Please use a PC Browser to access Register-Tadawul

Globus Medical (GMED): Examining Valuation as Share Price Recovers but Remains Below Analyst Targets

Globus Medical Inc Class A GMED | 87.59 | -0.25% |

Over the past several months, Globus Medical’s share price has seesawed, rallying 6% in the last 30 days but remaining down more than 25% year-to-date. This suggests that while short-term momentum is building, longer-term investor sentiment remains cautious, as reflected in its 1-year total shareholder return of -17.4%.

If the recent uptick in medical device stocks has you looking for more opportunities in the sector, explore the latest names breaking through in our healthcare screener: See the full list for free.

With shares still trading below analyst price targets and posting solid revenue growth, the question for investors is whether Globus Medical is undervalued right now or if the market has already factored in the company’s next chapter.

Most Popular Narrative: 22.3% Undervalued

With Globus Medical shares closing at $60.72 and the narrative’s fair value set at $78.18, the stock stands out well below the consensus estimates based on forward-looking expectations. This gap in price versus projected value reflects optimism surrounding Globus Medical's future, but also incorporates key financial assumptions that warrant a closer look.

Successful integration and synergy capture from the NuVasive and Nevro acquisitions are providing opportunities for increased cross-selling, cost efficiencies, and realization of deferred tax assets. These are expected to drive margin expansion, boost earnings, and enhance recurring cash flows in upcoming years.

Curious how margin recovery and strategic acquisitions might tip the scales? Analysts’ fair value factors in ambitious growth, rising profits, and shifting competitive dynamics. Ready to discover what assumptions drive that number?

Result: Fair Value of $78.18 (UNDERVALUED)

However, ongoing integration challenges from recent acquisitions or prolonged sales cycles, particularly in new robotic systems, could undermine these optimistic projections.

Another View: Multiples Tell a Consistent Story

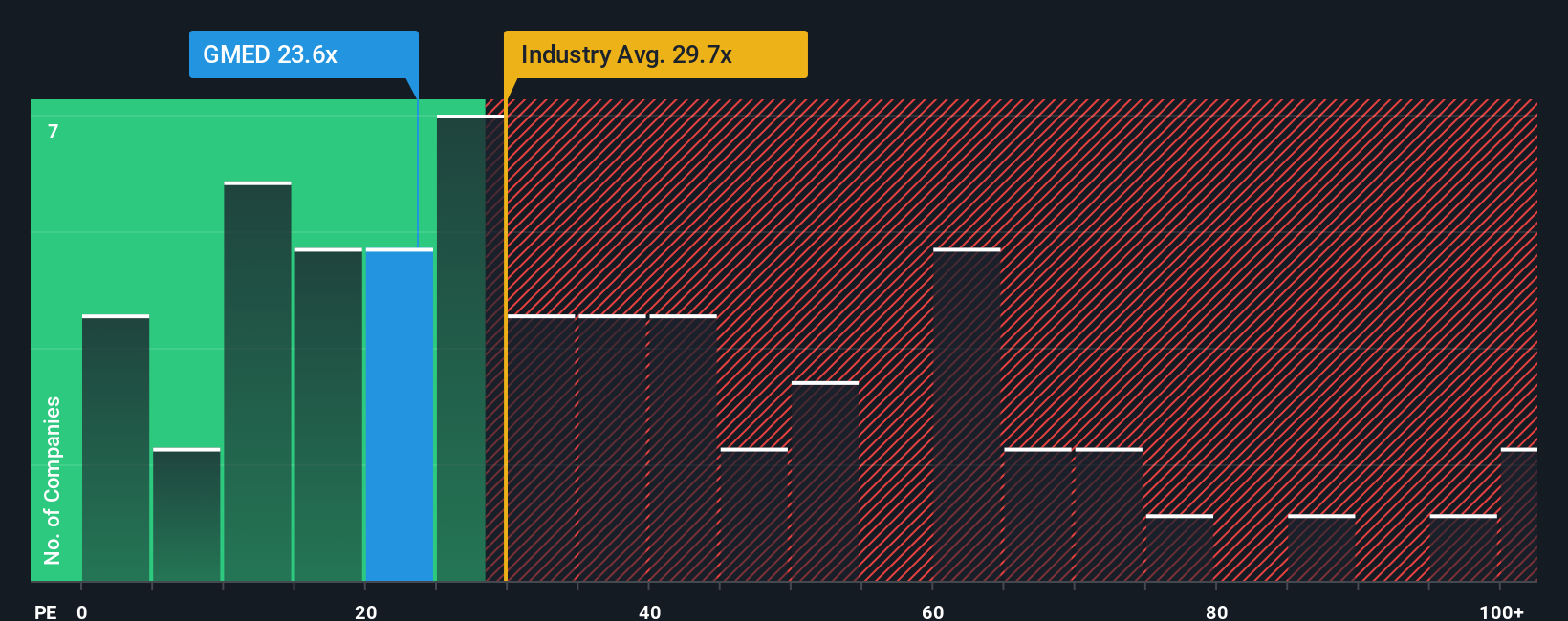

Looking at valuation through the lens of earnings multiples, Globus Medical’s price-to-earnings ratio stands at 23x, which is below both the Medical Equipment industry average of 28x and the peer average of 58.3x. The fair ratio estimate suggests the market could move toward 24.1x in the future. This places the company in a relatively attractive spot compared to its sector. However, does trading below these benchmarks mean there is less risk, or are investors missing something critical?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Globus Medical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 834 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Globus Medical Narrative

If you see the story differently or want to delve deeper into the numbers yourself, it’s quick and easy to develop your own take. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Globus Medical.

Looking for More Investment Ideas?

Unleash your potential for smart returns by acting now. These opportunities are moving fast, so seize your edge and get started today.

- Get ahead with stocks that have stable cash flows and attractive valuations by using these 834 undervalued stocks based on cash flows for your next opportunity.

- Capitalize on financial breakthroughs and working innovations by checking out these 26 AI penny stocks shaping tomorrow’s markets right now.

- Boost your income with companies offering robust payouts. Take a look at these 24 dividend stocks with yields > 3% to see which stocks are delivering above-average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.