Please use a PC Browser to access Register-Tadawul

GEO Group (GEO): Evaluating Valuation After Detention Facility Controversy and Investor Volatility

GEO Group Inc GEO | 16.58 | -0.42% |

If you hold or are eyeing GEO Group (GEO), a recent media investigation may have grabbed your attention and possibly made you rethink your next move. A well-publicized report highlighted allegations of abuse, neglect, and due process violations at a Louisiana immigrant detention center managed by the company. This kind of scrutiny often sparks renewed concerns about business practices and could cast a shadow over GEO Group's financial outlook in the near term.

This negative press comes at a time when GEO Group stock has already experienced some turbulence. While shares are up an impressive 71% over the past year, they have been volatile in the past 3 months and are still down year-to-date. The market's shifting perception of risk and recent contract wins, such as new managed-only agreements in Florida, are all feeding into a dynamic situation for anyone considering the long game with this stock.

After a strong year, is GEO Group undervalued and offering a rare entry point, or is the market already factoring in both the upside and the risks tied to its latest headlines?

Most Popular Narrative: 43.5% Undervalued

According to the most widely followed narrative, GEO Group is seen as significantly undervalued. This view is based on expectations of sustained revenue and earnings growth, supported by long-term federal contracts and expansion in immigration detention capacity.

The recent surge in federal funding for immigration enforcement and detention, $171 billion for border security, $45 billion earmarked for ICE detention, and multi-year discretionary spending authority, creates a multi-year runway for substantial increases in facility activations, utilization, and new contract wins. This is expected to directly drive top-line revenue growth and EBITDA expansion through to at least 2029.

Curious about the math behind this optimistic valuation? This narrative is built on bold growth assumptions that could reshape GEO Group’s financial profile, leveraging future federal funding and operating leverage. Discover the surprising momentum that analysts believe could unlock much higher returns and see what numbers power their bullish outlook.

Result: Fair Value of $39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifting federal priorities or setbacks in ICE contract renewals could quickly undermine GEO Group’s bullish outlook. This highlights significant risks ahead.

Find out about the key risks to this GEO Group narrative.Another View: Higher Price Tag by Market Standards

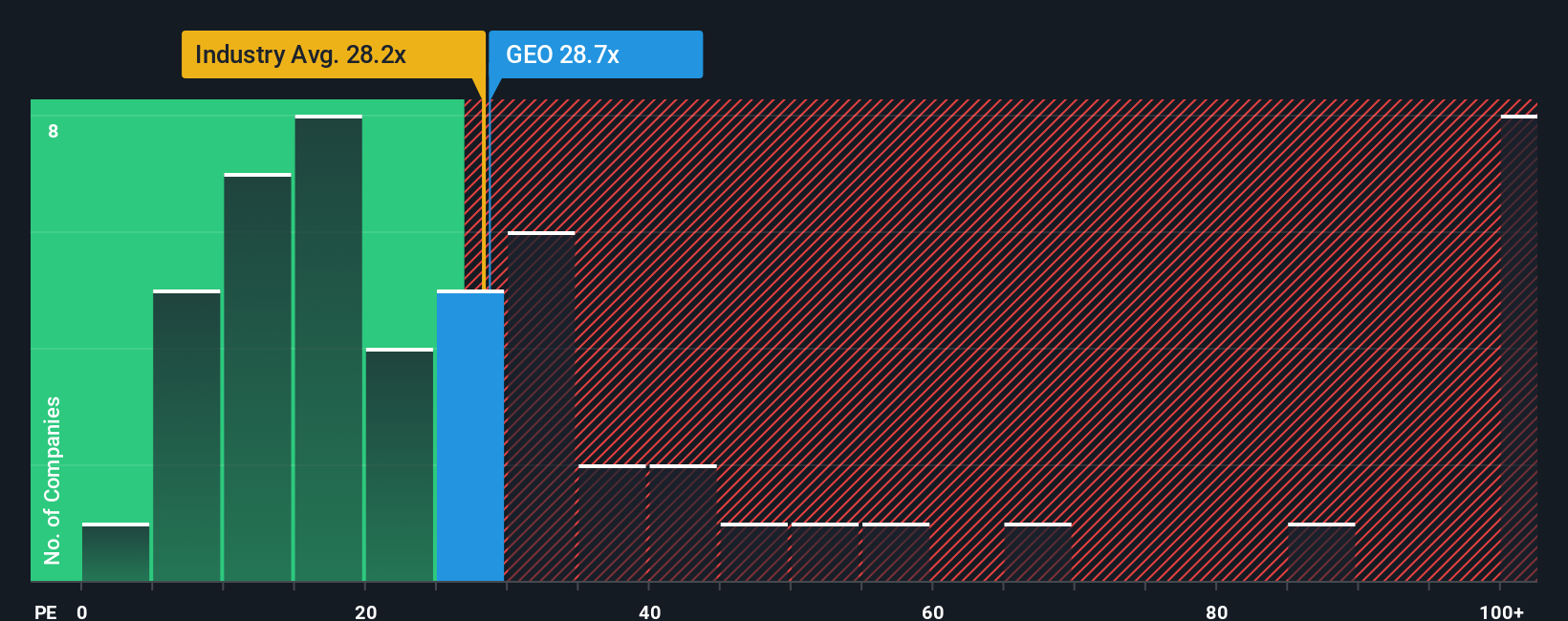

Looking from a different angle, compared to the rest of its industry, GEO Group is currently trading at a much higher market valuation multiple. This approach challenges the idea that the shares are attractively priced. Could the market be signaling caution about future prospects?

Build Your Own GEO Group Narrative

If these narratives don’t match your perspective or you prefer to dig into the details on your own, you can build your independent take in minutes. Do it your way.

A great starting point for your GEO Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Make your next move count and spot tomorrow’s winners before everyone else. Don’t let these strategic ideas pass you by. Your edge in the market starts here:

- Grab an early advantage with undervalued stocks based on cash flows and uncover high-quality stocks flying below the market’s radar while their cash flows set them apart.

- Unlock the potential of companies redefining healthcare by checking out healthcare AI stocks and see which stocks are harnessing AI to revolutionize patient care.

- Boost your portfolio’s income with dividend stocks with yields > 3%, where you’ll find top picks generating yield above 3% and strengthening your returns over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.