Please use a PC Browser to access Register-Tadawul

Forrester Research (FORR) Q4 Loss Of US$33.9 Million Reinforces Bearish Earnings Narratives

Forrester Research, Inc. FORR | 6.14 | +4.42% |

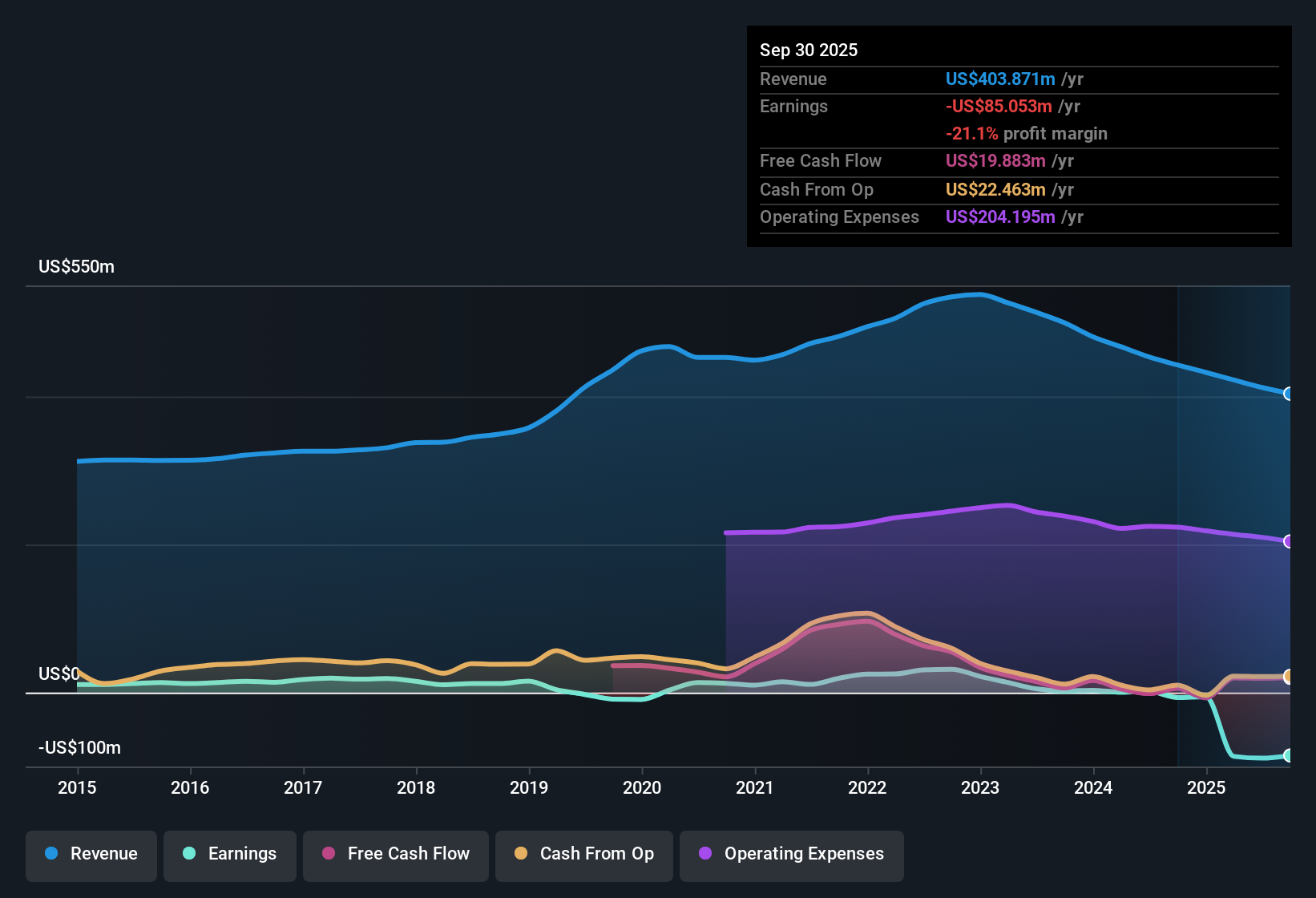

Forrester Research (FORR) has just closed out FY 2025 with Q4 revenue of US$101.1 million and a basic EPS loss of US$1.78, alongside a quarterly net loss of US$33.9 million that keeps profitability firmly in the red. Looking back across recent quarters, revenue has moved between US$89.9 million and US$111.7 million, while basic EPS has swung from a loss of US$4.62 to a modest profit of US$0.21. Together, these figures present a picture where top line stability contrasts with pressure on margins and earnings quality.

