.

See our full analysis for First Interstate BancSystem.With the numbers on the table, the next step is to see how this earnings profile lines up with the widely followed narratives around growth, risk, and income for First Interstate BancSystem.

Net interest margin holds above 3.3%

- Net interest margin sat at 3.38% in Q4 2025 compared with 3.36% in Q3 2025 and 3.04% in Q3 2024, while the trailing twelve month margin is 3.32%.

- What stands out for a bullish view is that higher profitability metrics are lining up with these margins, as trailing net income on a twelve month basis is US$302.1 million and net margin is 29.3%, which supports arguments that earnings quality is solid even though trailing revenue of US$1.0 billion is only growing modestly.

- Supporters of the bullish case can point to trailing earnings growth of 33.7% year over year alongside a cost to income ratio of 59.19% over the last twelve months and 52.17% in Q4 2025. This is consistent with tighter cost control helping those margins.

- At the same time, the more cautious part of that bullish story is that revenue is forecast to grow about 2% per year. This means a lot of the earnings outcome depends on margins and efficiency staying at these levels rather than on fast top line expansion.

Loan book shrinks while credit quality improves

- Total loans moved from US$18,038.9 million in Q3 2024 to US$15,209.9 million in Q4 2025, while non performing loans over the same points moved from US$174.5 million to US$134.9 million, so the stock of problem loans is smaller on a smaller book.

- Critics focusing on a bearish angle often worry about regional bank loan books, yet here the data show non performing loans falling on both a quarterly basis, from US$194.9 million in Q1 2025 to US$134.9 million in Q4 2025, and on a trailing basis, from US$194.9 million to US$134.9 million over the last year, which challenges the idea that credit quality is currently the main pressure point.

- Even with that improvement in non performing loans, total loans have stepped down from US$17,387.9 million in Q1 2025 to US$15,209.9 million in Q4 2025, so anyone with a bearish view can still point to a smaller earning asset base as a potential headwind for interest income.

- For someone weighing those bearish concerns against the numbers, the key tension is that reported credit metrics are moving in a healthier direction, while the loan contraction and slower forecast revenue growth of about 2% per year keep expectations in check.

P/E of 12.1x with DCF fair value above price

- The shares trade on a P/E of 12.1x compared with a peer average of 21.4x and a US banks industry average of 11.7x, while the current share price of US$36.14 sits below both a DCF fair value of about US$45.21 and an analyst price target of US$37.38.

- Supporters of a bullish stance argue that this valuation setup looks appealing because earnings grew 33.7% over the last year and are forecast at about 20.1% per year while the stock also offers a 5.2% dividend yield. What may surprise them is that the P/E is only slightly higher than the broader US banks industry despite the stronger reported earnings growth and higher trailing net margin of 29.3% versus 24.3% a year earlier.

- The combination of a P/E below the peer average, a DCF fair value above the current price, and a 5.2% yield provides several concrete reference points for investors who see this as a value and income story.

- At the same time, the modest revenue growth forecast of about 2% per year shows why some investors might hesitate to pay a much higher multiple, even with those profitability and dividend figures on the table.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First Interstate BancSystem's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

First Interstate BancSystem’s smaller loan book and modest revenue growth forecast of about 2% per year mean earnings rely heavily on margins and efficiency staying supportive.

If you want ideas where growth does more of the heavy lifting than cost cuts or margin fine tuning, check out stable growth stocks screener (2171 results) to zero in on companies with steadier revenue and earnings trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.