Please use a PC Browser to access Register-Tadawul

Garrett Motion (GTX) Margins Beat Investor Caution, But Balance Sheet Risks Temper Narrative

Garrett Motion Inc. GTX | 17.05 17.05 | -0.23% 0.00% Pre |

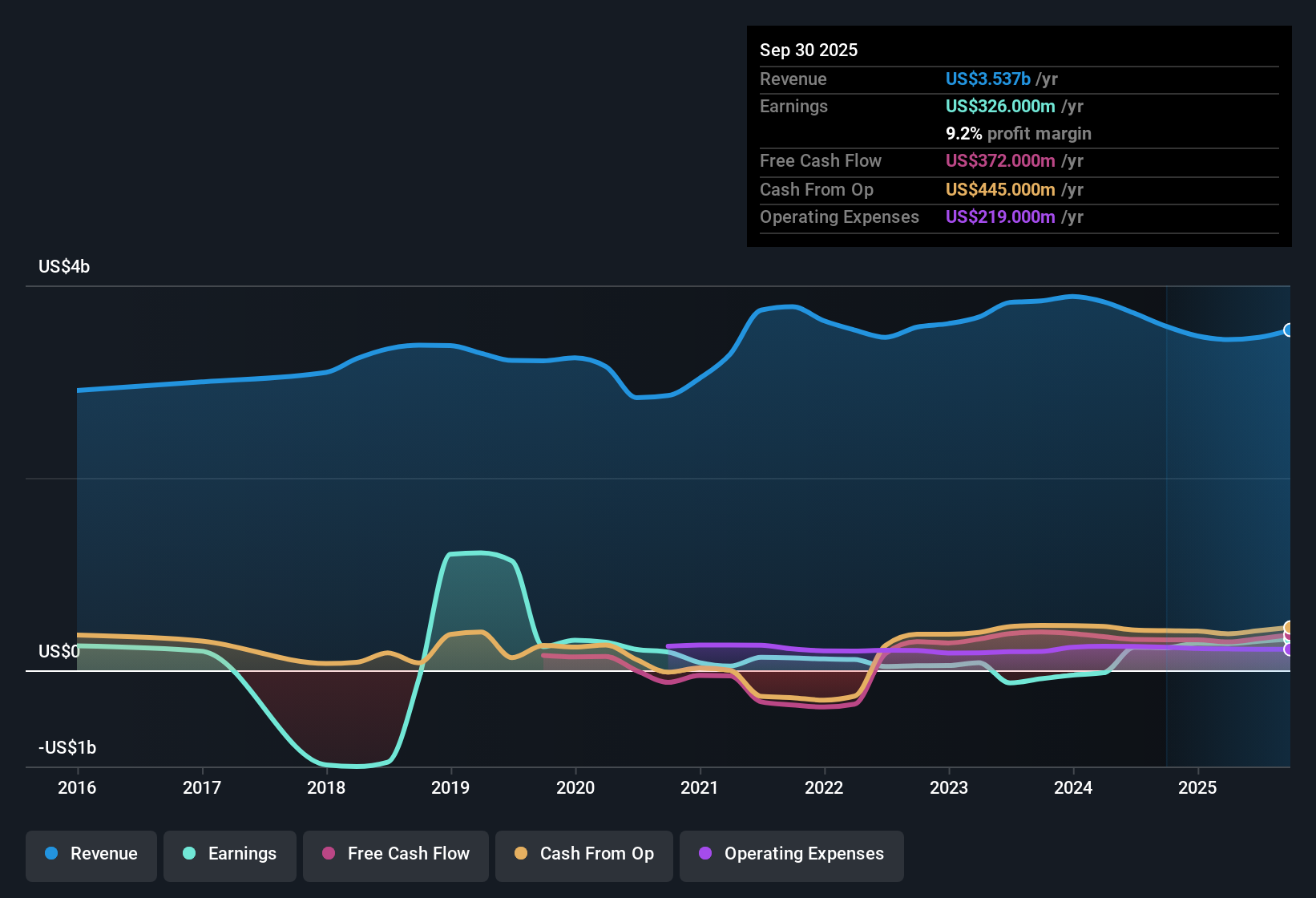

Garrett Motion (GTX) reported a net profit margin of 8.7%, up from 6.4% last year, with EPS growth of 25.9% over the past year. This outpaces its five-year average increase of 18% per year. Shares are trading at $14.93, which is notably below the company’s estimated fair value of $29.90. Its price-to-earnings ratio of 10x is below both industry and peer averages. These results, combined with steady margin expansion and high-quality earnings, signal a positive shift for investors, even as balance sheet risks remain under discussion.

See our full analysis for Garrett Motion.Next, we will weigh these figures against prevailing investor narratives to see where the numbers support or surprise current market expectations.

Share Declines Outpace Market Growth Forecasts

- Analysts expect Garrett Motion's revenue to grow by 3.1% annually over the next three years. This rate trails well behind the US market average of 10% per year and highlights a potential drag on top-line enthusiasm even as the industry moves toward electrification.

- Analysts' consensus view weighs the tension between slower headline growth and recent strategic wins:

- Expansion into hybrid, electric, and industrial sectors is expected to stabilize revenue and position Garrett for diversified, higher-margin growth. This may help offset sluggishness in legacy turbocharging products.

- Momentum in large turbo launches for generators and marine applications delivers new revenue streams. However, analysts are watching to see if these segments can materially impact performance compared to headwinds in the larger ICE business.

- What is especially relevant this season is how the latest numbers leave both growth skeptics and bulls looking for signals on when new business lines become material for the bottom line. 📊 Read the full Garrett Motion Consensus Narrative.

Profit Margins Inch Higher but Face Mix Pressure

- Margin guidance calls for profit margins to rise modestly from 8.7% currently to 8.9% in three years. This spotlights incremental progress but reveals limited headroom as gasoline turbo sales, which are typically lower margin, continue to dominate the sales mix.

- Analysts' consensus view highlights mixed forces influencing profitability:

- Improved operational efficiency and strong free cash flow conversion (98% in Q2) support profit durability and offer a buffer against moderate volume or pricing shocks.

- Bears argue that persistent margin pressure from a weak diesel and aftermarket segment, along with an unfavorable product mix, may stall further margin expansion even as management introduces new initiatives.

Valuation Discount Widens Versus Peers

- Garrett Motion's price-to-earnings ratio stands at 10x, which is substantially below the US Auto Components industry average of 18.2x and the peer group average of 37.5x. The current share price of $14.93 also sits at a deep discount to its DCF fair value of $29.90.

- Analysts' consensus view sees this gap as a key talking point for value investors:

- The wide discount relative to both industry and peer multiples suggests the market remains cautious, likely reflecting concerns around slow growth, balance sheet risks, and ICE exposure.

- Still, Garrett’s consistent profitability and improving cash flows are seen as positives that could prompt a rerating if confidence in its transition plan strengthens in coming quarters.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Garrett Motion on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Dive in and craft your perspective in just a few minutes, and Do it your way.

A great starting point for your Garrett Motion research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Garrett Motion’s modest growth outlook and ongoing balance sheet concerns highlight its exposure to financial risk and limit its near-term upside.

If you want companies with stronger financial foundations, check out solid balance sheet and fundamentals stocks screener (1984 results) that are engineered for resilience and reliability through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.