Please use a PC Browser to access Register-Tadawul

Grab (NasdaqGS:GRAB): Reassessing Valuation After WeRide Partnership and Strong Q2 Results

Grab GRAB | 4.95 | -1.39% |

If you are watching Grab Holdings (NasdaqGS:GRAB) these days, the latest developments might have you weighing your next move. The company just announced a strategic equity investment in WeRide, aiming to roll out autonomous vehicles across Southeast Asia by the first half of 2026. This move comes shortly after a second-quarter earnings report that surpassed expectations, especially in On-Demand and Financial Services. It is easy to see why these headlines are catching investor attention; they could reshape both the technology and profit profile of Grab over the next few years.

Following these catalysts, market momentum seems to be building for Grab. The stock has climbed 71% over the past year and is up 27% so far in 2025, suggesting that the market is recognizing the company's expanding potential. While there have been some leadership changes at the executive level recently, the bigger swing factor has been Grab’s operational progress and growing conviction around its AI-driven mobility roadmap. These factors, together with solid revenue and bottom-line growth, are giving investors plenty to consider.

The question now is whether all this excitement is already factored into Grab’s valuation or if there is still a window for buyers who believe the autonomous bet will pay off. What do you think— is there more upside left?

Most Popular Narrative: 9.1% Undervalued

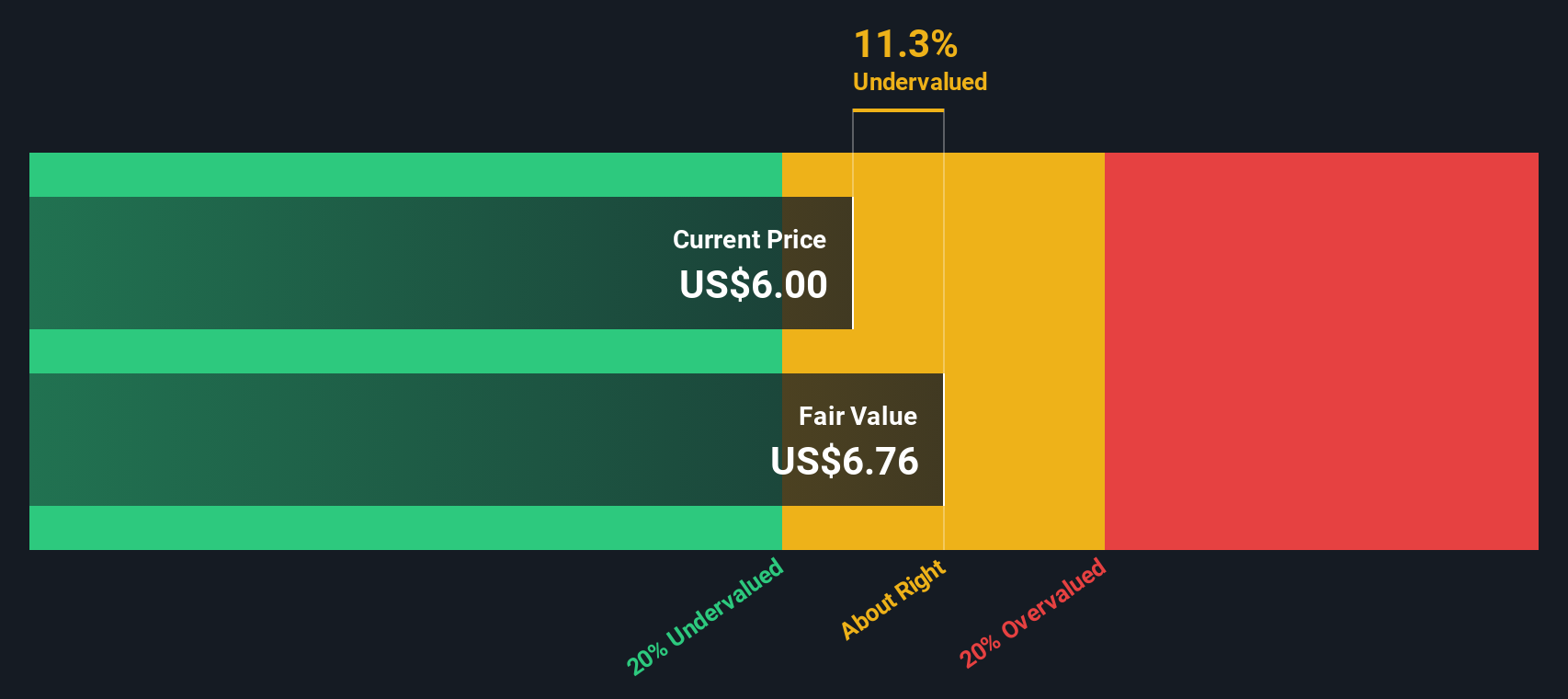

According to the most widely followed narrative by BlackGoat, Grab Holdings is currently undervalued by just over 9%, signaling a potential upside for investors who believe in the company’s long-term strategy and financial trajectory.

"I assume a 20% CAGR in revenue over the next five years, driven by rising digital adoption in Southeast Asia, Grab’s ecosystem expansion, and deeper monetisation of payments and financial services. By year five, I project net profit margins of around 15% (up from 3.6%), supported by operating leverage at scale, tighter incentive discipline, and incremental contribution from Ads and Fintech."

What is fueling this upbeat outlook? Rumor has it, the secret sauce is all about explosive growth projections and a high-conviction future profit margin. These are numbers you will not want to miss. Wondering which aggressive forecasts underpin that punchy fair value, or how Grab plans to deliver? Get the inside story by reading the full narrative.

Result: Fair Value of $6.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising regulatory scrutiny in Indonesia and thin profit margins could serve as significant catalysts that may challenge optimistic forecasts for Grab’s long-term valuation.

Find out about the key risks to this Grab Holdings narrative.Another View: When Numbers Paint a Different Picture

While the earlier fair value estimate hints at future upside, our DCF model tells a similar story and suggests the market may still be underappreciating Grab's long-term earnings power. But which perspective is closer to the mark?

Build Your Own Grab Holdings Narrative

If you see things differently, or want to dive into the numbers and craft your own perspective, you can piece together a custom narrative in minutes, your way. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Grab Holdings.

Looking for more investment ideas?

Smart investors keep their radar on high-growth and unique sectors. Don't settle for one opportunity when you could be tracking tomorrow's winners before everyone else.

- Uncover fresh value by tracking undervalued stocks based on cash flows, and spot stocks that could be flying under Wall Street's radar right now.

- Set your sights on innovation with AI penny stocks, where ambitious companies are using artificial intelligence to shape the next era of tech.

- Cash in on compounding income streams by targeting dividend stocks with yields > 3% and see which businesses are rewarding shareholders with robust, reliable payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.