Please use a PC Browser to access Register-Tadawul

Gevo (GEVO) Soars 9.4% After Landmark Carbon Management Deal with Frontier Infrastructure — What’s Next?

Gevo, Inc. GEVO | 2.27 | -2.16% |

- On September 22, 2025, Frontier Infrastructure Holdings LLC announced a strategic partnership with Gevo, Inc. and its Verity platform to launch North America's first fully integrated carbon management solution for ethanol producers, leveraging advanced BECCS technology and digital tracking with rail-based CO2 transport linking to Frontier's Sweetwater Carbon Storage Hub in Wyoming.

- This collaboration could be especially meaningful for ethanol producers previously excluded from pipeline access, offering them a new commercially viable route to low-carbon fuel contracts and compliance markets through carbon capture and sequestration.

- We'll explore how this new carbon management platform and its focus on underserved ethanol plants could reshape Gevo's investment narrative and growth prospects.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Gevo Investment Narrative Recap

To be a Gevo shareholder today, you need to believe the path to profitability depends on scaling high-integrity carbon solutions and capitalizing on government incentives like clean fuel credits. The Frontier partnership provides a fresh opportunity to broaden Gevo’s Verity carbon platform to a segment of ethanol producers previously without access, potentially accelerating adoption and lowering revenue risk tied to nascent carbon markets. However, the reliance on tax credits and external financing for large projects remains a substantial near-term risk, with the partnership not materially altering this reality.

Among recent developments, Gevo’s August alliance with Axens to fast-track sustainable aviation fuel production is particularly relevant. This partnership, much like the Frontier collaboration, highlights Gevo’s continued efforts to expand its addressable markets and reinforce its technology positioning, providing further optionality around future sales and margin catalysts while still underscoring the operational and funding hurdles ahead.

In contrast, investors should also be aware that reliance on policy-driven tax incentives...

Gevo's narrative projects $192.2 million revenue and $28.4 million earnings by 2028. This requires 33.8% yearly revenue growth and a $86.7 million earnings increase from -$58.3 million currently.

Uncover how Gevo's forecasts yield a $5.55 fair value, a 180% upside to its current price.

Exploring Other Perspectives

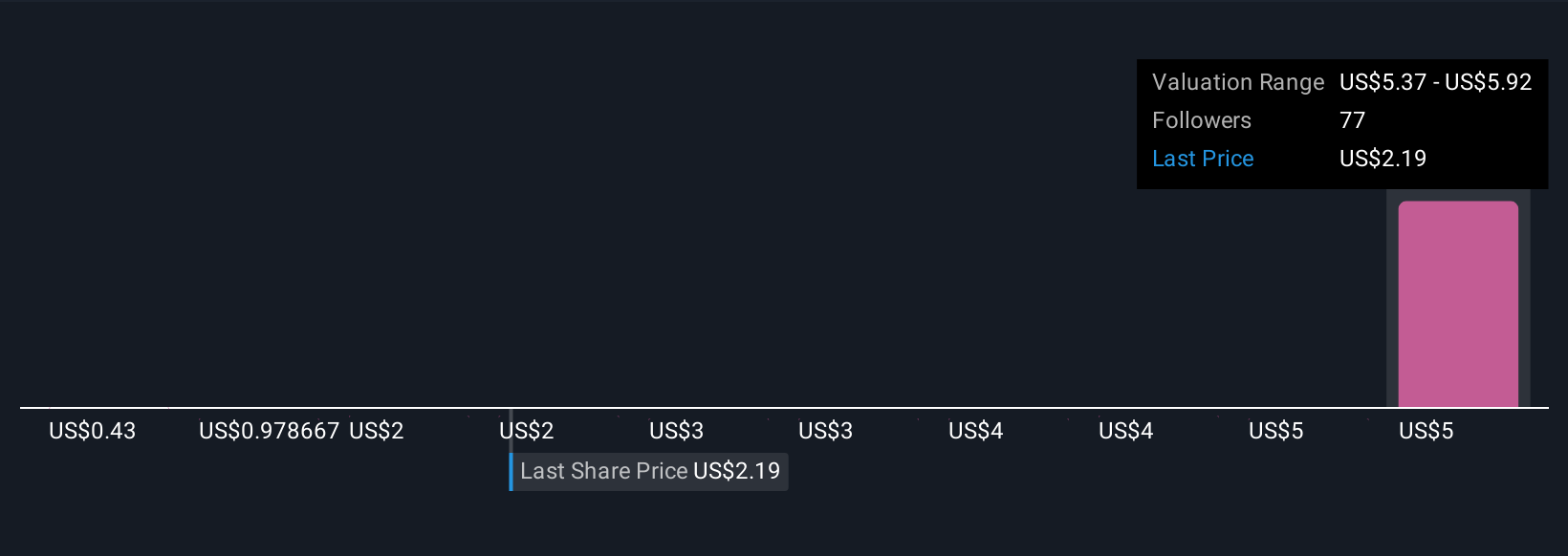

Fair value views from the Simply Wall St Community span from US$0.43 to US$5.92 per share across nine estimates, showing a broad spread in expectations. While many see upside in Gevo’s low-carbon platform, the company’s need for policy support and funding underscores why opinions on the stock’s prospects can differ widely, consider comparing these perspectives before making any decisions.

Explore 9 other fair value estimates on Gevo - why the stock might be worth less than half the current price!

Build Your Own Gevo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gevo research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Gevo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gevo's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.