Please use a PC Browser to access Register-Tadawul

Golar LNG (GLNG): Examining the Valuation Case Behind Long-Term Growth and Market Expectations

Golar LNG Limited GLNG | 42.87 | +1.42% |

Golar LNG (GLNG) stock’s performance has caught the attention of investors lately, especially as the company continues to evolve its role in the energy sector. With recent price action and industry developments, many are watching for signs of new catalysts that could influence future returns.

This year’s share price action for Golar LNG has been relatively subdued, but the bigger picture remains impressive. While the stock is down year-to-date, a 2.8% total shareholder return over the past 12 months and substantial gains of 77% and 423% over the last three and five years point to underlying momentum and a history of value creation for patient investors.

If you’re curious about discovering other companies with a track record of strong growth and engaged leadership, broaden your search and see what you find in our fast growing stocks with high insider ownership.

With impressive long-term returns but a lukewarm stretch this year, the question is whether Golar LNG’s current valuation leaves room for further upside or if the market is already factoring in all the expected growth.

Most Popular Narrative: 23.7% Undervalued

Compared to Golar LNG’s last close at $38.99, the most widely followed narrative pegs fair value much higher. This reflects optimism about long-term cash flow certainty and future profitability.

The company has secured long-term (20-year) charters for its existing FLNG units, providing $17 billion in contracted EBITDA backlog and 20 years of cash flow visibility. This is expected to drive a significant (4x) increase in EBITDA and contracted free cash flow by 2028, indicating the market may be undervaluing its forward earnings stability and revenue growth.

Want to see what’s powering that bold upside calculation? The linchpin is exponential growth in both earnings and margins, underpinned by forward-looking profit assumptions rarely seen outside the tech sector. Ready to uncover the surprising projections and financial milestones shaping this narrative’s target? Dive into the full story behind the numbers.

Result: Fair Value of $51.10 (UNDERVALUED)

However, heavy reliance on global LNG demand and execution risks around uncontracted FLNG expansion could present challenges to Golar's impressive profit growth narrative.

Another View: Caution From the Multiples

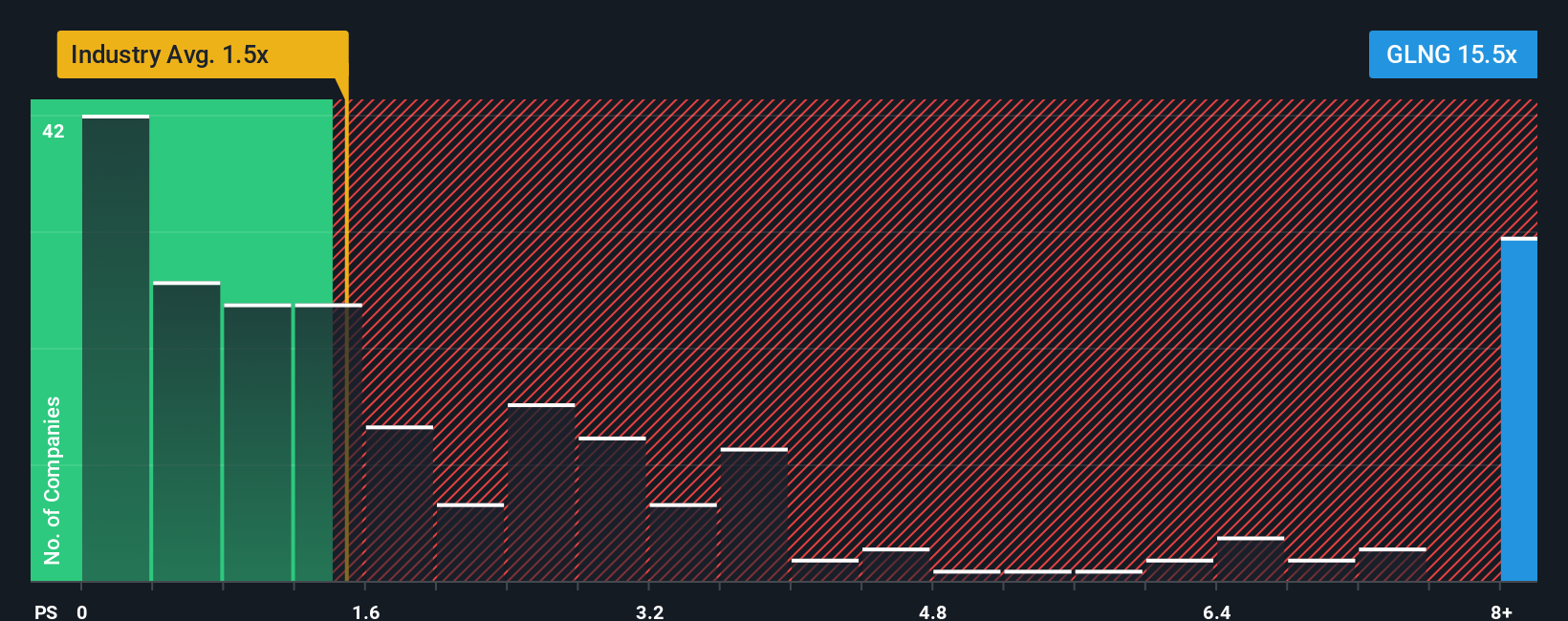

While analysts see upside based on future earnings, Golar LNG’s current price-to-sales ratio sits at 14.8x, far higher than both industry (1.5x) and peer averages (2x), and well above its fair ratio of 1.8x. This steep premium suggests the market is pricing in a lot of optimism already. Could this leave little room for error if growth expectations fall short?

Build Your Own Golar LNG Narrative

If you see things differently or want to dig into the financials yourself, creating your personalized view takes just a few minutes. Do it your way.

A great starting point for your Golar LNG research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t just stop at one opportunity. Tap into expertly curated lists and discover what could be your next winning stock before others catch on. Use these handpicked themes to guide your strategy and stay a step ahead:

- Grow your income by tapping into companies offering strong yields through these 19 dividend stocks with yields > 3%. This screener is designed for investors who want consistent returns.

- Ride the momentum in artificial intelligence by tracking the innovators shaking up tech in these 24 AI penny stocks. Here, future leaders are emerging today.

- Catch undervalued gems with real upside potential and unlock market-beating opportunities using these 891 undervalued stocks based on cash flows before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.