See our full analysis for Forrester Research.With the headline numbers on the table, the next step is to see how this earnings profile lines up with the dominant stories around Forrester, and where the latest results challenge or confirm those widely held narratives.

Losses Stay Heavy Across The Year

- Across FY 2025, Forrester booked net income losses in every quarter, ranging from a loss of US$2.1 million in Q3 to a much larger loss of US$87.3 million in Q1, with Q4 landing at a loss of US$33.9 million.

- Analysts' consensus view talks about operational improvements and more multiyear contracts helping future margins, yet the trailing twelve month net loss of US$85.1 million and a reported 78.2% annual rate of earnings decline over five years keep the bearish argument about pressure on profitability firmly backed by the numbers.

- Supporters of the consensus narrative point to a growing focus on AI driven research tools and longer contracts for better visibility. The FY 2025 quarterly EPS range from a loss of US$4.62 in Q1 to a small profit of US$0.21 in Q2 shows how far results have swung around those efforts.

- Critics highlight that despite talk of better sales processes and contract value expansion, trailing EPS of a loss of US$4.48 and continued quarterly losses in three of the last four quarters show that any improvement case still sits against a backdrop of sizeable ongoing losses.

Revenue Holds Near US$400m While Margins Struggle

- The trailing twelve month revenue figures move from US$453.4 million at 2024 Q2 to US$403.9 million at 2025 Q3, yet across that same span the company stayed in loss making territory, with trailing net income going from a small profit of US$1.4 million to a loss of US$85.1 million.

- Consensus narrative suggests that government contract wins and a growing sales pipeline could help revenue stability and margin recovery, but the reported 8% year over year revenue drop cited in the risks section and weakness across research, consulting and events segments sit squarely with the bearish concern that top line pressure is weighing on profit potential.

- The commentary around a 23% revenue decline in the events business and lower contract value and wallet retention connects directly to the data showing that even with quarterly revenue between US$89.9 million and US$111.7 million, profit has not kept pace.

- Management efforts to trim operating expenses, including a 12% headcount reduction, are meant to protect margins, yet the continued losses each quarter illustrate why some investors lean toward the cautious, more bearish interpretation of these moves.

Cheap Sales Multiple Versus Deepening Losses

- Forrester trades on a P/S of 0.3x, compared with 6.4x for peers and 1.1x for the wider US Professional Services industry, while the current share price of US$5.61 sits well below a DCF fair value of about US$13.71 and an analyst price target of US$12.00.

- Bears argue that a low P/S and large discounts to both DCF fair value and the analyst target are not enough on their own, and the trailing twelve month net loss of US$85.1 million together with five year earnings declines of 78.2% a year give that cautious view substantial support despite the apparent valuation gap.

- The wide gap between the current price of US$5.61 and the DCF fair value of US$13.71 shows how modeled cash flows differ from what the market is willing to pay while the company remains unprofitable.

- At the same time, the consensus target of US$12.00 assumes future earnings of US$29.0 million by 2028, which stands in contrast to the most recent Q4 loss of US$33.9 million and highlights why skeptics focus on execution risk before giving much weight to any implied upside.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Forrester Research on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See these results through a different lens? Turn that view into your own narrative in just a few minutes and put your thesis on record. Do it your way

A great starting point for your Forrester Research research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Forrester is contending with consistent net losses, a trailing EPS loss of US$4.48, and pressure on margins despite revenue holding near US$400 million.

If those ongoing losses and earnings swings make you cautious, check out our 85 resilient stocks with low risk scores to quickly focus on companies where financial risk scores look far more reassuring.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.