يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

جنرال ميلز (المدرجة في بورصة نيويورك بالرمز: GIS) تُكمل عملية إعادة شراء أسهمها؛ وتُعلن عن أرباح متباينة وزيادة في توزيعات الأرباح

General Mills, Inc. GIS | 47.47 | +2.09% |

General Mills (NYSE:GIS) recently declared a 2% increase in its quarterly dividend and provided an update on its share buyback program, demonstrating continued shareholder returns. Over the last week, the company's stock price moved mostly in line with the broader market, which climbed 1.9%. While earnings results revealed a decrease in sales and net income, contributing to a challenging financial backdrop, the dividend increase signals confidence in cash flow. New product launches, such as the Blue Buffalo fresh pet food line, could bolster growth prospects for the North America Pet segment, aligning with trends in consumer preferences.

The recent 2% dividend increase and updates to General Mills' share buyback program underline a commitment to returning value to shareholders despite a challenging financial backdrop signaled by decreased sales and net income. This move could bolster investor confidence, potentially impacting future revenue and earnings forecasts through strengthened cash flow management. However, the reinvestment in innovation and strategic changes, such as the potential Yoplait closure, might delay immediate margin recovery and earnings growth. The company's focus on innovation and brand competitiveness through strategic reinvestment could sustain its long-term growth strategy.

General Mills' total shareholder return, including dividends and share price movements, was 4.18% over the past five years, reflecting the company's longer-term performance. Over the past year, however, General Mills underperformed the US Food industry, which saw a 6% decline, and the broader US market, which grew 12.2%. Current share price movements remain notably close to the price target of US$62.48, with a modest discount suggesting analysts see the stock as fairly priced based on expected future earnings and revenue dynamics.

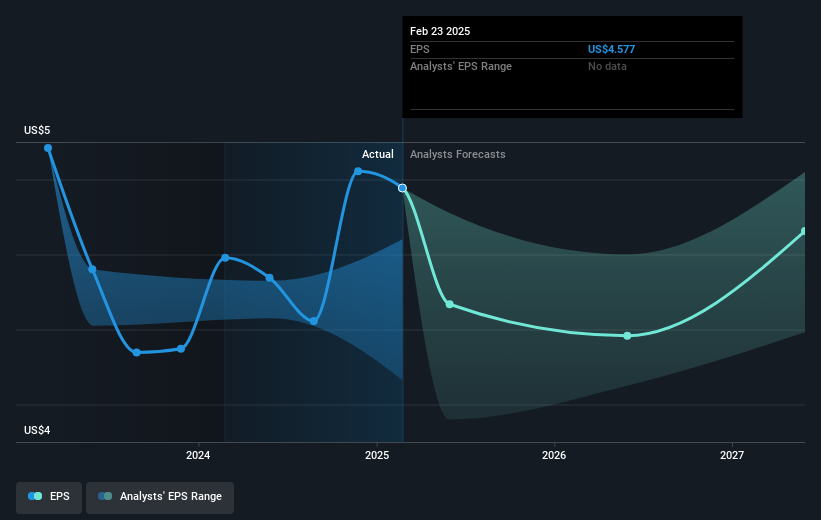

The anticipated investments in pricing and innovation aimed at driving future growth could influence revenue and earnings projections, with analysts forecasting a 2.2% annual decline in earnings over the next three years. As General Mills focuses on optimizing its brand portfolio amid changing consumer preferences, the company’s strategic initiatives, including enhanced marketing on core products, might enhance its market share and competitiveness in the long run.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.