Please use a PC Browser to access Register-Tadawul

Genpact (G) Valuation in Focus as Company Unveils Bold Rebrand and AI-Driven Growth Strategy

Genpact Limited G | 47.50 | -0.59% |

Genpact (NYSE:G) just made headlines with the announcement of a global rebrand and the unveiling of 'GenpactNext,' a new growth approach centered on agentic AI solutions. This isn't just a facelift; it points to a much bigger ambition to transform the way complex business processes are managed and place the company at the forefront of technology innovation. For investors trying to make sense of what comes next, this kind of strategic pivot often signals management’s expectations that demand for automation and AI-driven solutions will define the next phase of growth.

Against this backdrop, Genpact’s stock has seen its share of swings. Over the past year, shares are up about 11%, making up some ground after lagging in previous periods. However, momentum has been steady rather than outsized, even as the company participated in events like Boston Fintech Week and handled executive transitions. The long-term track record is mixed, with moderate gains over five years but subdued returns in the past three years, hinting that the market is still weighing the risks and rewards of Genpact’s evolution.

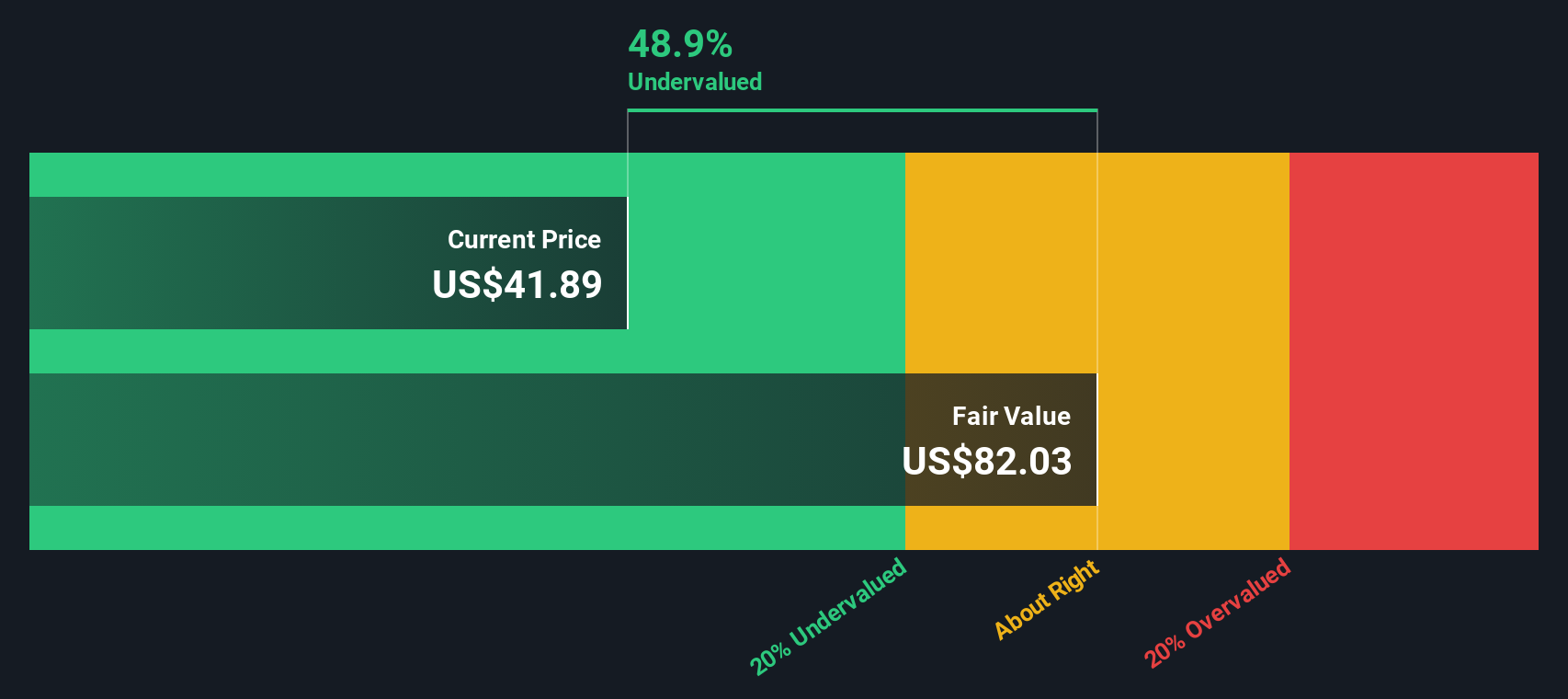

With all eyes now on management’s bold strategy shift, the big question remains: does the current price reflect a buying opportunity before further growth materializes, or is the market already pricing in all of Genpact’s next chapter?

Most Popular Narrative: 18.9% Undervalued

According to the most widely followed narrative, Genpact is currently undervalued, with a fair value estimate significantly above its recent share price. This view is grounded in expectations of accelerating growth and profitability as digital transformation and AI initiatives reshape the company's business model.

Accelerated client adoption of Genpact's Advanced Technology Solutions, particularly in data and AI, should drive higher growth and improved margins. These offerings deliver over twice the revenue per headcount compared to legacy services and are expanding at over twice the company's overall rate, which points toward robust long-term revenue and margin expansion.

What could power such a bullish target? The playbook behind this view is built on bold growth assumptions, a strategic move into next-generation AI, and a future profit profile that the market has not fully digested. The catalysts and key financial improvements that tip the valuation scale upward can be found in the narrative’s deep dive into Genpact’s fast-evolving business mix and the numbers that could change the story for investors.

Result: Fair Value of $52.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if Genpact's legacy services decline faster than expected or if macroeconomic caution persists, growth could miss forecasts and undermine the bullish outlook.

Find out about the key risks to this Genpact narrative.Another View: Discounted Cash Flow Perspective

While analysts' consensus targets suggest upside, our SWS DCF model provides a different perspective on value. This method considers Genpact's future cash flows and, in this case, indicates that the stock is still trading below its estimated worth. Which approach should be most relevant to investors as the company changes direction?

Build Your Own Genpact Narrative

If you see things differently or want to dig into the numbers yourself, you can shape a Genpact narrative of your own in just a few minutes, and Do it your way.

A great starting point for your Genpact research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't settle for just one story when you can target multiple winners. Use Simply Wall Street's powerful screeners and uncover stocks that fit your best strategies before the crowd does.

- Boost your income stream by tapping into dividend stocks with yields > 3% that offer yields above 3% and steady financial health, even when markets get choppy.

- Supercharge your portfolio with AI penny stocks poised to lead in artificial intelligence across fast-evolving industries.

- Get ahead on hidden gems by zeroing in on undervalued stocks based on cash flows that currently trade below their fair value based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.