Please use a PC Browser to access Register-Tadawul

Fiserv (NYSE:FI) To Open Fintech Hub in Overland Park Creating 2,000 Jobs

Fiserv FI | 63.80 | 0.00% |

Fiserv (NYSE:FI) recently announced plans to establish a new fintech hub in Overland Park, Kansas, a move aimed at fostering innovation and job creation. Despite this positive development, the company's share price remained flat over the last quarter. This is not surprising given the broader market trend, as stocks have experienced turbulence, highlighted by a Dow Jones dip due to tariff concerns. Fiserv's stable share price suggests that the market's broader trends of uncertainty, exacerbated by ongoing global trade tensions, likely outweighed individual company initiatives during this period.

The announcement of Fiserv's new fintech hub in Overland Park, Kansas, signifies a potential catalyst for long-term growth and innovation. While recent share price movements have been stable amidst market uncertainty, the company's focus on enhancing its technological capabilities and expanding its footprint could positively influence revenue and earnings projections. Over the past three years, Fiserv delivered a total return of approximately 113.03%, showcasing strong performance that outpaces the recent yearly trends observed in the broader U.S. market. Specifically, over the past year, Fiserv's returns exceeded the market's 5.9%, illustrating resilience in a challenging environment.

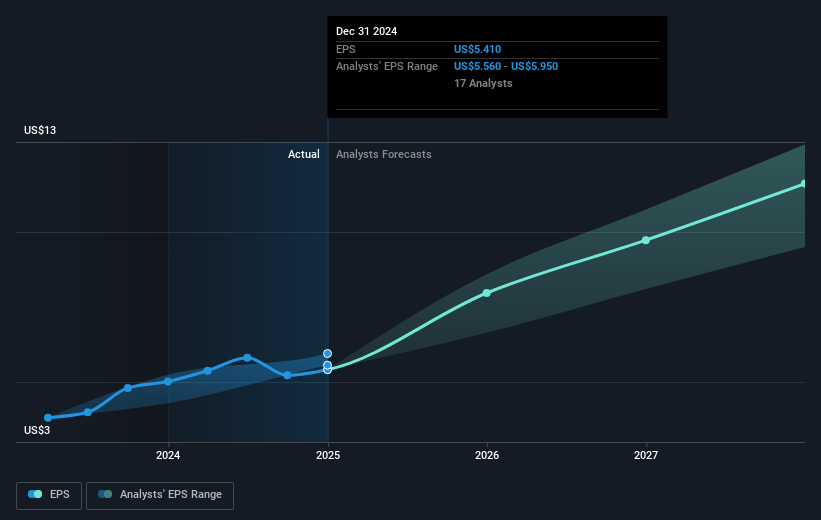

As Fiserv continues to promote global expansion with strategic partnerships, analysts anticipate these initiatives could bolster revenue and improve client acquisition. Currently, company shares are priced at US$210.11, with a target of US$249.70, representing a potential 15.9% upside. The ambitious outlook hinges on projected earnings growth with estimates suggesting a transition to a price-to-earnings ratio of 25x by 2028, compared to present valuation levels. The integration with platforms like Clover, along with new product rollouts, positions Fiserv to achieve incremental revenue gains, while broader industry pressures and macroeconomic risks remain key considerations. As the company leverages existing partnerships, its earnings forecasts may also see upward revisions, aligning with its strategic vision for the year 2025 and beyond.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.