Please use a PC Browser to access Register-Tadawul

Globus Medical (GMED) Is Down 5.1% After CEO Resignation and Leadership Reshuffle – Has The Bull Case Changed?

Globus Medical, Inc. Class A GMED | 85.79 85.79 | -0.82% 0.00% Pre |

- In recent days, Globus Medical announced a major leadership transition as Keith Pfeil was appointed President and CEO following the resignation of Daniel Scavilla, while Kyle Kline stepped in as the new CFO.

- This executive restructuring coincided with the launch of advanced navigation and drilling systems, highlighting the company’s focus on innovation and operational continuity during a period of significant change.

- We'll explore how this shift in executive leadership, particularly the appointment of Keith Pfeil, could influence Globus Medical's investment outlook.

Globus Medical Investment Narrative Recap

To believe in Globus Medical as a shareholder, you need conviction in its ability to successfully integrate acquisitions like NuVasive and Nevro, while capitalizing on a strong pipeline of surgical technologies. The recent leadership transitions, with Keith Pfeil becoming CEO and Kyle Kline as CFO, represent continuity from within and are not expected to materially impact the near-term catalyst of achieving integration synergies. The biggest immediate risk remains the complexity and execution risk around merging and leveraging recent acquisitions, particularly Nevro.

Among recent announcements, the expansion of the Excelsius navigation platform with the DuraPro system stands out. This aligns closely with the company’s short-term catalyst: accelerating market penetration and revenue from innovative enabling technologies, which could help offset integration-related challenges.

By contrast, investors should be mindful of how integration hurdles, especially with the added scale from Nevro, could...

Globus Medical's narrative projects $3.2 billion in revenue and $548.3 million in earnings by 2028. This requires 8.0% yearly revenue growth and a $445.3 million earnings increase from $103.0 million currently.

Exploring Other Perspectives

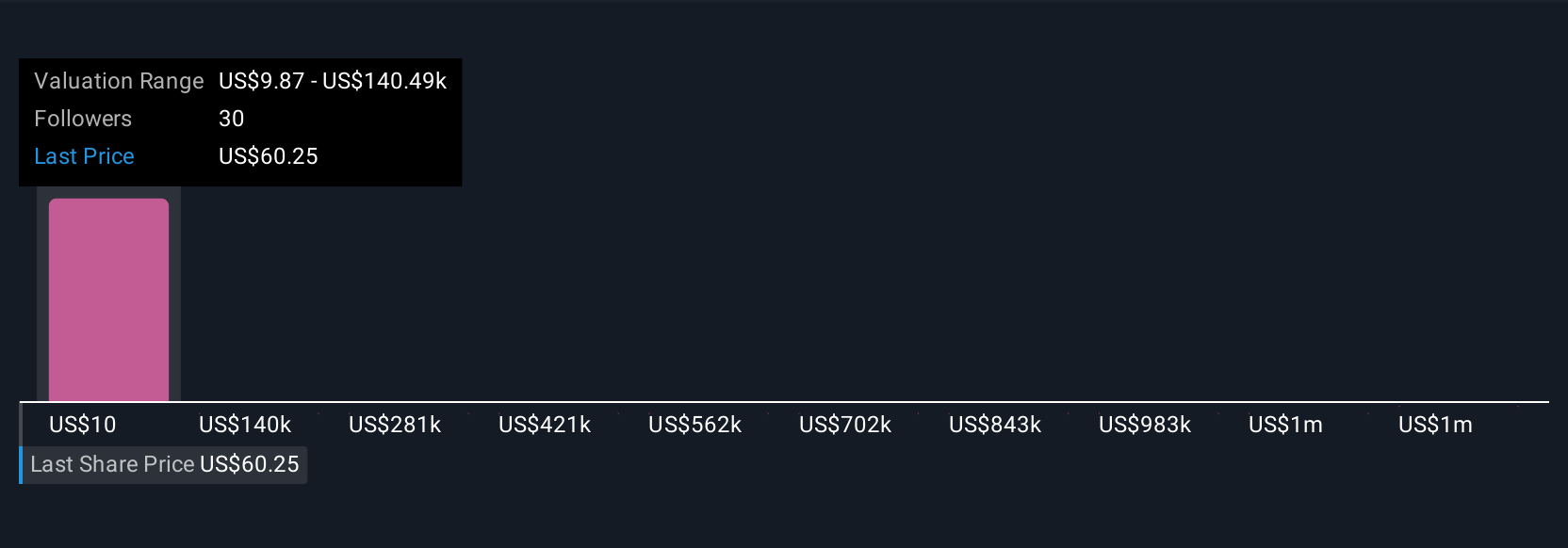

Four fair value estimates from the Simply Wall St Community span US$72 to over US$1,400,000 per share, underscoring the variety of individual analyses. As many weigh integration progress as a central catalyst, these diverging viewpoints reveal how differently investors can assess Globus Medical's next chapter.

Build Your Own Globus Medical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globus Medical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Globus Medical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globus Medical's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.