Please use a PC Browser to access Register-Tadawul

Granite Construction (GVA) Is Up 19.2% After Raising 2025 Revenue Guidance and Securing $13M Project – Has the Bull Case Changed?

Granite Construction Incorporated GVA | 115.08 | -0.10% |

- Granite Construction recently reported strong second quarter earnings and updated its full-year 2025 revenue guidance, now expecting US$4.35 billion to US$4.55 billion in revenue, including an anticipated US$150 million contribution from new acquisitions.

- In addition, Granite's subsidiary Layne secured a roughly US$13 million contract to build two high-capacity collector wells for the Lewis and Clark Regional Water System, reflecting ongoing demand for large-scale infrastructure projects.

- We'll examine how Granite’s improved revenue outlook, driven by new project wins and acquisitions, may influence its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Granite Construction Investment Narrative Recap

To be a Granite Construction shareholder today, you essentially need to believe in the momentum behind US public infrastructure investment, the company’s ability to leverage acquisitions for growth, and successful execution of large-scale projects. The recent earnings beat and upward revenue guidance reinforce this narrative in the short term, although margin expansion, reliable integration of acquisitions, and exposure to government project cycles still represent the most significant near-term catalysts and risks. The new Layne contract, while positive, is not a material catalyst on its own.

Among the recent company announcements, the updated 2025 earnings guidance stands out as most relevant: Granite now expects US$4.35 billion to US$4.55 billion in full-year revenue, including about US$150 million from acquisitions. With guidance factoring in new wins and M&A, investors’ focus remains firmly on the company’s ability to integrate acquisitions while preserving improved profitability metrics.

But while the story is compelling, investors should also be aware of how any missteps in acquisition integration could quickly...

Granite Construction's narrative projects $5.8 billion revenue and $533.1 million earnings by 2028. This requires 12.6% yearly revenue growth and a $374.6 million earnings increase from $158.5 million today.

Uncover how Granite Construction's forecasts yield a $124.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

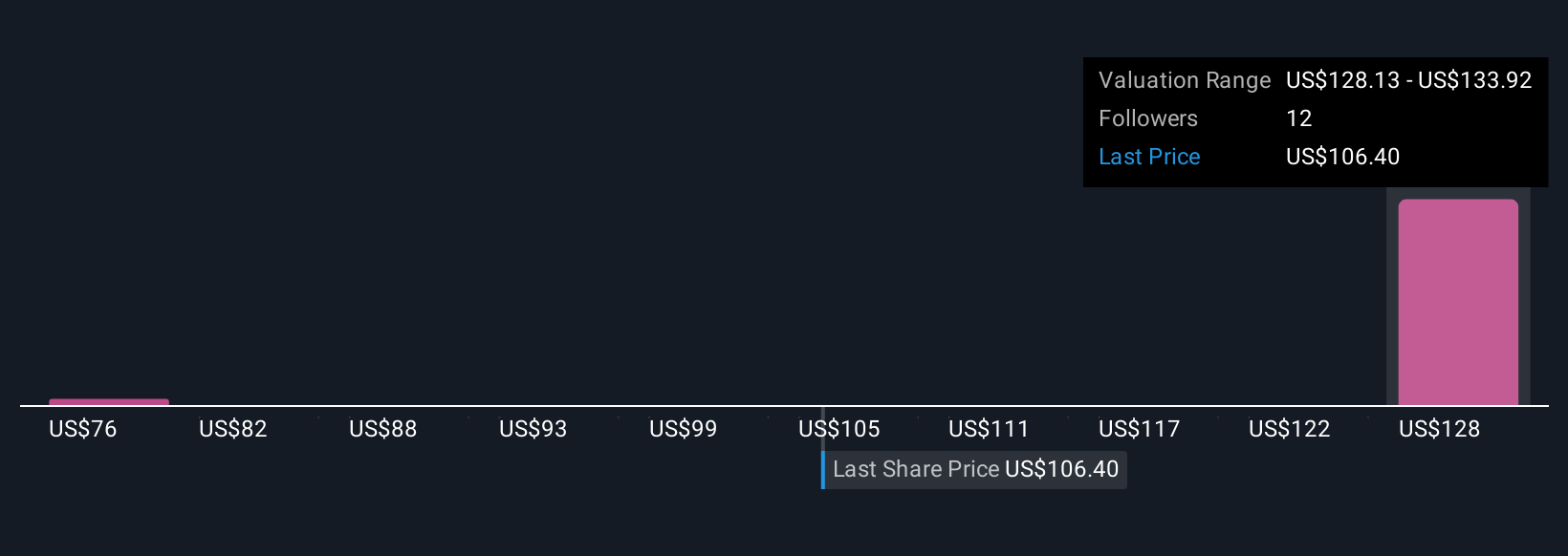

Simply Wall St Community members put Granite’s fair value anywhere from US$76 to US$137, based on three individual estimates. While recent revenue guidance highlights growth potential, execution risk on acquisitions remains a key issue for performance and future outlooks.

Explore 3 other fair value estimates on Granite Construction - why the stock might be worth as much as 23% more than the current price!

Build Your Own Granite Construction Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Granite Construction research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Granite Construction research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Granite Construction's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.