Please use a PC Browser to access Register-Tadawul

Granite Construction (GVA) Is Up 14.3% After Raising 2025 Outlook and Reporting Record-Breaking Backlog

Granite Construction Incorporated GVA | 115.08 | -0.10% |

- Granite Construction reported strong second-quarter 2025 results, including US$1.13 billion in sales, improved profitability, and raised its full-year revenue guidance to US$4.45 billion following the recent acquisitions of Warren Paving and Papich Construction.

- The company’s robust pipeline, now at a record US$6.1 billion in Committed and Awarded Projects, signals confidence in both market demand and its ability to expand through vertically-integrated operations.

- We'll explore how these profitable acquisitions and the upward revision in revenue guidance influence Granite Construction's investment outlook and future earnings assumptions.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Granite Construction Investment Narrative Recap

To be a Granite Construction shareholder right now, you’d likely want to believe in the company’s ability to capitalize on robust infrastructure investment, maintain profitable project execution, and grow through meaningful acquisitions. The recent strong Q2 results and higher full-year guidance reinforce short-term optimism and boost the most important catalyst, securing and delivering on a record US$6.1 billion awarded project pipeline. However, the company’s exposure to variables like government funding remains the biggest risk, and the latest news does not materially change that concern.

Of the company's recent announcements, Granite’s acquisition of Warren Paving and Papich Construction stands out as particularly relevant in light of current catalysts. This move significantly increases aggregate reserves, expands reach in key home markets, and directly supports the company’s raised guidance, reflecting management’s focus on accelerating revenue growth and adjusted EBITDA margin through vertical integration and a growing portfolio of projects.

In contrast, investors should be aware of ongoing risks tied to future federal and state infrastructure funding levels, as any shortfall could...

Granite Construction's outlook anticipates $5.0 billion in revenue and $518.9 million in earnings by 2028. This scenario assumes a 7.5% annual revenue growth and a $395.2 million increase in earnings from the current $123.7 million level.

Uncover how Granite Construction's forecasts yield a $116.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

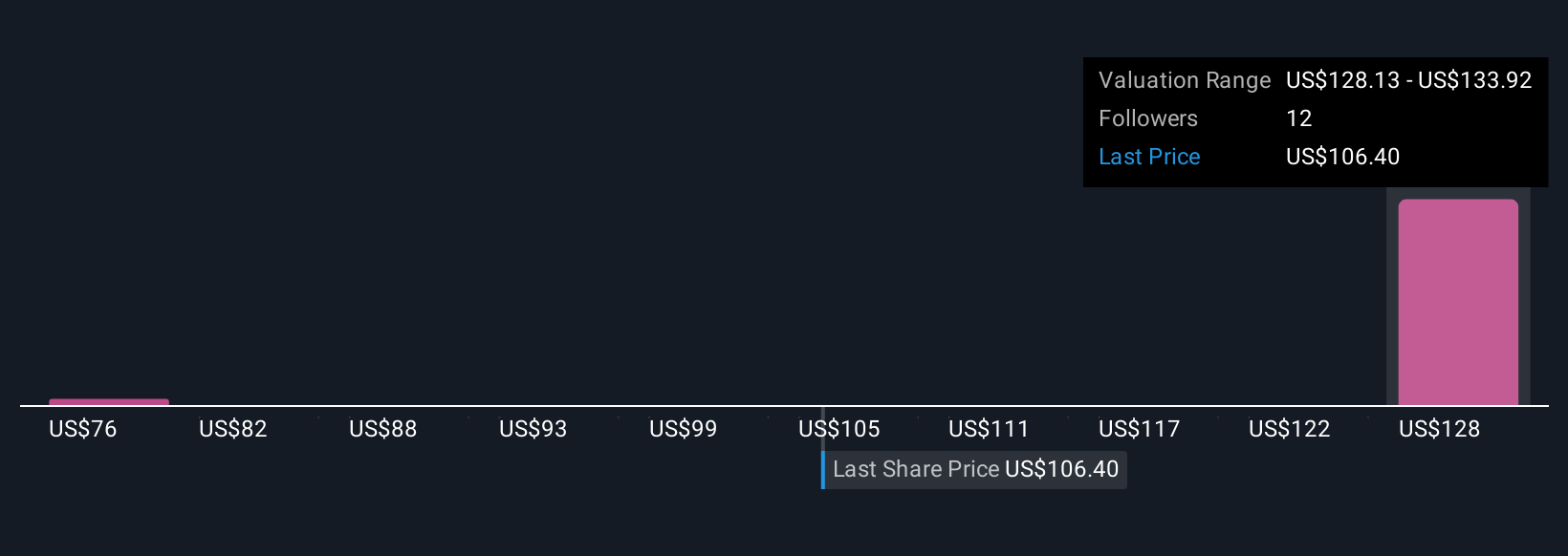

Simply Wall St Community fair value estimates for Granite Construction range from US$76 to US$137 per share based on three independent analyses. While many see growth potential from strong public project demand, opinions differ widely, reminding you to weigh several viewpoints when considering the stock’s outlook.

Explore 3 other fair value estimates on Granite Construction - why the stock might be worth 28% less than the current price!

Build Your Own Granite Construction Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Granite Construction research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Granite Construction research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Granite Construction's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.