Please use a PC Browser to access Register-Tadawul

GATX (GATX): Evaluating Valuation After Recent Momentum in Transport Leasing

GATX Corporation GATX | 168.65 | +0.49% |

GATX (GATX) shares have ticked up slightly this week, catching some attention from investors evaluating their options in the transportation leasing market. The company's long-term gains suggest steady momentum that may warrant a closer look.

While GATX’s share price has edged up only modestly in recent weeks, its one-year total shareholder return of 38% points to strong underlying momentum and growing investor confidence in the company’s long-term strategy.

If you’re thinking about where the next wave of potential might come from, take a moment to discover fast growing stocks with high insider ownership.

With the stock not far from its all-time highs and trading just below analyst price targets, investors now face a key question: is GATX still trading below its true value, or has the market already priced in its future growth?

Most Popular Narrative: 7.2% Undervalued

The latest narrative consensus places GATX’s fair value at $188.75 per share, compared to the last closing price of $175.16. That is a notable gap, setting up one of this year’s most intriguing stories in transport leasing.

Strategic deployment of new railcars via committed supply agreements and selective international expansion (particularly in India) position GATX to capitalize on long-term growth in commodity flows and diversified revenue streams. This approach may improve future revenue and operating margins.

What is propelling this high fair value? There is a bold outlook hinging on rising profits, margin expansion, and a re-rated valuation multiple. If you suspect there is more beneath the surface, now is the time to uncover which forecasted financial leaps and strategic shifts are driving analyst expectations.

Result: Fair Value of $188.75 (UNDERVALUED)

However, weaker fleet utilization in Europe or an over-reliance on volatile asset sales could quickly challenge the bullish case for GATX’s continued growth.

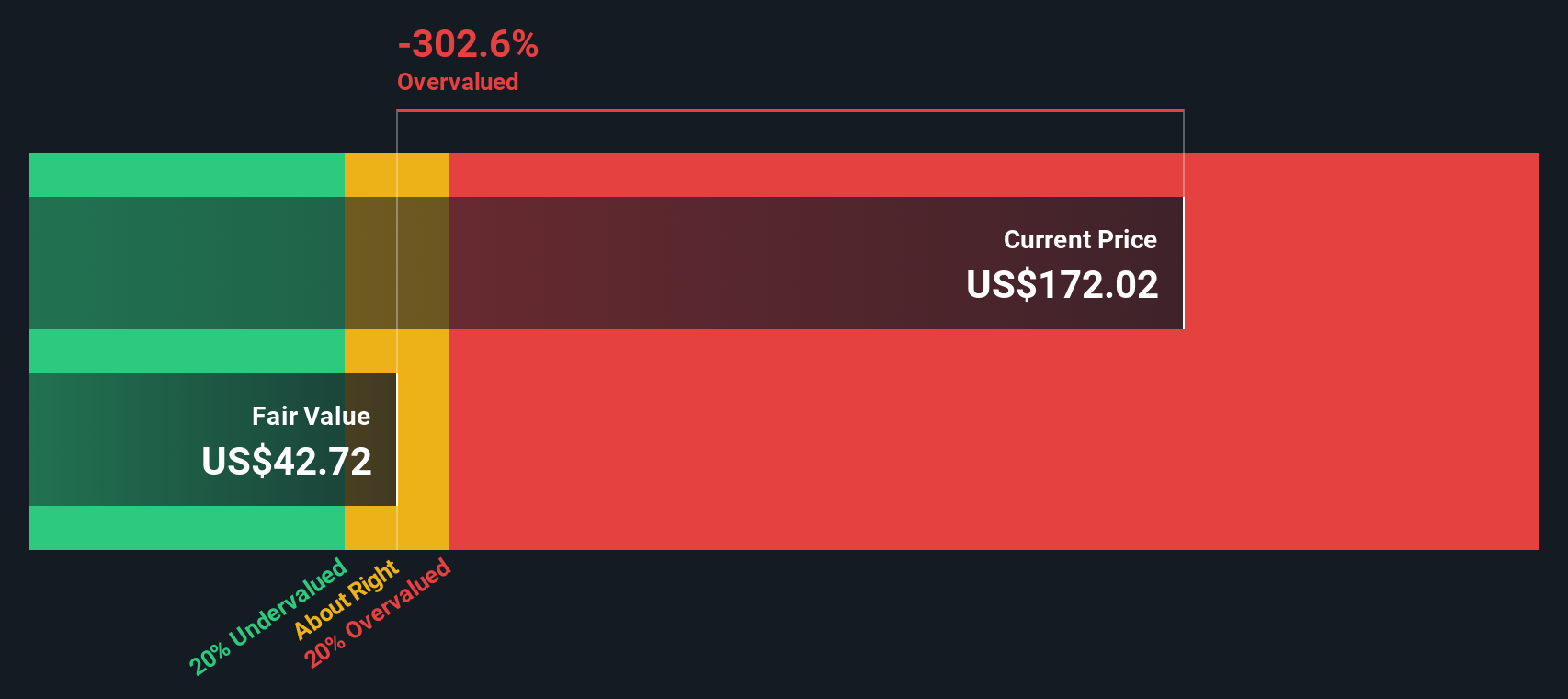

Another View: Our DCF Model Paints a Cautionary Picture

While analyst consensus sees GATX as undervalued, our SWS DCF model offers a very different perspective. According to this discounted cash flow approach, GATX is currently trading well above its fair value estimate. This suggests meaningful downside if growth and margin assumptions fall short. Which set of assumptions will the market ultimately price in?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GATX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GATX Narrative

If you would rather shape the story yourself, or want to test your own research against the consensus, try building your personal GATX narrative in just a few minutes by using Do it your way.

A great starting point for your GATX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to get ahead of market trends and find your next standout pick, don’t wait. These investment opportunities are already catching the attention of savvy investors.

- Uncover high potential with these 23 AI penny stocks, where innovative businesses harness artificial intelligence to transform entire industries and accelerate growth.

- Secure a steady stream of income by checking out these 19 dividend stocks with yields > 3%, packed with companies offering yields over 3% and the stability every portfolio needs.

- Leap into the world of tomorrow by following these 26 quantum computing stocks, trailblazers working at the forefront of quantum computing and game-changing technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.