Please use a PC Browser to access Register-Tadawul

First Watch Restaurant Group (FWRG): Evaluating Valuation After Back-to-Back Most Loved Workplace® Honors

First Watch Restaurant Group, Inc. FWRG | 16.36 16.36 | -1.92% 0.00% Pre |

First Watch Restaurant Group (FWRG) has just secured the top spot as the #1 Most Loved Workplace® in America for the second consecutive year, highlighting its focus on employee well-being and engagement. This achievement is fueling renewed investor interest.

After all the positive headlines, First Watch Restaurant Group has notched some impressive price action. Over the past week alone, its share price jumped 18%, shaking off earlier uncertainty from broader market headwinds. While the stock's 1-year total shareholder return of just over 6% underscores steady progress, investors are watching to see if momentum from recent honors and new restaurant growth can drive sustained upside.

If your curiosity is piqued by First Watch's surge, why not explore fast growing stocks with high insider ownership for more companies with breakout growth and strong leadership skin in the game?

With shares rebounding but still down year-to-date, and strong growth strategies in play, investors have to wonder: Is First Watch undervalued at current levels, or has the market already priced in its next steps?

Most Popular Narrative: 18.5% Undervalued

The most widely followed narrative points to a fair value noticeably above First Watch's latest closing price, hinting at untapped upside if the company's bold expansion plans take hold. This backdrop sets the stage for the narrative's detailed forecasting and strong growth projections.

Accelerating unit expansion into new markets, especially in fast-growing Sun Belt and suburban areas, leverages broad demographic shifts and significant untapped real estate opportunities. This positions First Watch for sustained double-digit revenue growth and market share gains. The brand's alignment with increasing consumer demand for health-conscious, fresh, and made-to-order daytime dining, plus continued menu innovation and digital investments (waitlist automation, nutrition filters), is likely to drive higher in-store traffic, check growth, and strong long-term same-restaurant sales.

Are those ambitious expansion plans and fresh-dining trends really enough to justify such a high target? The secret sauce behind these projections lies in bold future earnings and margin assumptions. Discover which growth drivers and numbers could power the next move. See what else the narrative is hinting at before making your call.

Result: Fair Value of $22.00 (UNDERVALUED)

However, persistent cost inflation or a slowdown in new unit ramp-up could compress margins and challenge the optimistic outlook surrounding First Watch’s future growth.

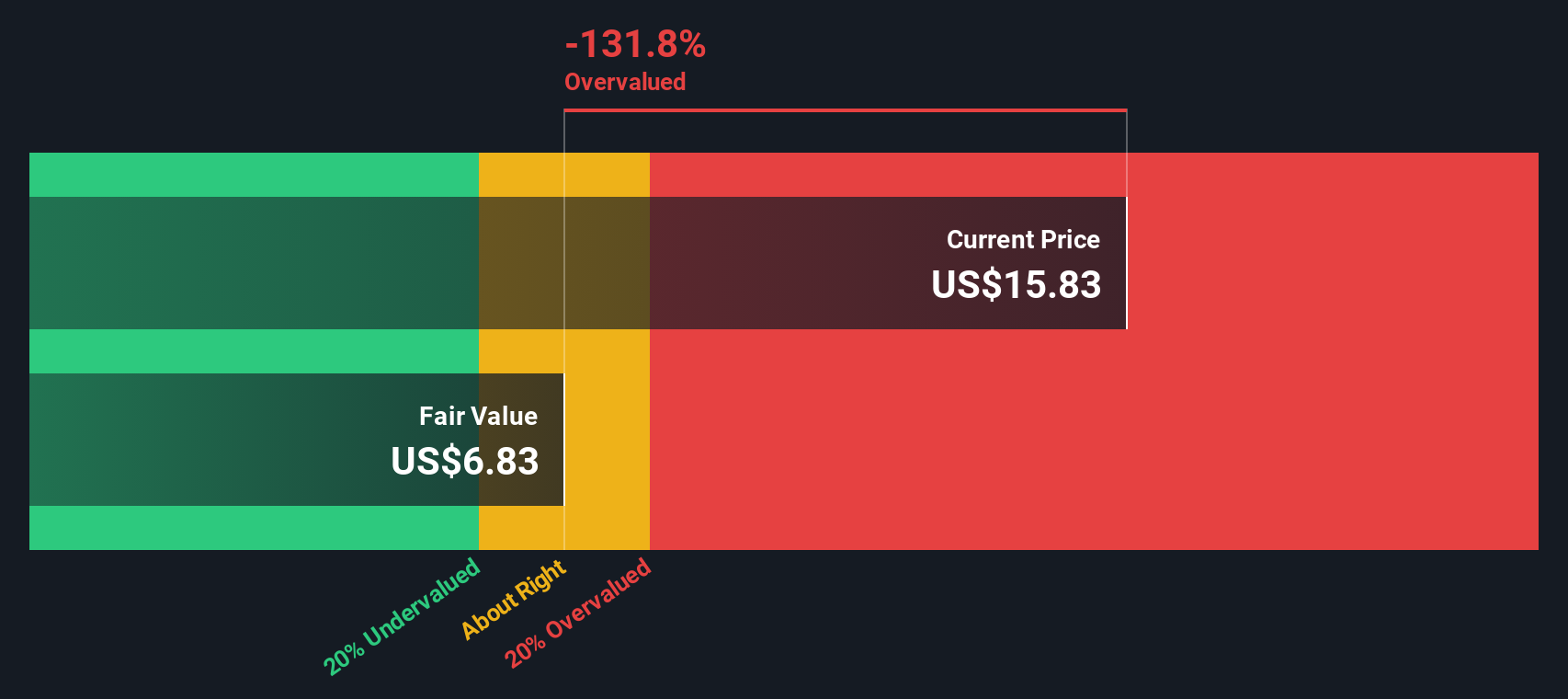

Another View: Discounted Cash Flow Model

While analyst targets put First Watch above its current price, our SWS DCF model tells a different story. By projecting future cash flows, the DCF method estimates a fair value that is far below today’s price. This suggests the market may be too optimistic on long-term growth. Which of these perspectives will prove right as the company evolves?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Watch Restaurant Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Watch Restaurant Group Narrative

If you’re not convinced by these perspectives or want to dig deeper on your own, you can build a personalized view in just a few minutes. Start now with Do it your way.

A great starting point for your First Watch Restaurant Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your edge and discover stocks bubbling with potential, income, and innovation by using Simply Wall Street's powerful screeners. The right move today could be tomorrow's winning story. Do not leave opportunity on the table.

- Catch powerful growth trends as you check out these 24 AI penny stocks reshaping industries from healthcare to finance with artificial intelligence breakthroughs.

- Unlock stable income streams by reviewing these 18 dividend stocks with yields > 3% offering strong yields and reliable payouts above 3% for long-term wealth building.

- Stay ahead of the market by reviewing these 878 undervalued stocks based on cash flows trading below their intrinsic value based on real cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.