Please use a PC Browser to access Register-Tadawul

Fox Factory (FOXF): Exploring Valuation as Institutional Buyers and Analyst Optimism Boost Market Confidence

Fox Factory Holding Corp. FOXF | 17.04 | +1.61% |

If you have been following Fox Factory Holding (FOXF), you might have noticed something interesting brewing recently. During the first quarter, several prominent institutional investors stepped up their positions in the company, with some significantly boosting their stakes. Meanwhile, Wall Street’s upbeat outlook, with analysts maintaining buy ratings and raising their expectations, signals a growing sense of confidence in Fox Factory’s future that is beginning to ripple through the broader market.

This shift in sentiment comes after a year where Fox Factory’s share price has faced substantial headwinds, declining 31%. Over the past three years, the stock has continued to slide, reflecting challenges that go beyond just short-term volatility. Still, despite this downward trend, recent quarter gains of around 4% hint that momentum could be turning, especially in light of renewed attention from big investors and consistently raised outlooks.

With the stock trading well below past highs, it is fair to ask a key question: is the market leaving room for upside, or is all the anticipated growth already on the table?

Most Popular Narrative: 17.4% Undervalued

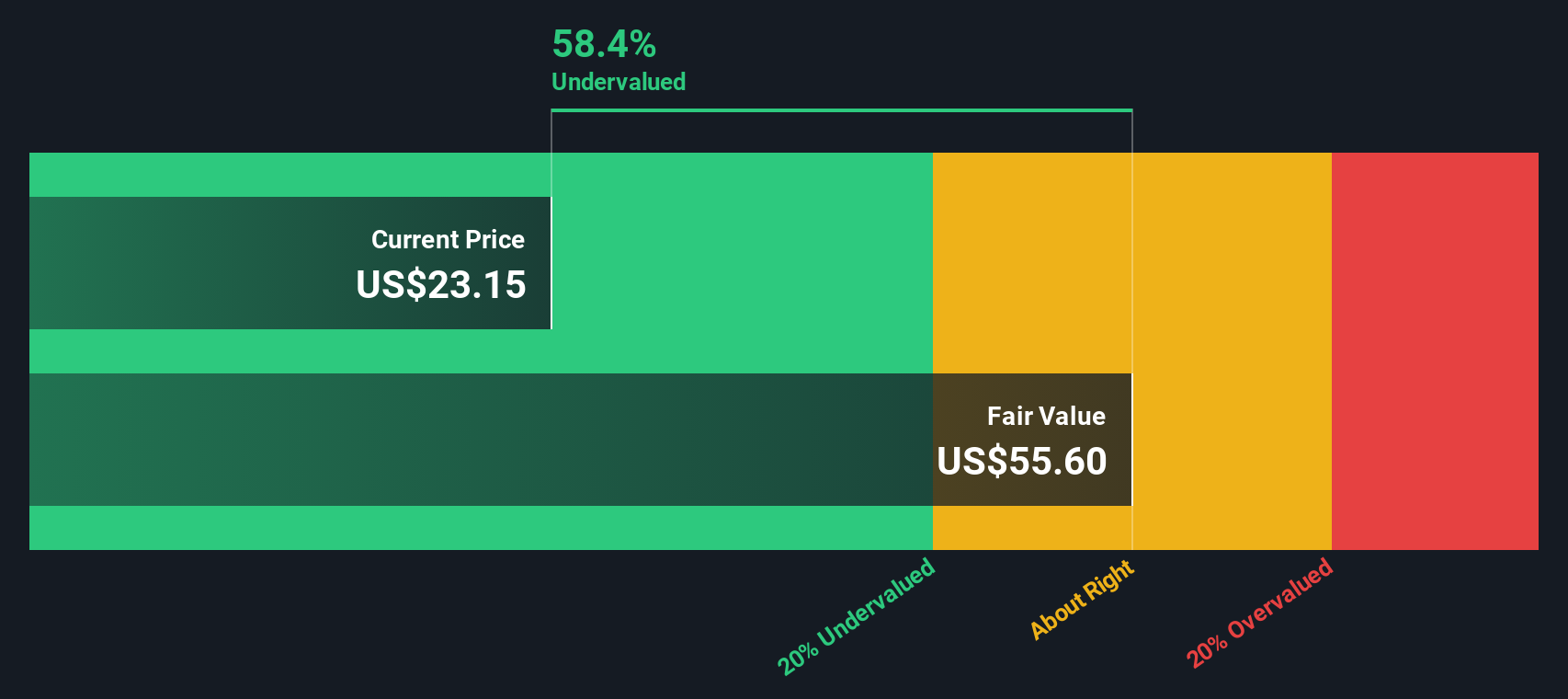

According to the most widely followed assessment, Fox Factory Holding's current share price reflects a substantial discount compared to the narrative’s fair value estimate. The company is viewed as offering significant potential upside if its future trajectory matches the expectations built into this narrative.

Fox Factory's focus on new product launches, especially in premium categories, e-bikes, and entry-premium bike segments, positions the company to benefit from rising consumer preference for high-performance and technologically advanced products. This supports future revenue growth and margin improvement. Expansion into new performance categories (such as EVs, hybrid vehicles, and motorcycles), increased OEM partnerships, and diversification into international markets (such as Japan for Marucci) expand Fox Factory's addressable market and establish new long-term growth vectors, which could translate into higher future sales and earnings.

Eyeing explosive growth and premium margins? This narrative claims Fox Factory's upside depends on a market-expanding mix of categories and global partnerships. But what exact assumptions about profitability and revenue power this bold valuation? Discover how these forecasts stack up against market realities and analyst optimism.

Result: Fair Value of $33.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent tariff pressures and the company’s exposure to volatile consumer markets could quickly shift sentiment and challenge these optimistic forecasts.

Find out about the key risks to this Fox Factory Holding narrative.Another View: Discounted Cash Flow Perspective

Looking at Fox Factory from the perspective of our DCF model provides an additional angle to the valuation debate. This approach also suggests that the shares may be trading below fair value, although different assumptions influence this outcome. Could this second opinion challenge your own expectations?

Build Your Own Fox Factory Holding Narrative

If you have your own perspective or want to reach your own conclusion, you can analyze the data for yourself and craft a narrative in just minutes. Do it your way

A great starting point for your Fox Factory Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while others seize tomorrow’s winners. Uncover new opportunities and sharpen your edge with a selection of hand-picked screens below. Miss these and you could miss the next breakout star.

- Spot fast-growing companies shaking up artificial intelligence, and ride the innovation wave through our selection of AI penny stocks.

- Boost your portfolio’s income potential and find resilient performers by browsing stocks that offer dividend stocks with yields > 3%.

- Catch undervalued gems trading below their true worth, and act before the rest of the market by using our curated undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.