Please use a PC Browser to access Register-Tadawul

FTI Consulting (FCN): Assessing Valuation Following Recent Share Price Rebound

FTI Consulting, Inc. FCN | 170.72 | +1.42% |

FTI Consulting’s share price has had a rough ride this year, with a 14.8% drop since January and a total shareholder return loss of 27.7% over the past year. The last week showed a modest bounce. While the longer-term results remain positive with a 41% five-year total return, recent momentum has been more mixed. This suggests the market is still weighing the company’s near-term prospects amid a changing risk profile.

If you’re open to broadening your search beyond today's movers, it might be the perfect moment to discover fast growing stocks with high insider ownership

With FTI Consulting’s shares still lagging over the past year, and analysts setting a higher price target, the key question is whether the current price reflects real value or if expectations for future growth are already accounted for.

Most Popular Narrative: 9.9% Undervalued

FTI Consulting’s most widely followed valuation narrative places fair value at $179.50, about 10% above its last close of $161.70. The narrative highlights several drivers behind this premium, including rising global demand for regulatory advisory, strategic expansion, and technology investment.

Ongoing global regulatory complexity and heightened scrutiny in areas such as anti-money laundering, financial crime, and cybersecurity are driving sustained demand for FTI's Forensic & Litigation Consulting, Corporate Finance & Restructuring, and Strategic Communications practices. This is likely to expand the overall addressable market and support future revenue growth.

Want to know what sets this narrative apart? The fair value is built on bold assumptions about FTI’s growth and future profitability, with a valuation framework that might surprise you. Discover the underlying financial forecasts shaping this price target. One number could change your outlook.

Result: Fair Value of $179.50 (UNDERVALUED)

However, challenges such as rising automation and regulatory unpredictability could weaken FTI’s growth outlook and profit margins, potentially shifting the bullish narrative if they persist.

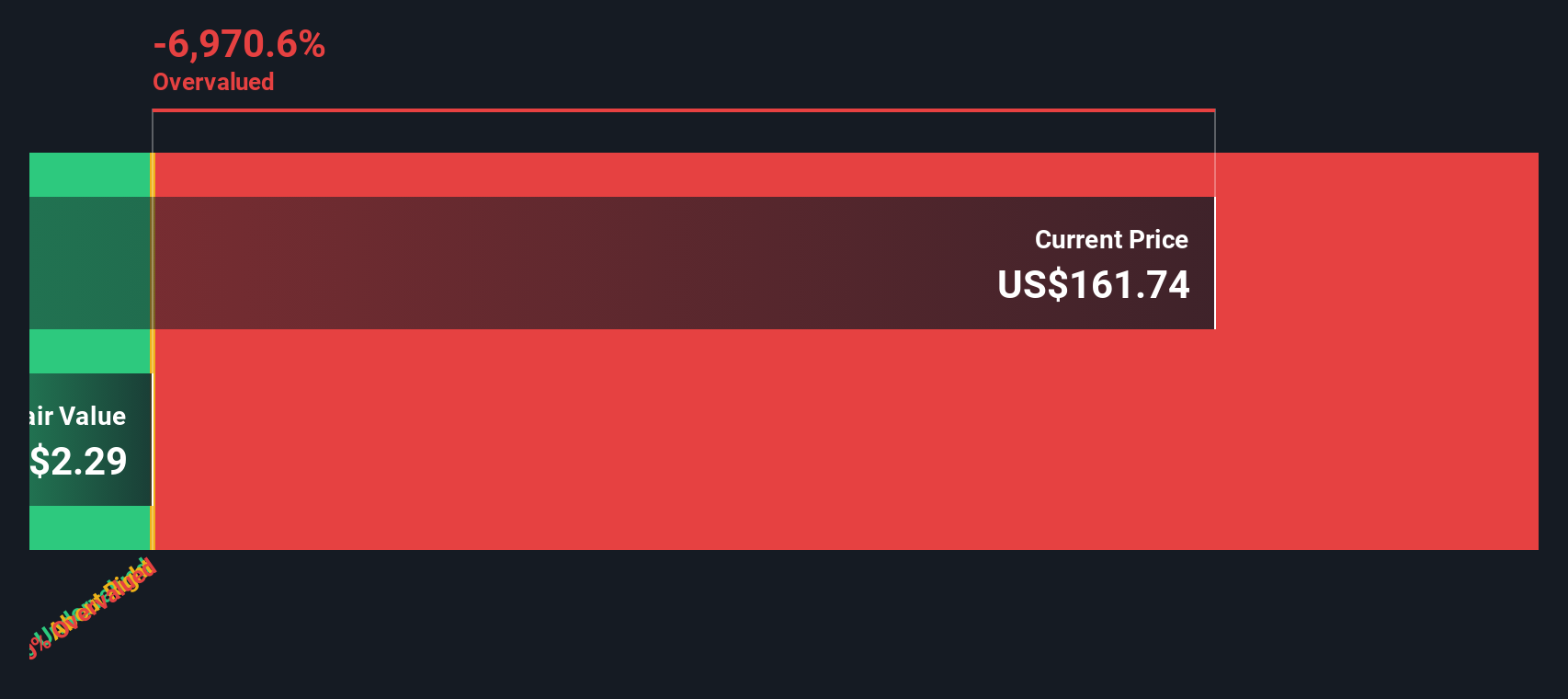

Another View: What Does the SWS DCF Model Say?

Stepping back from consensus forecasts, our DCF model offers a different perspective. Some see FTI Consulting as undervalued based on earnings potential; however, the DCF suggests the current price actually sits well above intrinsic value, hinting at hidden valuation risk. Could the story be less optimistic than it appears?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FTI Consulting for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FTI Consulting Narrative

If you see things differently or want to dig into the details yourself, it takes just a few minutes to craft your own perspective. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FTI Consulting.

Looking for More Investment Ideas?

You’re just a few clicks away from unique opportunities that most investors overlook. Don’t let the next big winner pass you by. Put your research to work now.

- Unlock high-yield income by adding these 19 dividend stocks with yields > 3% with above-average returns from established businesses to your radar.

- Target growth potential in new medical breakthroughs by reviewing these 33 healthcare AI stocks driving advances in health, diagnostics, and patient care.

- Join the data revolution and catch early-stage winners transforming industries with artificial intelligence. Check out these 24 AI penny stocks shaping tomorrow’s markets today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.